No Substitutes For the Real Thing

He shoots… he scores! The hero of the game is often the offensive hero. The person that creates the flash, is fun to watch and makes the highlights is regularly applauded and even admired. Well, today is about the unsung hero. Offensive is fun and clearly necessary yet its ultimate value holds up only if the defense performs its duties.

In our world, growth assets are the hero. Growth assets are often required to build our wealth but if we can’t hold onto that wealth their significance and value are rendered meaningless. Portfolio construction relies on both growth assets and wealth preservation assets to generate a healthy financial standing and the composition of the portfolio influences this essential balance.

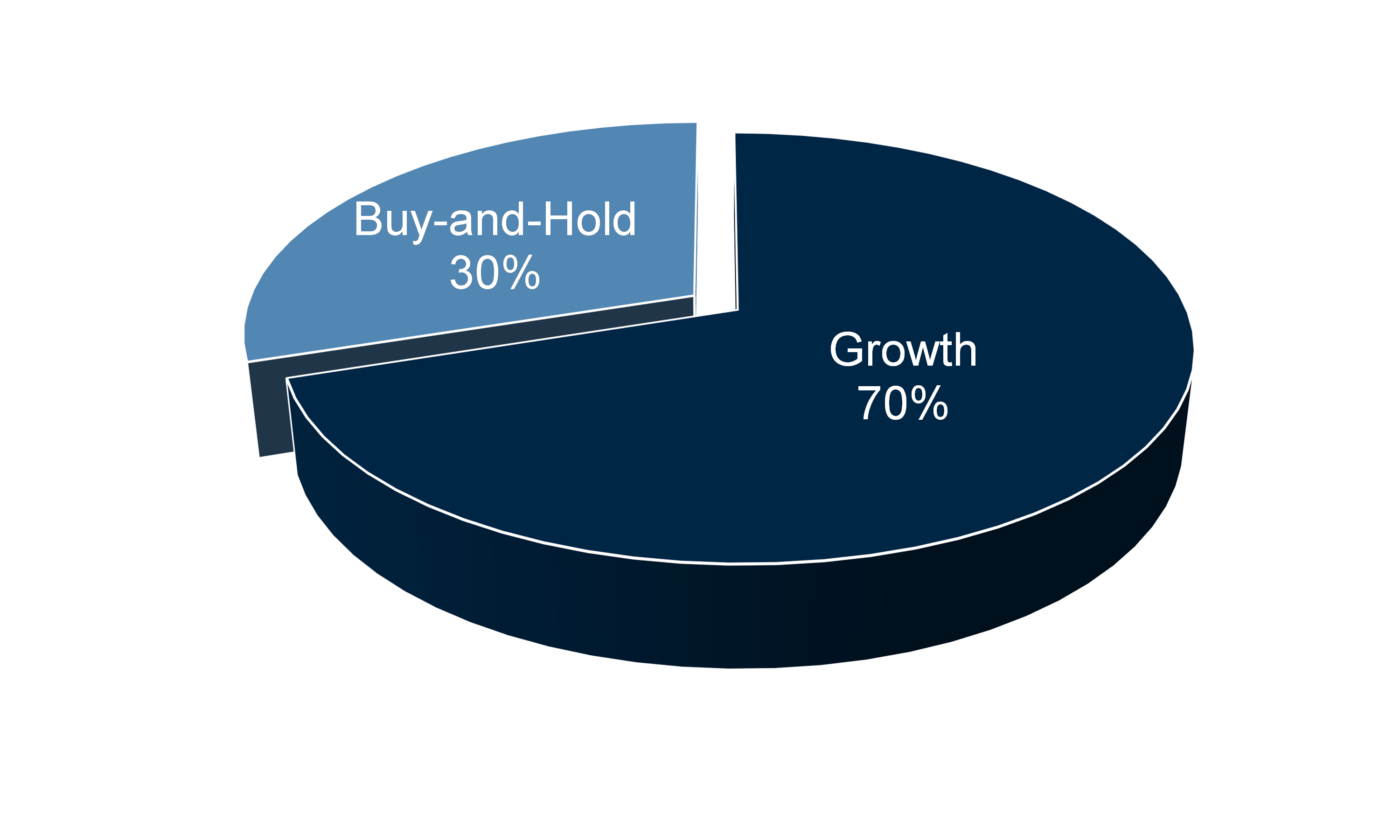

Imagine a portfolio that is split with 70% in growth assets and 30% in wealth preservation assets. This ratio can vary greatly depending on your accumulated wealth, risk tolerance and ability to generate income moving forward. For this example, let’s use a 70%/30% split.

Growth assets are primarily total return assets or those that rely on price appreciation to deliver value. Individual bonds are favored buy-and-hold assets because their features, including a stated maturity, provide a degree of assurance that is not readily duplicated or substituted for with many other products. Maturities provide dates where barring default, face value is returned to the investor while during the holding period, cash flow and income are locked in.

