Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

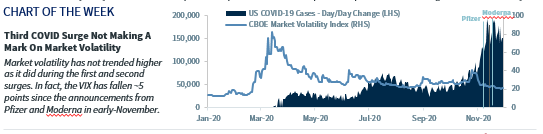

- Third surge not making a ‘mark’ on market volatility

- Widely available vaccine won’t set us ‘free’ until next year

- Biden may ‘call’ for tax overhaul with Senate control

It’s Bingo’s birthday month! For a game that has been around since the 1500s, it deserves more than one day to celebrate. The beloved pastime is a game of chance, with a game host announcing draws at random for players to mark on their cards using colored tiles or stamps. And when a player connects five boxes in a row, he or she gets the thrill of shouting ‘BINGO!’ for all to hear. But as exciting as it is to call out victory, there’s a lot of anticipation that comes beforehand, as players anxiously await the next ‘call’ in hopes the number is advantageously positioned on the card. Given the events of this year, investors know this feeling of anticipation all too well. There have been monetary policy shifts, stimulus debates, and of course, the presidential election – just to name a few! However, since the efficacies of the multiple vaccines have been announced, the equity market has seemed unfazed by some of the upcoming ‘calls’ that we believe have the potential to spark near-term volatility.

- B – Biden’s Tax Proposals Not Off The Table | All state election disputes and recounts are required to be resolved by next Tuesday, December 8, and with President Trump’s challenges gaining little traction thus far, Joe Biden is expected to be officially declared President-elect by the Electoral College the following week. The Senate majority (currently 50 Republicans, 48 Democrats) hinges on the January 5 Georgia run-off elections, and if a Democratic candidate wins each seat, control of the Senate will shift. Over the past month, the probability of a Republican Senate has declined from 83% to 70% (according to PredictIt), and although a Democratic majority would be narrow, our Washington Policy Analyst Ed Mills** believes tax reform and regulatory shifts would remain Democratic Party priorities. As mentioned previously, tax hikes, particularly on corporate tax rates, would be a near-term headwind for equities (especially since the S&P 500 has rallied 9.1% since election day) as it may decrease our 2021 earnings forecast by ~10%. However, longer term, the strength of the economy will ultimately determine the path of equities.

- I – Impeding Partisan Issues In Stimulus Negotiations | With additional CARES Act benefits expiring at month end (e.g., federal eviction moratorium, student loan interest freeze), Congress has yet to compromise on a Phase 4 stimulus package. The bipartisan $900 billion targeted bill appears to be building momentum, and we hope an agreement will be tied to the government funding bill come December 11. However, partisan differences may extend negotiations until the Senate outcome is known in January. To echo Chair Powell, the economy is in need of further fiscal action and a further delay may prolong the recovery.

- N – Not Easing Up On China Just Yet | While de-escalated tensions with China are an expected outcome from the Biden Administration, the removal of the tariffs passed under the Trump Administration won’t happen immediately. In fact, President-elect Biden indicated time will be needed for the Phase One trade deal to be fully reassessed and for a “coherent strategy” to be developed amongst our nation’s key allies in Europe and Asia. In the meantime, President Trump has taken an even tougher stance against China by limiting their access to the US capital markets, and further commercial pressure on China on intellectual property and human rights issues are not out of the realm of possibility. While we believe the trade relationship between the US and China will improve in the long run, near-term actions and retaliation may unsettle the markets.

- G – Growing COVID Cases Across The Country | In the initial stages of the outbreak, the CBOE Market Volatility Index (VIX) would rise as a surge in COVID-19 cases came to fruition. However, this most recent spike in new records for daily cases, hospitalizations, and deaths has not caused a similar movement due to the recent vaccine efficacy announcements by Pfizer and Moderna. While the equity market is a forward looking mechanism and focusing on a post-vaccine environment, it may be ignoring the impact that this recent surge (which is likely not over) will have on the economy in the near term. While metrics such as initial jobless claims have flat-lined, real-time mobility economic indicators such as hotel occupancies and restaurant bookings have declined, which is plausible given that ~80% of states have tightened restrictions in recent weeks. Tightening restrictions could hamper equities levered to the economic ‘reopening’ and hinder the broad momentum seen since the vaccine announcements.

- O – Obstacles In Vaccine Dissemination | While the development of an effective vaccine in less than one year’s time is an historic feat, vaccinating at least 70-75% of the population and achieving ‘herd immunity’ will be a process. Given that Pfizer and Moderna are both two-dose vaccines, the production level goals currently equate to ~900 million to 1.15 billion people, globally, receiving a vaccine in 2021. Since the initial dosages will be given to health care professionals followed by senior living facilities, essential workers, and those with comorbidities, our Bio Tech Analyst, Steve Seedhouse** believes the average, healthy American will not receive a vaccine until mid to late summer. The issue of durability (i.e., length of protection) may further complicate the timeframe. Any delays in distribution or question of protection could dampen the expectations of a strong sustainable recovery.

Video recorded November 13, 2020. All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.