Weekly Investment Strategy

Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Larger stimulus deal ‘may be history’ without a blue wave

- US economic recovery needs COVID to be ‘part of the past’

- ‘Future looks bright’ for potential trade agreements

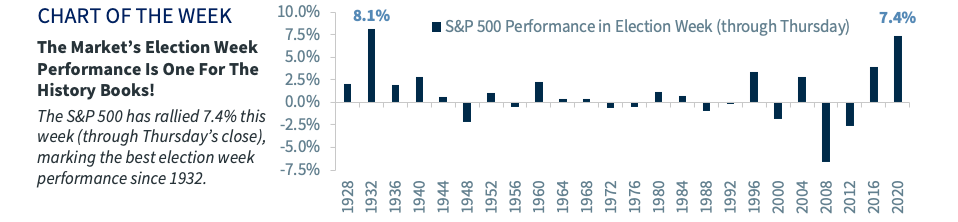

This has been a year for the history books, and the 2020 Election is yet another chapter filled with unprecedented occurrences. Between the highest voter turnout since 1900, the majority of votes being cast before election day, record campaign spending more than double the 2016 total, and the best election week performance for the S&P 500 (through Thursday) since at least 1932 (7.4%), there is no question that we are witnessing history in the making! But millions of Americans, myself included, want to witness the final results of both the presidential and congressional elections. With a potential recount in key swing states and likely two runoff Senate elections in Georgia, knowing the final composition of our nation’s government may unfortunately take more time. However, our team believes a split government is the most probable outcome, and we find it prudent to address the ways this has and has not altered certain aspects of our economic and financial market outlook.

- The US Economic Recovery Is Writing Its Own History | Assuming a split government comes to fruition, the election outcome will limit the impact to our base case macroeconomic assumptions. When it comes to GDP growth, either split government outcome does not alter our forecast of continued economic growth in 2021. In the event of a Blue Wave, our economist Scott Brown believes a larger fiscal stimulus package could have led to better growth in the earlier part of next year, but that prospect is now likely off the table. Instead, we believe there will be a compromise deal of at least $1 trillion and that it is more so a matter of when than if. If President Trump is reelected, we may receive it sooner, but under a Biden victory scenario, Senate Majority Leader Mitch McConnell’s potential willingness to strike a deal before year end could accelerate the timing. Ultimately, outside the fiscal stimulus proposals, many macroeconomic fundamentals remain the same under both divided government scenarios:

- The COVID-19 Pandemic Will Go Down In History | The COVID-19 outbreak escalated to one of the worst global pandemics, resulting in months of lockdowns and record declines in economic activity. While the 3Q20 GDP in the US rebounded 33.1% (the best quarter of economic growth since 1950), the US economy is still ~3.5% below pre-pandemic GDP levels. Despite the recovery progress made thus far, ~10 million workers are still unemployed and the number of open small businesses remains ~24% below the levels seen before the outbreak. Regardless of which political party is in power, the path of the virus will ultimately dictate the recovery. While a Biden administration may take a heavier hand with a potential national mask mandate, both administrations would likely leave the necessary decisions regarding restrictions to state and local government officials.

- The Fed’s Accommodative Stance Is Far From Ancient History | The extensive quantitative easing actions undertaken by the Federal Reserve over the last several months not only mitigated the extent of the downturn but have also aided the recovery process. In Chairman Jerome Powell’s testimony this week, he expressed that the Federal Reserve remains committed to holding interest rates at current levels until at least 2023 given the extent of and uncertainty still surrounding the COVID-induced slowdown. While the Fed’s balance sheet has already reached record levels, many of the established programs have yet to be maximized, and in the event the current surge of COVID causes a noticeable decline in real-time activity measures, the Fed will remain quick to act and their promise to “act as necessary” will hold true regardless of which party is in power.

- Certain Risks Have Become Part Of The Equity Market’s Past | Ahead of election day, many investors assumed that delayed results would directly translate to increased volatility and a decline in the equity market. Even though the final results are yet to be determined, the two most likely scenarios each involve split government, therefore the equity market is pricing in the decreased probability of a Blue Wave tax increase and the potential for subdued trade rhetoric should Biden be victorious.

- Blue Wave Tax Agenda May Be History | As the probability of a Democratic Sweep has fallen 40% from the early-October peak of 62%, the equity market no longer views Biden’s proposed tax hikes as a viable headwind. Focusing solely on the corporate tax hike, we expected the tax hike to reduce 2021 S&P 500 earnings by ~10% ($151 versus $165). With nine of the S&P 500’s sectors experiencing lower corporate tax rates as a result of Trump’s tax overhaul, its unlikely passage is a positive for equities.

- Biden May Bring Trade Agreements Back To The Future | President Trump was unapologetic about his tough stance on China, utilizing tariffs to renegotiate trade terms better aligned with our nation’s interests. Given that he took a similar approach with Mexico and Canada, and planned to do the same in Europe, the market believes his potential loss could dampen the trade-induced volatility. If Biden wins, we expect him to remain firm with China but that he will do so in a more diplomatic fashion. More important, we do not believe Biden will be as aggressive with Europe. As a result, multi-national companies that are more levered to global growth are likely to benefit from higher sales and earnings as global trade relations improve.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.