Weekly Investment Strategy

Key Takeaways

- In a tribute to Woodstock, markets could use ‘Three days of peace and music’

- Markets may need a ‘little help’ from President Trump and Fed Chair Powell

- An inverted yield curve starts the ‘shot clock;’ don’t panic

This week marks the fiftieth anniversary of the generation-defining Woodstock Festival. It was billed as ‘Three Days of Peace and Music,’ clearly something we could all use after the last two tumultuous weeks in the financial markets! Aside from iconic musical performances, Woodstock is also remembered for its crowds and inclement weather.

- Overcrowding | What was supposed to be a 50,000 person ticketed event evolved into a 400,000 person free concert on a farm in Bethel, New York. Overcrowding, or extreme levels of bullishness, can be a negative for equities. Elevated levels of bullishness exhibited in early August have reversed as the S&P 500 has fallen 6% from its highs. This has subsequently become a near-term positive for the equity market.

- Inclement Weather | Despite torrential thunderstorms, the festival persevered as most ignored the weather and focused on the history-making musical performances. Similarly, investors need to focus on their long-term goals and the underlying fundamentals of the market and disregard the daily deluge of negative headlines.

Turning to the music, many of the great songs performed at Woodstock connect to the current state of the financial markets:

- With a Little Help From My Friends | Two people that could be a ‘friend’ to the market are President Trump and Fed Chair Powell. The president could help market sentiment by alleviating the concerns around the potential for increased tariffs with China, Europe, and Japan. While the postponement of some of the Chinese tariffs until December 15 is a start, a more permanent declaration of a trade truce would serve as a catalyst for equity markets. While the Fed did cut interest rates at its July FOMC meeting, it was more coy about its commitment to further rate cuts, which disappointed the markets. As a result, the market will likely react strongly to any clues released at the Jackson Hole Economic Symposium starting next Thursday (August 22). This is especially true as we approach the September FOMC meeting, given that the futures markets are pricing in a 94% probability of two or more rate cuts and a 65% probability of three or more rate cuts by year end.

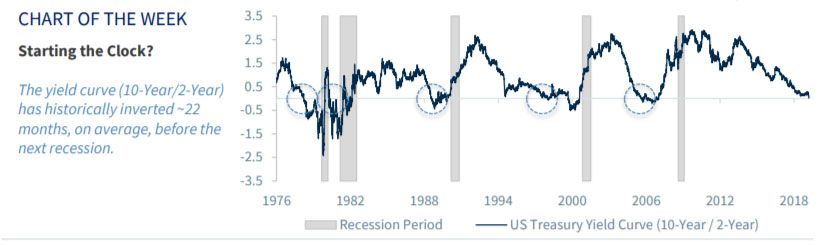

- Déjà Vu | The inversion of our preferred yield curve measure (10-year/2-year) for the first time in over a decade caused some investors to hit the ‘panic button’ this week. However, as this subset of the yield curve historically inverts, on average, ~22 months prior to the next recession, panic is not warranted. Although the ‘clock’ may have started for the US economy, the strength of the US consumer and labor market are consistent with a continued expansion. In fact, following the inversion and an initial dip, the S&P 500 is up 12% on average one year following the inversion and is positive 80% of the time.

- The Star Spangled Banner | Just as Jimi Hendrix’s acoustic rendition of our national anthem was unorthodox, so is the state of the fixed income market. US Treasury yields remain attractive, especially relative to countries such as Germany where the entire yield curve is in negative territory. With the amount of negative yielding debt approaching $17 trillion, equities are becoming increasingly attractive on a relative basis. For example, the S&P 500 dividend yield is above the 10-year Treasury yield by the widest margin since November 2016 and is in the 94th percentile over the last 15-year period. Currently, 57% of S&P 500 companies have a higher dividend yield than the 10-year Treasury yield.

- Commotion | Between President Trump’s trade tweets, unrest in Hong Kong, and evidence of weak economic data from Germany and China this week, the market has no shortage of commotion. Combine the heightened volatility with the fact that the August to September period has historically been the weakest rolling two-month time period for the S&P 500 (-0.6% on average since 1980) and it should be no surprise that there are likely to be short-term spikes and pullbacks over the coming weeks. With market participation lighter than average during this vacation-laden month, it is not surprising that the VIX has spiked, that each of the first 12 trading days of August has exhibited an intra-day swing of more than 1.0%, and that five of these days have exceeded swings of 2.0%.

- We Shall Overcome | The combination of depressed Treasury yields, positive earnings growth in both 2019 and 2020, and a more dovish Fed should provide a more positive environment for equities moving forward. Short-term volatility will continue to challenge investors to continue to remain positive during pullbacks and to not be complacent during rallies. We believe that investors who diversify across asset classes and stay true to their risk profile will be able to strike the right note.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.