The Job Market, The Fed, And Bond Yields

March 5, 2021

Chief Economist Scott Brown discusses current economic conditions.

The February Employment Report was stronger than expected, even though job gains were held back by unfavorable weather. Yet, we are a long way from full employment.

In his online discussion of the economy, Fed Chair Powell repeated that the central bank is nowhere close to achieving its inflation and employment objectives. Monetary policy will remain “patiently accommodative.”

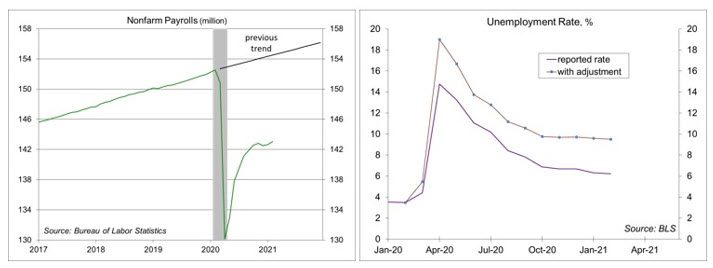

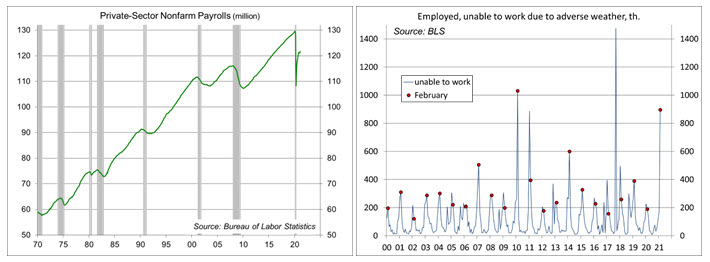

Nonfarm payrolls rose by 379,000 in the initial estimate for February, with private-sector payrolls up 465,000. The household and establishment surveys that make up the report missed the worst of February’s weather, but weather was still a significant factor. Construction jobs fell by 61,000. Retail hiring was slower in the holiday shopping season, leading to reduced job losses in both January and February (up 46,300 and 41,100 after seasonal adjustment). Prior to seasonal adjustment, education jobs normally rebound in February from a seasonal dip in January, but this year’s bounce was smaller, resulting in a seasonally adjusted decline of 71,000. Accounting for weather and seasonal issues, payroll growth would have been much stronger than the reported February gain. However, payrolls are still 9.5 million below the year-ago level and we would have expected about 2.0 million additional jobs if not for the pandemic. We are about 11.5 million below trend – indeed, a long way from full employment.

The unemployment rate edged down to 6.2% in February, which doesn’t sound so bad. However, that figure understates the weakness in labor market conditions. Factor in the people who have dropped out of the labor force and an ongoing misclassification issue, and the unemployment rate would be about 9.5%. In addition, about 6.1 million are involuntarily working part time (that is, they would prefer full-time work), up from 4.4 million a year ago. The broad U-6 measure on unemployment remained at 11.1% in February.

Powell’s comments on monetary policy were no surprise. The Fed chair repeated that the central bank would refrain from raising short-term interest rates until the economy is close to full employment. However, his comments about long-term interest rates caught the market’s attention. Asked about the recent rise in bond yields, Powell said, “I don’t want to be the judge of a particular level of long-term interest rates,” but he added that “I would be concerned by disorderly conditions in markets or a persistent tightening in financial conditions broadly that threatens the achievement of our goals.” Market participants took this as a lack of concern. Powell had previously noted that higher long-term rates are not a bad thing if they reflect stronger economic fundamentals. January economic data were mostly better than expected and the distribution timetable for vaccines has continued to improve. Still, the speed of adjustment matters and the Fed has tools to prevent long-term interest rates from rising too rapidly. For the Fed, it’s a question of whether higher long-term rates are restraining the recovery.

