Weekly Investment Strategy

Review the latest Weekly Headings from CIO Larry Adam.

Key Takeaways

- Economic recovery will be a ‘marathon not a sprint’

- Economic optimism harmed if COVID-19 gets a ‘second wind’

- Stimulus helped equity market rally take its first ‘steps’

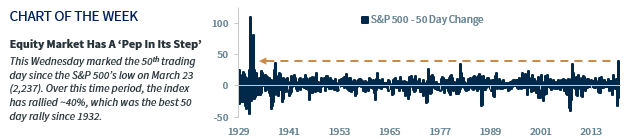

This past Wednesday, over 28,000 runners (my family included!) across the globe participated in Global Running Day. Whether you jog casually or race competitively, running is a great reason to step outside and enjoy some fresh air. There are many miles to a race, but each one begins with a first ‘step.’ Across the nation, states have taken several ‘steps’ to reopen their economies, but there will be many more to take as this economic recovery will be a marathon rather than a sprint. Since it is a forward-looking indicator, the equity market has had more ‘pep in its step.’ This week marked the 50th trading day since its March 23 low, with the S&P 500 rallying ~40% —the best 50 day rally since 1932. While the index has recovered ~85% of its virus-induced losses, there is still distance to go, and if you are like me, the further the race goes, the more challenging it gets and the slower I advance. The big question is how much energy has the equity market expended to get us to this point and where could it go.

- The Bottom Line | The equity rally has run-up at a near record pace, pricing in an exorbitant amount of good news as outlined below. In previous Weekly Headings (May 1), we outlined catalysts that could propel the S&P 500 above 3,100—which was achieved this week (currently 3,210). As a result, in the near term, the equity market may need to ‘rest’ since valuations have ‘stretched’ to the highest levels since 2001. The next 10% rally will likely be more challenging than the last, and while we remain confident equities have the ‘stamina’ to move higher over the next 12-24 months, they are primed to face volatility in the interim. Our assumption that earnings growth will rebound briskly in 2021 would present summertime pullbacks as buying opportunities.

- Fiscal Stimulus The Frontrunner | Congress took action ‘right out of the gate’ and, cumulatively, spent over $3.6 trillion dollars to mitigate the negative economic consequences of the lockdown. The ‘quick’ passing of bills helped spark the rally as it reduced the worst-case scenarios for both economic growth and earnings. More fiscal stimulus in the form of state aid, additional direct payments, and possibly an extension of elevated unemployment benefits is already anticipated by the market, so the eventual passage will likely not be an upside catalyst from current levels.

- Monetary Stimulus Sets The Pace | The emergency rate cuts, expansion of quantitative easing, trillion dollar facilities, and substantial lending programs alleviated investor tensions, provided liquidity, and restored overall confidence in the markets. In fact, the Fed’s intervention helped narrow investment-grade and high-yield spreads by 215 and 600 bps, respectively. Similar to the fiscal actions, these measures reduced the Armageddon scenarios and helped lift equity prices. While continued focus by the Fed likely limits the downside from current levels, its ability to significantly drive equities higher is likely exhausted.

- Economic Activity Metrics Pick Up The Tempo | Real-time indicators suggesting a bottoming in economic growth supported the positive sentiment surrounding the recovery. Currently, the equity market has priced in a fairly sizable rebound in 2H20 growth, with the consensus expecting 15% and 8% GDP growth in 3Q and 4Q, respectively. While these rebound levels are possible, the bar for economic growth expectations continues to float higher which increases the potential for disappointment.

- Case Count No Longer On The Fast Track | The rebound in economic growth is based on a contained COVID-19 new case count going forward with low probability of another shutdown. Admittedly, we don’t (and really no one) knows what course COVID-19 will take in the fall. However, the high degree of current optimism could be thwarted should the virus get a ‘second wind.’

- Positive Intervals In Therapeutic/Vaccine Developments | A record number of biotech and pharmaceutical companies backed by a record level of funding are in the race to discover a potential treatment or vaccine. While we are hopeful that a vaccine will ultimately be found, our Biotech analyst, Steve Seedhouse, places only a 25% probability (50% by mid-2021) that a broad scale vaccine will be developed. In addition, although there has been some progress on a few therapeutics, none are considered a ‘magic bullet’ to combat COVID-19. Progress in any of these areas, sooner rather than later, would serve as an upside catalyst.

- Outbreak Was A Test Of Endurance For Oil Prices | Remember when oil prices were negative? Well, May saw a record 88% increase in oil prices, with the current price at $39/bbl. Our view is that oil will struggle to move above $40/bbl which may reduce one of the tailwinds that has helped the energy sector rally ~77% from its lows.

- Political and Geopolitical Risks Could Cause An Injury | Thus far, the equity market has largely underappreciated the rising tensions between the US and China, which could cause a derailment of the trade truce, and the increasing odds of a Democratic sweep (Raymond James estimate is 40%) in the upcoming elections, which could lead to the potential reversal of corporate tax cuts. Both developments have the ability to cause a minor setback in this major comeback, and must be monitored closely.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.