Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Election uncertainty & COVID fears interrupt the ‘rally’

- The us continues to ‘tally’ new COVID-19 cases

- The sectors that are still at the ‘top of our ballot’

Your voice, your vote! With only four days remaining until Election Day, more than 84 million voters have already voiced their choice—over 61% of the total turnout of the 2016 election. We’ve previously highlighted the unprecedented nature of this election, from the record $14 billion in campaign spending to the record 83% of registered voters who believe the outcome of this election truly matters, but if there is one characteristic that has been more prevalent than not throughout our country’s history, it is that elections cause uncertainly within the equity market. Narrowing polls combined with our nation’s third surge of COVID-19 led the S&P 500 to decline 5.6% in the first three trading days of this week. While we find it prudent to put the decline into perspective and to address these volatility inducing catalysts, we also urge long-term investors to remain focused on the fundamentals as we are in the midst of the 3Q20 earnings season and are set to receive key economic data next week.

-

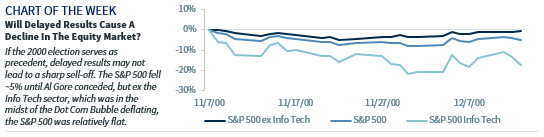

- Election Outcome Casting Uncertainty In The Equity Market | Despite former Vice President Biden’s evident lead in the polls, we had cautioned that the presidential race may come down to the wire. Over the last few weeks, Biden’s lead in key swing states narrowed and the odds of the Democratic Party gaining control of the Senate declined ~15% (from 70% to 55%). The decreasing probability of a Blue Wave clouds the outlook for the size, scope, and timeframe for further fiscal stimulus, but the potential for a highly contested election brings other questions to investors’ minds. A delay in the election results leading to a sharp decline in the equity market is one of the consistent concerns, but if the 2000 election serves as a precedent, we do not expect this will occur. The S&P 500 declined ~5% between Election Day and when Al Gore conceded (on December 13); but ex the Info Tech sector, which was in the midst of the Dot Com Bubble deflating, the S&P 500 was relatively flat and in a holding period until the final results were confirmed. However, one potential difference is that in 2000, Congressional gridlock was confirmed before the 2000 presidential outcome was known whereas the presidential outcome this time could be the difference between a sweep or gridlock. As a result, focus will be on Senate races, as control of the Senate will ultimately dictate how few or many campaign promises will be fulfilled and the market will likely price in the expected policies once the probabilities of passage are known.

- Campaign Against COVID-19 Cannot Stop Now | The US posted its largest daily increase in COVID cases on record (88k) this week, hospitalizations are at the highest level in two months, and 34 states have a 7-day positivity rate above our desired 5% threshold. A modest rise in cases was expected given the return to school, the further easing of restrictions, and temperatures becoming colder, but the sizable uptick has health officials concerned. Operation Warp Speed gave pharmaceutical companies a solid ‘platform’ for developing a vaccine in record time (1 year versus ~6-10 years on average), and while we’ve received positive headlines in recent days (e.g., AstraZeneca announced a positive immune response amongst older patients), it is important to remember that a widely available vaccine is not likely until next year. Therefore, current social distancing practices are necessary in mitigating the outbreak and protecting the economic recovery progress made thus far. While nationwide lockdown measures are not our base case, we anticipate local restrictions as needed (e.g., Chicago prohibited indoor dining in bars and restaurants), a high number of which would be detrimental to our economic and earnings forecasts.

- No Debate That Long-Term Investors Should Focus On The Fundamentals | As evidenced by this week’s 5.6% decline, the aforementioned risks are viable threats to the near-term performance of equities. However, our long-term optimistic view of the equity market is supported by fundamental factors (e.g., ongoing economic recovery, earnings rebound in 2021, lower for longer interest rates, supportive Fed, cash on sidelines) that we believe will be more influential to the performance of equities.

- Quite The Queue Of Economic Data | Next week, both ISM indices, vehicle sales, and the October jobs report will all hopefully signal the strength of the US economy. The Federal Open Market Committee will also provide a timely update, and while Chair Powell has reiterated that the recovery is dependent on the path of the virus, he may offer specific insights in light of the recent surge. We also expect the Fed, whose ongoing quantitative easing measures led to record balance sheet levels, to ‘delegate’ the next major policy maker move to Congress. Ultimately, the timing and scope of fiscal stimulus is essential to the economy given that ~7.8 million workers are still filing unemployment claims, which is in turn critical to our overall outlook for equities.

- Polling Forward Guidance | The 3Q20 earnings season has far exceeded expectations, but the markets are more concerned with positive future guidance given the uncertainty surrounding the recovery. Ultimately, until the virus is fully curtailed, the Info Tech, Communication Services, Health Care, and Consumer Discretionary sectors remain at the ‘top of our ballot’ given their favorable earnings and sales growth due to their position in the top portion of our expected ‘K-shaped’ recovery.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.