Weekly Investment Strategy

March 5, 2021

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Technical supports for the S&P 500 remain intact

- Better economic growth should bring better earnings

- The recent tech sell-off may be misplaced

Can you hear me now? Good! This Sunday will mark 145 years since the US Patent Office awarded Alexander Graham Bell with the patent for the telephone. By the end of World War II, there was only one working phone for every five people, and now, there are more than 260 million smart phone users within the US alone. It is hard to imagine a world without these technological and telecommunication innovations, especially developments like video conferencing, which helped virtually connect us with coworkers, friends, and family over the last 12 months. These advancements have also allowed us to share our thoughts on the economy and financial markets no matter how near or far an investor may be. Given the anniversary of this specific, significant communication breakthrough, we’ll address the miscommunications between Chair Powell and the markets this week, and provide context for the inflation and interest-rate induced market volatility.

- Positive View on Equity Market A Long Distance Call | Since their peaks, the Dow Jones Industrial Average, the S&P 500, and the NASDAQ have declined 3.3%, 4.2%, and 9.7%, respectively. While pullbacks in the equity market are unnerving in the moment, it is important to put them into context. First, these declines are minimal from the perspective that the Dow Jones Industrial Average, the S&P 500, and the NASDAQ have rallied an astounding 66%, 68%, and 85%, respectively, since the market lows last March 23. Second, pullbacks are not uncommon. In fact, dating back to 1990, the S&P 500, on average, experiences three to four 5% plus declines during the course of the year. Pullbacks remain a buying opportunity as we reiterate our year-end S&P 500 target of 4,025. From a technical perspective, the S&P 500 remains above its 200-day moving average (3,493) and is nearing oversold territory (current Relative Strength Index (RSI) level 39.97 versus 30 threshold).

- Dialing In On The Decline—Interest Rate and Inflation Static | Investors should not overreact to modestly higher inflation and interest rates because they are rising for the right reasons as it is a sign the economy is healing from the depths of the pandemic-induced recession. In addition, the combination of the vaccine roll-out, additional massive fiscal stimulus, and pent-up demand is likely to drive US economic growth to ~5% this year—the best economic growth we have seen since 1984. The point is that better economic growth should support better earnings growth which should ultimately support higher equity market prices. Similarly, healthy inflation gives companies the ability to raise their prices, which if they can control their costs, can lead to better earnings growth as well. Contrary to the recent angst in the markets, historically, the equity market has had above-average performance in rising inflation and interest rate environments.

- Expectations Chair Powell Would Hold The Line | In his address at the Wall Street Journal’s Job Summit, it was not as much about what Chair Powell did say as it was what he did not say. His commentary largely addressed the inflationary concerns, as he acknowledged that upward pricing pressure is expected given the base effects of an improving economy, reiterated the Fed’s “patient” stance in the midst of transitory increases in inflation, and explained that the current economic backdrop is different from the runaway inflation periods experienced in the 1960s and 1970s. However, investors were hoping to hear a stronger message regarding the tactics the Fed would utilize should bond yields continue to move higher. Chair Powell stated that the substantial move had “caught his eye,” yet he did not offer potential or specific actions (e.g., purchasing longer-duration bonds as part of its current quantitative easing program) that the Fed may undertake. While it remains our base case that a further rise in rates will be limited, the next Federal Open Market Committee Meeting in two weeks (March 16-17) will be critical and it remains our belief that the Fed will take all necessary actions to contain the rate rise if the magnitude of the move worsens.

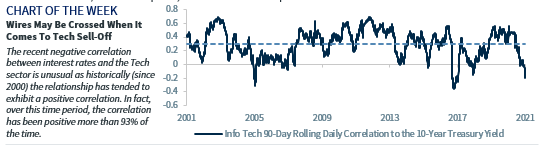

- Don’t Hang Up On The Tech Sector Yet | The Tech sector, which turned negative on a year-to-date basis this week, has significantly weighed on the NASDAQ as the index posted its worst two-day decline since early September yesterday (-4.8%). However, it is far too early to give up on this sector given its recent above-average earnings results, strong visibility in earnings (e.g., 5G), and our expectation that Tech will be a beneficiary of significant continued consumer and business demand as the economy reopens. The recent decline of this sector as a result of higher interest rates and inflation may be misplaced as historically, Tech has been the best performing sector during these environments because of its strong pricing power (mitigates inflation risk) and strong cyclicality (sales benefit from surging economy). As an example, the recent negative correlation between interest rates and the Tech sector is unusual as historically (since 2000) this relationship has tended to exhibit a positive correlation. In fact, over this time period, the correlation has been positive more than 93% of the time.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.