Weekly Headings

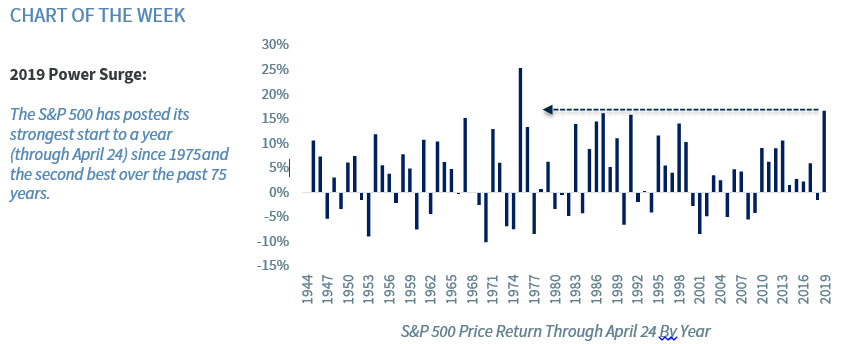

On the back of 1Q19 solid earnings results and healthy economic data releases, the S&P 500 continued its remarkable move higher this week and closed at a record high (2,933) for the first time since September 2018. To put the strength of the rally into perspective, the S&P 500 is now up 17.5% year-to-date through April 24, which marks the best start to a year since 1975 and the second best over the last 75 years. In addition, with the S&P 500 up ~25% since the Christmas Eve bottom, it is in the 99.6 percentile relative to all other time periods over the past 30 years. This means that the S&P 500 has experienced a stronger 87 trading-day rally (the number of trading days between Christmas Eve until present) only 0.4% of the time. Given the robust rally, it would not be surprising to see a near-term pause in the equity rally or a brief consolidation as the 14 day RSI (relative strength index) rose into overbought territory (a level above 70) and to its highest level (73) since January 2017. Despite this, we remain constructive on the equity market longer term and would use any near-term weakness as a buying opportunity for the following five reasons:

- Solid Macro Environment | This morning’s strong reading on 1Q19 GDP* (+3.2%, well above the previous 10 first quarters which averaged +1.1%) and the solid economic data points received thus far for the second quarter (e.g., retail sales and manufacturing surveys) reflect continued above trend economic growth (2019 U.S. GDP forecast: +1.9%) with little risk of recession over the next 12 months. This, in conjunction with the stabilization in global economic momentum following a potential U.S./China trade deal, should provide an attractive environment for equities and risk assets to continue to move higher.

- Fed on the Sideline | The Federal Reserve (Fed) has signaled that it will end its balance sheet run-off process in September and remain on the sideline in 2019 (consistent with our view of zero rate hikes for 2019). In addition, the Fed has insinuated that it may allow both the economy and inflation to run “hotter” before raising interest rates. Lower interest rates should lead to a higher multiple on equity prices and support their upward trajectory.

- Earnings Stabilization | Following the sharp downward revision to future earnings expectations over recent months, 2019 (+4.3%) and 2020 (+11.3%) earnings forecasts have stabilized in recent weeks and have actually started to move higher as we have had a strong start to the 1Q19 earnings season. Record levels of earnings and positive earnings growth going forward should continue to push U.S. equities to all-time highs.

- Favorable Shareholder Activity | After rising ~10% year-over-year (YoY) in 2018, dividends are expected to grow an additional 7% in 2019 to another record high. As the current S&P 500 dividend yield (+1.9%) remains elevated relative to short-term Treasury yields, U.S. equities remain an attractive investment. In addition, following a record amount of corporate buybacks over the last twelve months, buyback activity remains healthy.

- De-Equitization of the Equity Market | S. M&A activity is on pace to post the strongest year on record. As a result, the number of publically-listed U.S. companies is near the lowest level (~4,500) since the 1980s and is down ~50% from its mid-1990s peak. Given that there are now fewer companies for investors to buy, this provides upward pressure on U.S. equity prices. This is referred to as the “de-equitization” of the equity market.

Economy

- Real GDP rose at a 3.2% annual rate in the advance estimate for 1Q19*, but growth was not as strong as the headline figure suggests. GDP was largely boosted by faster inventory growth and a narrower trade deficit. Consumer spending and business investment slowed, and residential fixed investment fell for the fifth consecutive quarter. These components are expected to reverse in 2Q19, with inventories and foreign trade subtracting from GDP growth, while consumer spending, business investment, and residential homebuilding are likely to pick up.

