Weekly Investment Strategy

Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

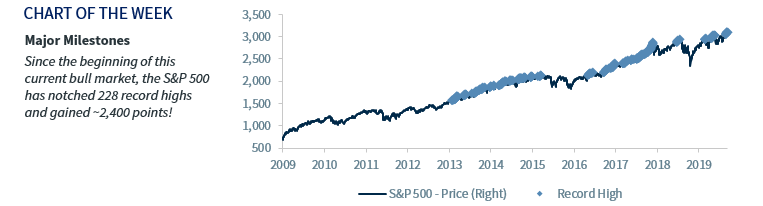

- Current Bull Market Achieved 200+ New Record Highs

- S&P 500 & DJIA Differ in Composition & Construction

- Equity Market Upside Remains if Trade Truce Materializes

November Nostalgia! Amazingly, yesterday was the anniversary of the first major milestone for the Dow Jones Industrial Average, as it closed above the 1,000 level for the first time on November 14, 1972 (47 years ago). While many Wall Street analysts popped champagne and likened this record to the breaking of the 4-minute mile, little did they know there were many celebrations to come as the Dow would go on to double, triple, quadruple, quintuple, and so on. In fact, as the Dow approaches its next milestone of 28,000, it has rallied 2,678% (from a price level perspective) which translates into an average annualized price return of 7.4% (~11% including dividends). With this week bringing new record highs to both the Dow and S&P 500, a question we often get is why, of the two, do we reference the S&P 500 in our equity analysis?

- It Is Not About Performance | Over time, both indices have similar performance dynamics. In fact, over the last ten years the indices have been strongly correlated (0.92), have similar levels of volatility (standard deviation ~12.0%), and, surprisingly, both have had an identical total annualized return of 13.6%. Since the beginning of this current bull market, the S&P 500 has notched 228 record highs versus the Dow that has achieved a similar 220 record highs.

- Market-Cap Weighting More Intuitive | The Dow and the S&P 500 have different construction methodologies. The Dow is a price-weighted index, meaning companies with a higher stock price are assigned a higher weighting and the S&P 500 is market-capitalization weighted, meaning larger companies have a higher weighting within the Index. Our belief is the S&P 500 market-cap construction is more intuitive. For example, Boeing Company, the largest weighting in the Dow (at 8.8%) because of its high share price ($370/share) is only the 28th largest position (at 4.4%) in the S&P 500. Similarly, Travelers, the thirteenth largest weighting in the Dow (representing 3.3%) is the 171st biggest stock in the S&P 500 (representing only 0.13%). In addition, while the S&P 500 includes the third (Amazon), fourth (Facebook), fifth (Berkshire Hathaway), and sixth (Alphabet) biggest companies in the US, the Dow does not include them.

- Composition More Comprehensive| The Dow is a highly quoted US equity market reference and provides a gauge to the health of the equity market. However, the S&P 500 is a more accurate representation of the overall US stock market due to:

- Individual Constituents | We prefer the broader depth of companies in the S&P 500. The Dow only consists of 30 blue-chip stocks, representing what the Dow’s selection committee deem industry leaders versus the S&P’s 500 stocks. This large differential in the number of stocks leads to the Dow representing ~25% of the total US stock market versus ~85% for the S&P 500. Similarly, the Dow’s companies, on average, are larger, with an average market capitalization of $261 billion whereas the average market capitalization of the S&P 500 is ~20% of the average for the Dow’s at ~$53 billion. Because the S&P 500 includes smaller companies, its composition is more diversified and provides a better platform to assess both multi-national and more domestically focused companies.

- Sector Weightings | We also prefer the sector allocation of the S&P 500. For example, the Dow has an ~10% higher allocation to Industrials and ~5% lower weighting for Communication Services (one of our favorite sectors!). Also, the Dow does not have any exposure to two of the eleven S&P 500 sectors–Utilities and Real Estate–which comprise 3.5% and 3.1% of the S&P 500, respectively.

- Evaluating Earnings | Due to the broader scope of the S&P 500, we evaluate earnings trends based upon this Index instead of the Dow as it provides a greater sample size, broader diversification and more ‘touchpoints’ into the current state of the economy, financial markets and future growth expectations. Also, because of the larger number of companies, it is easier to access the quality of earnings in regards to beats/misses, sales growth, and management guidance.

- Bottom Line | We remain optimistic on the US equity market based on solid economic growth, a rebound in earnings growth, accommodative monetary policy and favorable seasonality. Our 12-month target for the S&P 500 is 3,145 (with upside risk if a trade truce materializes). Both the Dow and S&P 500 provide exposure to the US equity market to benefit from our outlook. For the reasons listed above (i.e., composition, construction, and breadth) our analysis will remain biased to the S&P 500.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.