Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

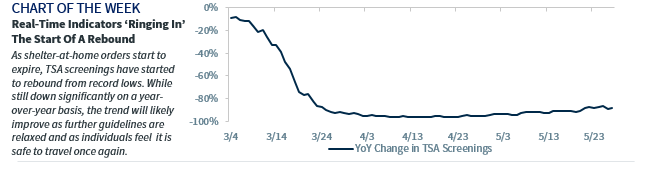

- Real-time indicators ‘ringing in’ the start of a rebound

- Equity market not ‘alarmed’ yet by escalating U.S./China tensions

- ‘Bells still chiming’ for growth-oriented sectors

Our ears are ringing as the iconic bell on the New York Stock Exchange is dinging – in person – once again! This week, Governor Andrew Cuomo had the honor of reopening the trading floor for the first time in two months, but of course, there were a few new rules in place. From mandatory masks to temperature checks upon entry, all of the protective measures implemented on the floor have become commonplace across our nation as states continue to lift shelter-at-home orders and allow businesses to reopen their doors. While not everyone will rush back to their preferred retailers and favorite restaurants with bells on, I think most of us, along with the equity market, are looking forward to the return to our normal routines. Unfortunately, we cannot ring the final bell on the COVID-19 outbreak just yet, but our insights on where the economy and markets stand currently may be beneficial to investors debating an allocation change or needing reassurance to stay the course.

- US Economy Starting To Ring The Recovery Bell | With the health and safety of their residents at stake, nearly all 50 states were left no option but to execute shelter-at-home orders from mid-March until at least the end of April. Such action was deemed critical in combatting the virus, despite the inevitable sharp economic downturn that ensued. Upon the initial implementation of the mandates, there was a high degree of uncertainty surrounding the severity of the decline as it was heavily tied to the duration of the closures and the nature of the virus itself. Due to the delayed release of key government-sponsored economic data, we instead rely upon a number of real-time economic indicators to formulate our outlook during these unprecedented times. And with all states having started easing at least some restrictions, these indicators support our belief that the US economy ‘bottomed’ in April and that the recovery process has begun. Last month, TSA screenings were down 96.4% year-over-year, business formation applications contracted 36% (the worst since the Great Recession), and restaurant reservations fell 100% year-over-year. Now, TSA screenings are down 88.5% year-over-year, business applications are slightly positive, and restaurant reservations are down 87% from the previous year. While these metrics do not reflect a booming economy, it is a noticeable improvement from the previous month when lockdowns were in full effect and each provides a semblance of hope that as states continue to safely reopen, the US economy could be well positioned for a robust rebound.

- All The Bells And Whistles When It Comes To Fiscal Stimulus | From the initial healthcare response to the record setting bill providing direct relief to businesses and households, we’ve acknowledged the expedited, diligent actions taken by Congress. However, it should be noted that just as COVID-19 is a global pandemic, the fiscal response has been global too. Just this week, Japan compiled a new $1.1 trillion stimulus package and the European Union proposed a €750 billion recovery plan, both of which are supplemental efforts to bolster the relief and aid that had already been provided. Although restrictions have been largely eased across the globe, limitations are still intact for certain industries and the psychological impact of the virus will likely complicate and challenge the recovery for many nations. Therefore, we expect that phased fiscal stimulus actions will continue not only within the US but in other countries for the foreseeable future, or at least until areas of distress are subdued.

- No Alarm Ringing On US/China Tensions Yet | Last year, any sanctions between the US and China would have rattled the financial markets, but currently, the escalating tensions between the two have not been a distraction for the equity market. Over the last several weeks, the Senate passed legislation to delist foreign companies from US exchanges should certain audit requirements fail to be met, the Commerce Department expanded export controls in an effort to limit Huawei’s access to critical supplies, and the State Department declared that Hong Kong is no longer autonomous from China. Overall, the actions taken seek to limit China’s access to the US capital markets, protect US intellectual property, and address civil liberty violations. Although this potential risk seems underappreciated by the market, it remains front and center on our radar of volatility-inducing catalysts.

- Does Sector Rotation Have A Ring To It? | The prolonged shutdowns and now phased recovery process has inherently favored certain sectors and industries. As the reopening process continues, some investors are questioning if now is the time to adjust their sector allocation and/or tilt away from our growth-oriented bias. In short, we maintain our preference for growth, and our favorite sectors remain unchanged. Historically, value has been less volatile during times of crisis, but the outbreak has led nearly 50 S&P 500 companies to cut or suspend their dividend. With the resurgence in economic activity, growth-oriented sectors will benefit from higher earnings growth, better earnings visibility, stronger balance sheets and attractive valuations. For these reasons, we continue to favor the Info Tech, Communication Services, and Health Care sectors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.