Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- ‘Georgia on our mind’ ahead of two run-off elections

- Widely available vaccine to bring us back ‘together again’

- ‘Can’t stop loving’ these same four sectors

Tomorrow marks 60 years since Ray Charles’ hit ‘Georgia On My Mind’ reached the #1 spot on the charts. His talents as a singer, songwriter, pianist, and composer rightfully earned him the nickname ‘The Genius’ as well as numerous accolades, including a Grammy Lifetime Achievement Award. Radio stations have played the music icon’s greatest hits and classic covers for decades, but today the lyrics of this particular song have gained new meaning for our nation, as control of the Senate rests on the outcomes of two run-off Senatorial elections in his home state of Georgia. As a general rule the financial markets do not like uncertainty, but whether it be political risk or the alarming trajectory of COVID-19, the equity market has rallied in the midst of it all, with the S&P 500 posting its best eight day period since April earlier this week. To help us explain which risks remain viable threats to the equity market in the near term, we’ll borrow some additional lyrics from the Father of Soul.

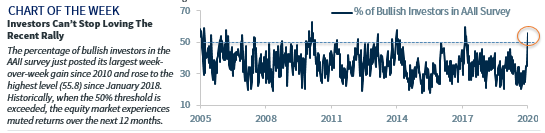

- Bottom Line: Investors ‘Can’t Stop Loving’ The Recent Rally | The S&P 500 is trading within ~1.2% of its record high, but some indicators suggest the rally may be overdone. For example, the percentage of bullish investors in the AAII survey just posted its largest week-over-week gain since 2010 and rose to the highest level (55.8) since January 2018. Historically, when the 50% threshold is exceeded, the equity market experiences muted returns over the next 12 months. While we may receive more than one successful COVID-19 vaccine, political developments and a worsening of the pandemic may cause volatility in the near term.

- Out Of ‘The Danger Zone’ – Major Policy Shifts Off The Table | While not official per the Electoral College, the financial markets have seemingly accepted Joe Biden as President-elect (88% probability according to PredictIt) with a Republican Senate (82% probability according to PredictIt) and Democratic House as the outcome of the 2020 election. If this holds, the split government composition would mirror the message of voters – that major policy shifts are not their desire. In fact, a President Biden could be the first Democratic president with a Republican Senate and Democratic House since 1884, and his party’s majority in the House is likely to be the tightest since the 1940s. This scenario is viewed optimistically, assuming legislators seek compromise rather than no-action gridlock. However, two risks still need to be monitored closely:

- ‘Them That Got’ The Senate | The Senate majority (currently 50 Republicans, 48 Democrats) hinges on the January 5 Georgia run-off elections. With at least one Republican win, a split-government will be in place for at least the next two years. However, if a Democrat wins both, control of Congress raises the potential for increased taxes and regulations, a near-term equity risk.

- ‘Here We Go Again’ With Stimulus Negotiations | Until the Senate is determined, the battle over the size and scope of the Phase 4 stimulus will continue. The gap between Senate Majority Leader McConnell ($500 billion) and House Majority Leader Pelosi ($2.2 trillion) remains wide, and it is increasingly likely that a deal will not be reached until 2021. We still believe a compromise of ~$1 trillion will unfold under a split government. With localized COVID-induced shutdowns increasing (e.g., Chicago’s Stay-At-Home Advisory), a delayed bill will likely hamper the economic recovery and pose a risk to the equity market.

- Vaccine Would Make COVID ‘Hit The Road Jack’ | The development of Pfizer’s vaccine with a 90% efficacy rate is a game changer in fast-tracking the economic recovery and bringing us back ‘together again.’ The announcement naturally benefitted the ‘re-opening’ trade (Financials, Industrials, small cap), which was reflected by small-cap equities posting their largest two-day outperformance over the NASDAQ in at least 30 years to start the week. However, there are still plenty of obstacles the vaccine must overcome (e.g., durability, manufacturing, distribution, and psychological barriers) before it is widely available to the public, which we still believe is unlikely to occur in 1Q21. In addition, given the rampant rise in COVID cases, additional social distancing and local lockdowns will again favor the ‘stay-at-home’ sectors at the top portion of the ‘K-shaped’ recovery.

- Cannot ‘Unchain Our Heart’ From These Sectors | We favor the Info Tech, Communication Services, Health Care, and Consumer Discretionary sectors due to still attractive valuations, positive earnings, and secular trends. Despite their strong outperformance year-to-date, Info Tech, Communication Services, and Health Care all have relative valuations in line or below their previous 20-year averages. For the 3Q20 earnings season, the Tech sector has the largest percentage of companies exceeding estimates (92% versus the previous 20-quarter average of 85%) and Health Care has the best earnings growth on a year-over-year basis (+9.8%). As we look ahead to 2021, earnings per share revisions are stronger for our preferred sectors, and each is expected to have dividend growth that outpaces the broader market. Lastly, from a secular trend perspective, the 5(G) rollout, broadband or tech-oriented infrastructure spending (supported by both parties), the rise in e-commerce, and the need for enhanced telehealth service offerings should benefit these sectors too.

Video recorded November 13, 2020. All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.