Weekly Investment Strategy

Key Takeaways

- The S&P 500 is off to its best start to a year (19.9%) since 1996.

- A budget deal and earnings have been recent catalysts.

- The fed, earnings, and data are key items to watch next week.

In my travels this week to Dallas, I discovered that the 2019 Horseshoe Pitching World Championship was underway in Wichita Falls, TX, running from July 22 through August 3. I wish I could have stayed to participate (they have all levels) as horseshoes is a great game of skill (and a little luck)! The game involves two individuals throwing two horseshoes (also called ‘pitches’) each in a series of innings with the first to reach 40 points winning the match. Three points can be scored by notching a ‘ringer’ (horseshoe surrounds the stake) and one point is earned by throwing a ‘leaner’ (horseshoe within six inches of the stake). Avoiding ‘dead shoes’ (horseshoes that are not eligible to score) is paramount. Given the record level of equity prices, with the S&P 500 posting its best start to a year (19.9% through July 23) since 1996, the below four catalysts (‘pitches’) need to continue to score if the market is to maintain its upward momentum. We remain cautious in the near term as the ‘tosses’ next week get more challenging as the stakes grow at such elevated levels.

- Spending Compromise (Ringer) | President Trump and congressional leaders announced a bipartisan, two-year debt ceiling and budget deal on Monday. The agreement scored three points with the market because it (1) alleviated the threat of debt default, (2) avoided the $225 billion of sequestration spending cuts, and (3) precluded what could have been the fourth government shutdown under Trump’s tenure. The two-year deal sets spending $320 billion above the Budget Control Act sequester levels and pushes the next big budgetary showdown past the next presidential election. The two years combine for ~$100 billion in net stimulus (~0.24% of gross domestic product (GDP) annually). Despite the grumbling from several members of both parties, we expect the proposal to pass Congress and the president to sign it. This ‘ringer’ takes out a potential late summer/early fall risk earlier than we suspected and gives a slight boost to the economy.

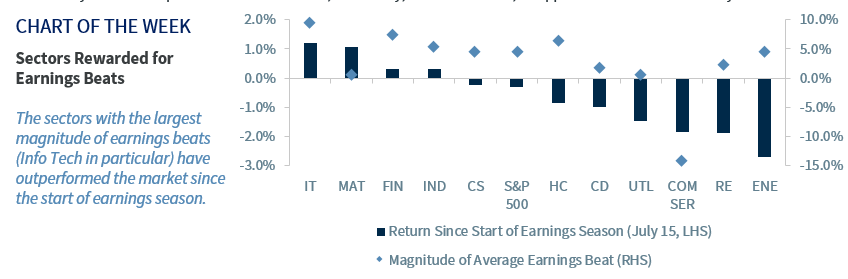

- Excellent Earnings Season (Ringer) | This week and next mark the two busiest weeks of the 2Q19 earnings season, with 310 companies and ~64% of the S&P 500 market cap reporting earnings over that time frame. Thus far, earnings have squarely surrounded the post for a ringer. With ~44% of S&P 500 companies reporting, 78% have beaten on the bottom line (above the previous 20-quarter average of 72%) and 59% have beaten on the top line (in line with the previous 20-quarter average). On aggregate, while the earnings season is still in the fairly early innings, S&P 500 constituents have beaten their earnings estimates by 6.8%, significantly above the previous 20-quarter average of 4.8% and the best of any quarter since 1Q18. If, as we expect, earnings continue to beat, 2Q19 earnings growth should ‘flip’ into positive territory after beginning earnings season with a -1.2% year-over-year (YoY) earnings growth expectation. Tech companies (our favorite sector) have seen the strongest aggregate beats, outpacing estimates by 9.7% (the best of any quarter since 3Q17) and have been rewarded as the Tech sector is outperforming the S&P 500 by 150 basis points (bps) and is the best performing sector since the start of earnings season.

- Fed Easing (A Pressure Pitch) | Next week’s July Federal Open Market Committee (FOMC) meeting (Tuesday/Wednesday) is accompanied with high expectations. The market is pricing in a ~100% probability of a rate cut, including a 15% probability of a 50 bps cut. With the S&P 500 at all-time highs, a ‘ringer’ throw by Chairman Powell will be difficult as he will have to strike a balance between continued dovishness (and the potential for more cuts) while not being overly pessimistic about the economy. While ECB President Mario Draghi issued a very dovish statement at the ECB meeting this week, the lack of an interest rate cut and details for further bond purchases disappointed the markets. Look for benign inflation and overseas weakness to be the rationale for the first of what will likely be two ‘insurance’ cuts by the Federal Reserve (Fed) this year to preserve the longevity of this expansion.

- “Goldilocks” Data Points (A Difficult Pitch Awaits) | While international momentum continues to lag (German PMI declined to the lowest level in seven years), the US economy has remained fairly resilient amidst the foreign weakness. Next week, we receive a trifecta of key economic readings that includes ISM Manufacturing (expected to improve for the first time in four months), consumer confidence (expected to rise to 126 from 121.5) and employment (expected to show 149k jobs were added in July). While a rebound in data is a positive long-term factor for equities (leads to better earnings growth), strong upside surprises to the data may limit the scope for future Fed rate cuts, which may, in the short term, disappoint the market at currently elevated levels.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.