Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Short-term volatility may cause emotions to ‘burst’

- ‘Pressure’ rising for certain sectors due to ‘K’ recovery

- Bonds are an important part of the investment ‘landscape’

Today marks 150 years since the discovery of Old Faithful Geyser, one of the most renowned features of Yellowstone National Park. It may not be the largest geyser in the park, but it was the first to be named due to its consistent, predictable eruptions. Many eruptions have occurred since its discovery, and the geothermal events occur frequently throughout the day! The start of this year was calm with the economic expansion reaching a record duration, unemployment at record lows, and earnings growth set to reach all-time highs. However, a ‘Black Swan’ event—COVID-19—erupted, driving market and economic volatility to unprecedented levels. These occurrences reaffirmed that disciplined asset allocation would serve as the ‘Old Faithful’ investment approach, and with the possibility of increased volatility due to the election or a second wave of the virus we revisit why this strategy is tried and true.

- Emotions Cannot Erupt | The final quarter of 2020 is quickly approaching, and we believe volatility is likely to remain elevated. From an optimistic point of view, there is the potential for favorable results from the Phase III clinical trials as early as the end of October, the elections could be decided in an affable manner, and holiday shopping could be robust with limited disruption from COVID-19. However, all of these are far from certain as vaccine trials could be disappointing, the election results could be significantly delayed, and a second COVID-19 surge is a fear of many health experts. These are just a few of the outstanding risks, but each has the potential to shape the trajectory of the equity market over the near term. We urge long-term investors to not let their emotions ‘burst,’ as knee-jerk investment decisions dictated by sentiment typically result in subpar performance. This year’s COVID-19-induced decline is a prime example, as investors who panic-sold during the mid-March lows would have locked-in a 34% decline and missed out on the 51% record-setting rally that ensued. In fact, an equity investor missing just the best five days over the past 15 years would have underperformed the S&P 500 by ~3.2%, annually. Why? Because the best days tend to occur not too long after the worst days—the days many investors capitulate and sell. As a result, having an investment strategy and a plan for when volatility occurs is paramount in helping avoid erroneous, emotionally-driven portfolio changes.

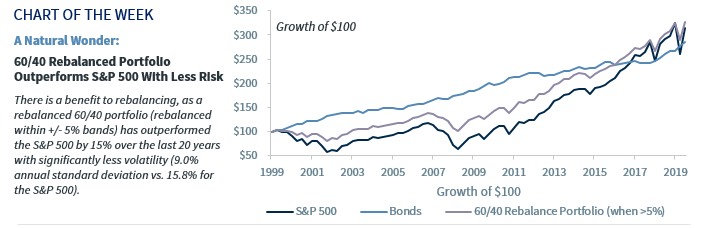

- Asset Allocation Is A Natural Wonder | For an investor, establishing asset allocation parameters that reflect risk tolerance, time horizon, and investment objectives is a critical step of creating a financial plan. Your asset allocation determines the percentage weighting of equities, bonds, commodities and cash, just to name a few. While the allocations of the various components will naturally fluctuate given market movements, it is important to determine how often and how far the stated percentage allocated to each asset class can stray before rebalancing. Coincidentally, the total return of a rebalanced 60/40 (60% S&P 500, 40% Bloomberg Barclays Aggregate Index) with 5% bands (rebalanced if allocation is +/-5% away from target) has outperformed a portfolio with 100% allocation to the S&P 500 by 15% over the last 20 years with significantly less volatility.

- Under The Surface Selectivity Matters | Once you determine your weighting in an asset class, you can decide whether to be a passive (follow the index) or active investor. Given the dispersion in equity performance at the sector and individual stock level on a year-to-date basis, selectivity remains important. For example, our projection of a K-shaped economic recovery has led us to prefer tech-oriented large-cap growth companies that benefit from streaming, e-commerce, and software over companies that will experience a delay in their recoveries (airlines, restaurants, and real estate). In the bond market, our preference is to buy what the Federal Reserve is buying in its programs, which is why we like investment-grade bonds and municipal bonds.

- Diversify Across The Investment Landscape | This week the Federal Reserve provided its first indication for the path of interest rates, with the majority in agreement for holding interest rates at zero through 2023. With the anticipation that this low interest rate environment will continue for the foreseeable future, many investors question the need for such a low-yielding investment. However, the importance of bonds, particularly Treasurys, has been displayed in the last two market corrections. When the S&P 500 was down ~20% in late 2018, the 10-year Treasury bond was up ~4%. This year, when the S&P 500 was down ~34%, the 10-year Treasury was up nearly 8%. So bonds not only provide an income component to the portfolio, they help dampen the volatility of a portfolio in times of crisis.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.