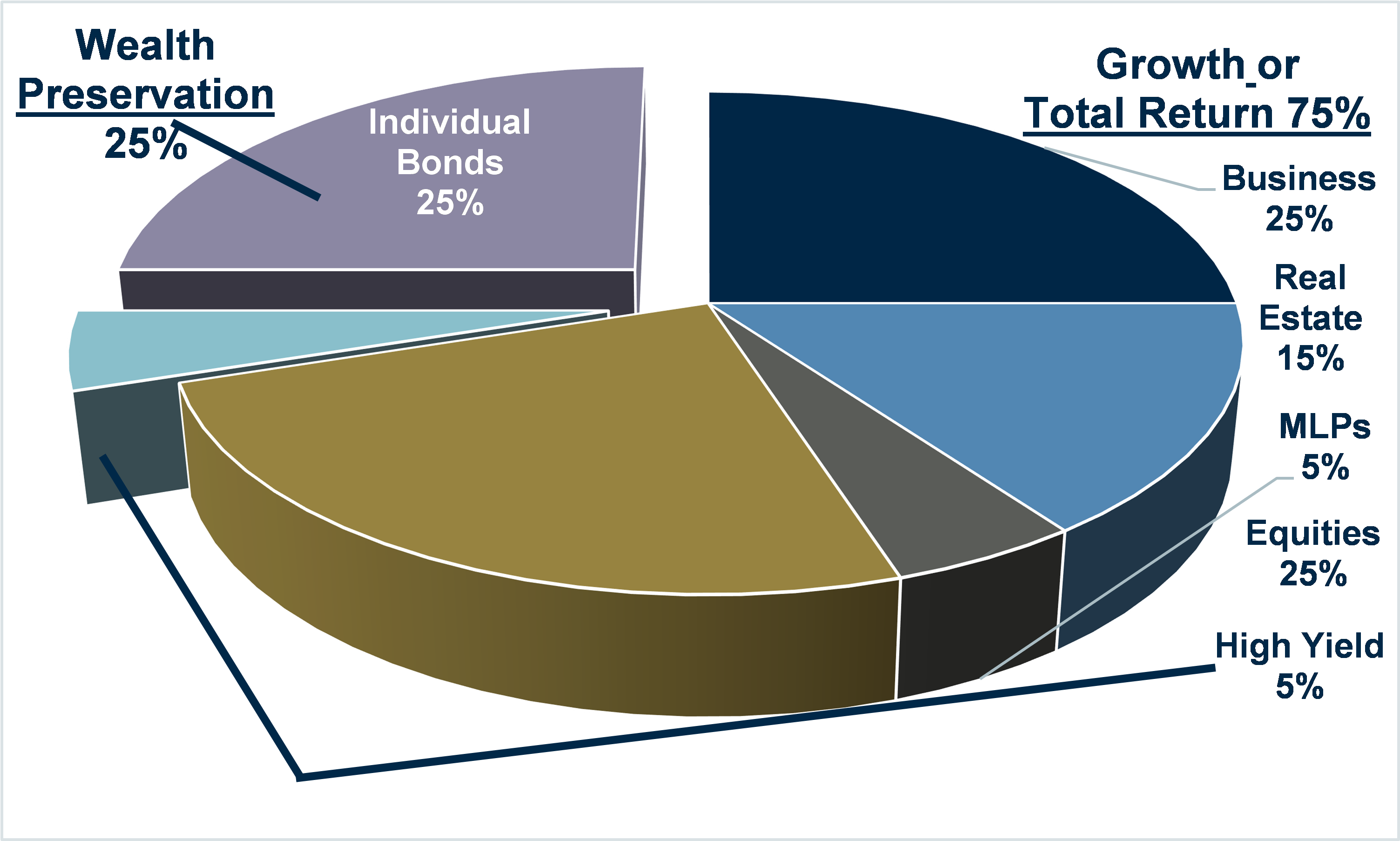

Using investment substitutes can disrupt the important balance between growth and wealth preservation. For example, high yield bonds (junk bonds) and their associated volatility can behave more in line with equities than defensive buy-and-hold individual bonds. Owning high yield bonds or other substitutes (like dividend-paying stocks) may be suitable for many investors. That’s not the point. The point is understanding that many individual bond substitutes change the balance between growth and wealth preservation.

Using 5% of the portfolio’s wealth preservation (individual bonds) and buying “substitutes” can change the desired 70%/30% split to 75%/25%. In the chart above, there it is not necessarily erroneous to add 5% into high yield, just note that this substitute changes the ratio of growth to preservation. The word “income” in an investment does not necessarily define its characteristics or how it interacts within the portfolio. Make sure the balance that is appropriate for your portfolio stays intact.

Where should we be looking for wealth preservation assets? The corporate sector continues to provide its best value in investment grade BBB rated bonds. Investors can target around 2.00%. If even stronger credit is desired, low A-rated corporate bonds in around the 6-8 years part of the curve provide good value according to one of our corporate traders. Another corporate trader reiterated that demand is strong for BBB-rated corporate bonds in the 5-10 year part of the curve. Bank and finance paper has traded wider and widened another 1-3bp this week (wider spread means higher yield).

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.