With the vaccine calendar shortening and more fiscal support on the way, the outlook for economic growth has improved. However, it’s unclear whether labor mismatches will restrain growth. Many jobs will never come back, although many more will be created. It’s likely to take some time for the labor market to sort itself out, but the outlook is positive.

Recent Economic Data

The Fed’s Beige Book noted that “economic activity expanded modestly from January to mid-February.” Nonlabor input costs rose “moderately,” while wage and price increases were “modest.”

The ISM Manufacturing Index rose to 60.8 in February (from 58.7 in January), reflecting stronger growth in new orders, production, and employment. The ISM Services Index fell to 55.3 (from 58.7), reflecting slower growth in business activity, new orders, and employment. Both reports showed longer delivery times and further increases in input prices. Comments from supply managers were mixed, noting supply disruptions from the pandemic, optimism about vaccines, and rising input cost pressures.

Nonfarm payrolls rose more than expected in February (+379,000 overall, +465,000 private), despite the impact of poor weather. However, we are about 9.5 million jobs below where we were a year ago.

The unemployment rate edged down to 6.2%, but the broader U-6 measure remained at 11.1%. The household survey data showed that 897,000 people could not make it to work due to bad weather.

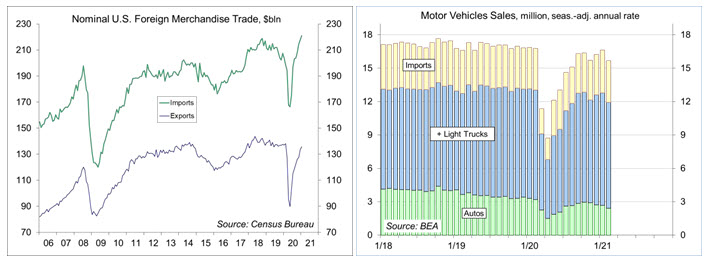

The U.S. trade deficit widened to $68.2 billion in January, from $67.0 billion in December ad $44.4 billion a year earlier. Imports rose 1.2% to record high (+3.2% y/y). Exports rose 1.0% (-7.6% y/y).

Unit motor vehicle sales edged down to a 15.7 million seasonally adjusted annual rate in February, down from 16.6 million in January and 16.8 million a year ago.

Gauging the Recovery

The number of new daily COVID-19 cases appears to have stabilized following a sharp decline from a highly elevated level in early January. The drop has led to a relaxation in social distancing directives, which should help the economy into 2Q21. The number of U.S. deaths from the coronavirus has surpassed 500,000.

The New York Fed’s Weekly Economic Index rose to -2.28% for the week ending February 27, up from -2.65% a week earlier (revised from -3.27%) and a low of -11.45% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

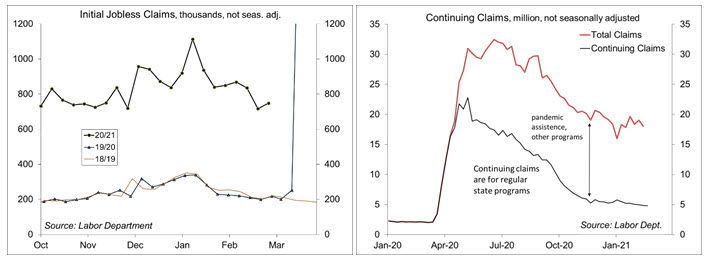

Jobless claims rose by 9,000, to 745,000, in the week ending February 27 (748,078 before seasonal adjustment), still very high by historical standards. Claims totaled 6.91 million over the first eight weeks of the year.

The University of Michigan’s Consumer Sentiment Index settled at 76.8 in the full-month assessment for February (the survey covered January 27 to February 22), vs. 76.2 at mid-month and 79.0 in January. The report noted reduced expectations for households with annual incomes below $75,000, despite pandemic assistance. Inflation expectations ticked up (after rising in January), but remained moderate.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.