Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Worst quarter of growth may be followed by the best

- More records in store for the equity market

- Highs and lows for oil while gold soars on uncertainty

Yesterday was the 65th anniversary of the Guinness World Records. The inspiration for the record book stemmed from a disagreement over the fastest game bird, but it has since set records of its own by becoming a best seller sold in more than 100 countries and offered in more than 20 languages. Categories in the book and database cover every topic imaginable (e.g., arts, sports, food and drink), and records are held not only by humans but by animals too! The celebration of this compilation of achievements has encouraged our Investment Strategy Team to create a list of economic and financial market records, and due to COVID-19, there has been no shortage of history making events. From the economic recovery to a possible vaccine, more records may occur by year end, therefore we include a few pending feats in our list too. 2020 has proven to be a tumultuous year for the markets, but above all, we encourage investors to keep their long-term objectives and asset allocation in mind.

- COVID-19 Response In The US | While the battle against the pandemic has been challenging, containment has been aided by a record number of tests administered (~80 million thus far) with a goal of at least 30 million during September. Operation Warp Speed will hopefully lead to the fastest development of a vaccine (~1 year vs 6-10 years historically) to help us return to normality.

- Pending—Vaccination | Operation Warp Speed hopes to deliver 300 million doses of an effective vaccine by January 2021.

- The US Economy | COVID-19-induced shutdowns ended the longest US economic expansion at 128 months. 2Q20 GDP (Gross Domestic Product) contracted -31.7%, more than 3x the previous record set in Q1, 1958 (-9.99%). As a result, jobless claims rose to 6.9 million in the week ending March 27, far exceeding the previous high of 695,000 from 1982. However, a record ~$2.7 trillion fiscal stimulus (which is expected to grow by at least another $1.5 trillion by October), record low (zero) Fed policy interest rates, and a record Fed balance sheet ($7.2 trillion) have supported the economy and provided liquidity to the financial markets.

- Pending—Best Quarter of Economic Growth | With high frequency, real-time activity metrics rebounding off of severely depressed levels, we forecast the third quarter will be the best quarter of GDP growth (+20%) in the US economy’s history.

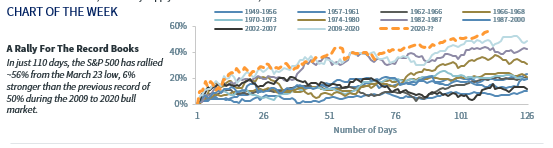

- The Equity Market | Equity market volatility surged to the highest level on record with the volatility index (VIX) hitting ~83. This volatility sparked the fastest bear market decline (20%+) from the February 19 record high, occurring in only 16 days. This record bear market was then followed by the strongest start to a bull market. In fact, in 110 days, the S&P 500 rallied ~56% from the March 23 low, 6% stronger than the previous record of 50% during the 2009 to 2020 bull market. Driving the market higher has been a record run by the NASDAQ, which lifted the most valuable company in the world, Apple, to a valuation level of more than $2 trillion.

- Pending—A New Record High | This week, the S&P 500 hit all-time highs. Despite negative earnings growth, a record breaking 82% of companies beat 2Q earnings estimates and helped lift the equity market. Momentum and an earnings recovery is likely to support additional records into 2021, especially as the potential for record S&P 500 earnings (>$161.25 needed) in 2021 grows.

- The Fixed Income Market | The 10-year and 30-year Treasury yields reached respective record lows of 0.50% and 0.92% on March 9, as fears surrounding the virus and stability of the economy heightened demand. Due to Fed rhetoric and bond purchases, investment-grade spreads narrowed 101 basis points from the March 23 peak in just six days (the fastest 100+ basis point contraction from a peak on record). However, spreads are currently still above pre-pandemic levels (93 basis points in January).

- Pending—Record Levels of Bond Issuance | With record budget deficits driving record Treasury issuance, the sheer increase in supply is likely to lead to slightly higher 10-year Treasury yields. However, the combination of the economic recovery, Fed purchases, and appetite for yield should lead corporate spreads lower, though the historic low of 75 basis points will be difficult.

- Commodities | WTI crude posted both its worst month (-8.0% in April) and its best month (+88.4% in May) on record this year. A record level of US oil production was interrupted by an unprecedented COVID-19 induced decline in production, as shutdowns drastically reduced global demand. In fact, a lack of storage capacity resulted in WTI crude prices briefly turning negative (-$37/bbl) for the first time in history. In comparison, on August 6, gold prices reached nearly $2,070/oz, well above the previous high of ~$1,892/oz set in 2011, due to low interest rates, a weakening dollar, and increased demand in light of so much uncertainty.

- Pending—Picky Peaks | Despite the rebound in oil prices, oil is unlikely to return to its high of ~$145 set in July 2008 as any increase in its price is likely to be offset by an increase in supply. Gold is more apt to reach additional record highs if uncertainty remains elevated, the money supply continues to increase, and the dollar continues to weaken.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.