Weekly Investment Strategy

Key Takeaways

- Stick to the Asset Allocation ‘Game Plan’

- Consumer Spending Should ‘Defend’ Against Recession

- US the ‘Top Draft Pick’ for Regional Equities

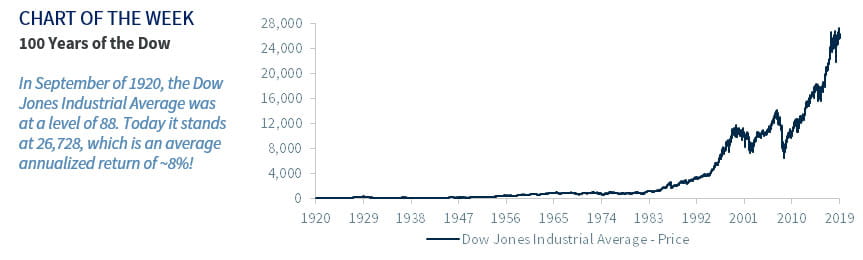

Last night, the Chicago Bears hosted the Green Bay Packers as the National Football League (NFL) celebrated the start of its 100th season! Since its founding, the NFL has transformed from a ten team regional league to the highest revenue generating sports league in the US with 32 teams worth a combined $91 billion (larger than 88% of the S&P 500 constituents)! For perspective, the Dow Jones Industrial Average was at a level of 88 in September 1920, whereas today it stands at 26,728 (an average annualized return of ~8%), and the S&P 500 was not even in existence. Many of the NFL’s Hall of Famers have remarked on the life lessons they learned from the game (e.g., perseverance, discipline, team work), but there are some key investment lessons that can be learned from football too:

- Stick to the Game Plan | The best coaches (Don Shula, Vince Lombardi, Bill Walsh, Bill Belichick, etc.) have one thing in common: they provide a game plan that puts their players in the best position to succeed. That is also exactly what successful investors have in common: a well thought out asset allocation that best suits their risk profile. By having a game plan, you should have a well-conceived response when financial markets inevitability do not move as planned. For example, conservative investors should maintain a higher allocation to income-producing investments so that their portfolio generates enough cash flow and is not subject to significant fluctuations during more volatile times. Conversely, investors with higher risk tolerance can maintain higher allocations to more volatile securities (such as equities) because they have a longer time horizon that will allow these ‘players’ to develop. Successful coaches also account for clock management, field position, and momentum when determining their next calculated move. At this juncture (i.e., the longest economic expansion in US history and heightened political and economic risks), now is not the time to be overly aggressive with portfolio allocations. Many investors are ‘ahead’ given the ‘super’ performance of both bonds and equities over the last ten years, and they should remain disciplined with their game plan instead of throwing a ‘Hail Mary!’

- Defense Wins Championships | While offense may win fans, it is defense that wins championships. Historically, many championship teams like the Chicago Bears (Da Bears), Pittsburgh Steelers (Steel Curtain), and Baltimore Ravens (my team!) focused on defense. Heightened economic and trade uncertainty has caused volatility to increase, and downside preservation for portfolios has become more important. In equity portfolios, we prefer the ‘home field advantage’ as our focus remains on US equities over international equities. We favor large-cap equities over small-cap equities based on better earnings prospects and ‘healthier’ balance sheets. In fixed income, we prefer -rade bonds over high-yield bonds.

- When the Crowd Gets Loud | There is a lot of noise coming from the crowd as presidential tweets, China trade, European politics, and Middle East tensions continue to drive the Global Economic Policy Index to near record highs. We encourage investors to ‘keep their head in the game’ and focus on the basic fundamentals of the economy, earnings, and valuations. While economic headwinds are building (e.g., ISM manufacturing in contraction), our expectation is that strong consumer spending, a synchronized global easing cycle, and a president motivated by reelection should help the economy avert a recession over the next 12 months. Given record levels of negative yielding debt overseas, low (but still positive) rates in the US have reduced the upside potential for bonds longer term. In this low rate environment, US equity valuations are attractive, especially if S&P 500 earnings approach the consensus ~$176 estimate for 2020.

- Not For Long | According to the NFL Players Association, the average career length of an NFL player is ~3.3 years. Due to this brevity, many have repurposed the NFL acronym to signify ‘not for long.’ Just as NFL players are only as good as their last play, we recognize that we are only as good as our last investment call. That is why we ‘train’ constantly and employ all the investment tools available to help provide a consistent ‘winning formula.’ Hopefully, our hard work and commitment will allow us to become the George Blanda (Hall of Famer who played a record 26 seasons) of investment strategy! We hope you enjoy the games this ‘kick-off’ weekend!

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.