Finding Value in Low-Demand Corners of the Market

March 29, 2021

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

As we all remember from the first economics course that we ever took, as demand for a product increases, so does the price. Conversely, as demand falls, so does the price. How can we use this Econ 101 lesson to optimize our fixed income portfolio? Simple. All we do is combine this lesson with the Fixed Income 101 lesson in which we learned that as prices fall, yields rise. We use this information to help us find bonds that have less market demand for some particular reason, yet still fall in line with our personal fixed income objectives.

A good place to start our search for low-demand bonds that might be a good fit for our portfolio is to look at high-coupon, high-priced bonds (high premium bonds). All else being equal, a bond with a high coupon is going to have a higher price than a low coupon bond. Think of it this way: a bond is just a series of payments that includes the coupons that the bond pays over its life along with a principal payment at maturity. When thinking of it this way, it makes sense that a series of ten $500 coupon payments plus a $10,000 principal payments is going to cost more than a series of ten $200 coupon payments plus a $10,000 principal payment. The mechanics are not complicated, yet it is commonplace to get stuck on only two of the three pieces: the price of the bond and the principal payment at maturity. This completely ignores the string of coupon payments that come in between. Due to this thinking, many investors are hesitant (or flat out refuse) to purchase a bond priced at a large premium (a premium bond is any bond priced above its par value) knowing that the bond is eventually going to mature at par (100). It is easy to miss the fact that bonds priced at a premium are going to provide more cash flow than a bond priced at par.

So as savvy fixed income investors, how can we take advantage of this? We can purchase high-coupon, high-premium bonds that have less demand from the general market. Remember, less demand can mean a lower price, which translates to a higher yield. So by simply understanding how bonds work and how the math works, we can find pockets of opportunity that many investors overlook.

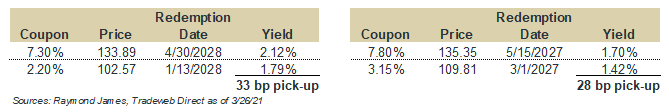

The examples below represent corporate bond offerings pulled on Friday afternoon, comparing the yield differences between low and high coupon bonds from the same issuer. The example on the left shows two offerings from a high-quality issuer (A2/BBB+), the top bond has a very high coupon (7.30%) and correspondingly high price (133.89). The misunderstood premium often creates a “low-demand” bond because purchasing a bond at 133.89 isn’t something many are willing to do (as discussed above, they are ignoring the large coupon payments that will be received over the next seven years). As the demand is lower, the relative price is lower, which means the yield is higher. The takeaway is that purchasing the higher-coupon bond will reward the investor with 33 basis points of additional yield for taking the same amount of credit risk and potentially less duration risk. The example on the right shows a similar situation from a different issuer (also high quality at Baa1/BBB+), whereby simply being open to purchasing a bond at 135.35 when most investors aren’t, 28 basis points in yield can be picked up.

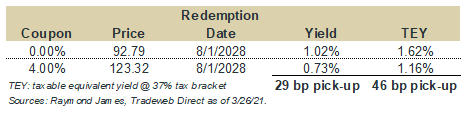

Staying with our theme of lower-demand coupons and dollar prices, the illustration below highlights the same idea by looking at a zero-coupon municipal bond. Zero-coupon bonds tend to be less in demand than their coupon-bearing counterparts because many investors purchase fixed income desiring for the cash-flow. For investors that don’t necessarily need the cash flow provided by coupon payments, zero-coupon bonds can provide an opportunity to increase overall portfolio yield (income). This example shows two bonds from a very high-quality issuer (Aa1/AA+) with identical maturity dates. The top line shows a zero-coupon bond, while the bottom line shows a 4.00% coupon bond. The zero-coupon bond provides the investor 29 basis points of additional yield by foregoing the cash flow along the way and choosing to receive all of their income at maturity (the income of a zero-coupon bond is simply the difference between the purchase price and the maturity price). For an investor in the 37% federal tax bracket, that is a taxable equivalent yield pick-up of 46 basis points. Again, same credit risk and same redemption date, but by purchasing a lower-demand bond, the zero-coupon bond provides the investor with additional yield.

These are just a couple of examples of how a savvy investor can take advantage of lower-demand pockets of the fixed income market. Every idea will not work for every investor, as there are tradeoffs and everyone is going to have different objectives and risk tolerances, but being open to a range of ideas can offer opportunities that more constrained investors might not have. Understanding some basic fixed income fundamentals and where to find low-demand pockets of the market can help to ensure that no yield is being left on the table.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.