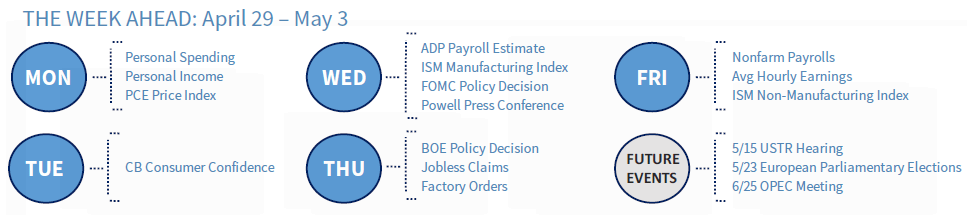

- Next week, the economic calendar is full. The monthly ISM survey results and the employment report are likely to be the highlights, but we will also get data on consumer confidence and spending (quarterly spending figures are included in the GDP report, but the monthly data will help to gauge the degree of momentum heading into 2Q19).

- While the economic data will be important, investors will be more interested in results of the Fed’s policy meeting (announced at 2:00 pm on Wednesday). No change in short-term interest rates is anticipated. We won’t get revised forecasts of senior Fed officials (no new dot plot), but investors will listen to Chairman Powell’s press conference for any clues about a possible rate cut in the months ahead (specifically, what conditions would prompt a change).

- Focus of the Week: Following the weather-related volatility in January and February, payroll growth appeared to settle to a more moderate pace in March, which likely continued in April. Keep an eye on manufacturing, retail, and temp-help payrolls, which were weak in March and could signal some concern in April. Our estimate is for 160,000 jobs created, 3.8% unemployment rate, and a month-over-month increase of 0.3% (for a YoY rate of 3.3%) in wages.

U.S. Equities

- Q1 earnings season has been generally well received with notable strength from the technology-oriented areas, which continue their market leadership. The S&P 500 and Nasdaq Composite reached all-time highs. In addition, 7 of the 11 GICS sectors are back above their previous September highs. Cyclical sectors continue to outperform.

- 38% of the S&P 500 has reported Q1 results thus far with 78% of companies beating on the bottom line* for an average earnings surprise of 6.33%. So far, these metrics are running above their five-year averages in what has been a better than expected Q1 earnings season. Full Q1 earnings estimates have moved higher, and now reflect -1.7% growth for the quarter. If earnings season continues to progress like it has, Q1 earnings will finish in positive territory.

- Focus of the Week: Earnings season and China trade negotiations are progressing well and remain the focus. U.S. officials are set to visit Beijing next week, with Chinese officials returning to DC the following week. Over 35% of the S&P 500 market cap reports earnings next week including Google, GE, Apple, McDonalds, and Gilead Sciences.

Fixed Income

- The data-driven bond market will hinge on a few big releases next week. Personal Consumption Expenditures (PCE), the Fed’s favored measure of inflation, will be released Monday with the consensus estimate (+1.7%) remaining below the Fed’s 2% target. Non-Farm Payroll and Hourly Earnings numbers will be released on Friday.

- Focus of the Week: The Peoples Bank of China also declared it has no intention of tightening or loosening its monetary policy. This sets the stage for the FOMC rate decision on Wednesday which anticipates that the U.S. central bank will also keep monetary policy unchanged. Any surprises in the FOMC statement regarding the economic outlook or future monetary policy could create bond market volatility.

International

- The MSCI All Country World index (ACWI) is consistent with the U.S. market as it is back above its September highs on improved global economic expectations. However, while the U.S. has led the way, developed markets ex-U.S. (MSCI EAFE) and emerging markets (MSCI EM) are not quite back to their all-time highs yet.

- The U.S. dollar rose to the highest level in 23 months. The strength in the U.S. dollar has been primarily against the euro, which declined to the lowest level (1.11) since June 2017 on the back of disappointing economic data.

- Focus of the Week: Chinese manufacturing purchasing manager’s indices (PMI) data will be published on April 30, which will provide further insights into the current strength of the world’s most important emerging market. For much of the rest of Asia and Europe, equivalent data will be published on May 2.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.