The Consumer Outlook

Chief Economist Scott Brown discusses current economic conditions.

We are still in a peri-pandemic economy. That is, we aren’t done with COVID-19. The virus is still affecting economic behavior. It seems clear now that the post-pandemic economy is going to differ from the pre-pandemic economy. Work-from-home is going to be a longer lasting phenomena. Consumer spending patterns are also likely to undergo permanent changes. Recent data suggest that 2Q21 GDP growth remained brisk (advance estimate due July 29), but it appears likely that the pace of growth will moderate in the second half of the year – still strong, but slower than in the blistering first half pace.

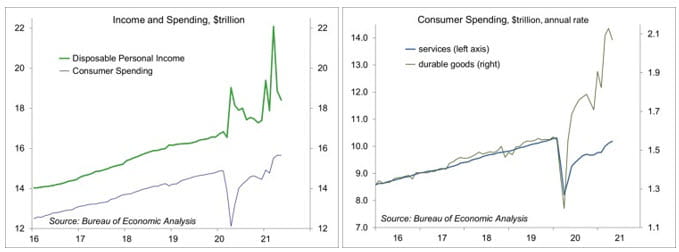

Personal income and spending exhibited patterns that were not expected at the start of the pandemic. Income has been well above the pre- pandemic trend, reflecting fiscal policy support (and especially the direct payments that went out in April and May last year and in January and March this year). Spending has remained below the pre-pandemic trend, but mixed. Spending on consumer durables is still far above the pre- pandemic trend. Spending on consumer services, which is much larger than spending on consumer goods, has remained soft, but is improving as the economy opens up.

As more people go out to restaurants, sporting events, and other things they couldn’t do during the pandemic, spending on goods should moderate. We may have seen a little of this in May, when motor vehicle sales declined (although a large part of that likely reflects production issues). Keep an eye on vehicle sales over the summer months.

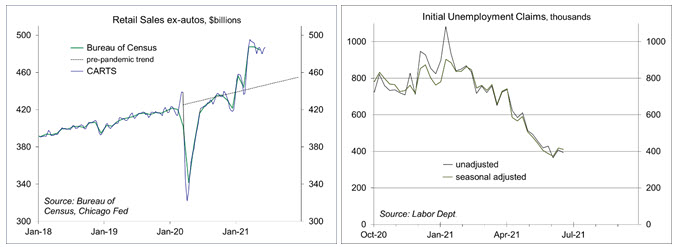

A new economic indicator was released last week, the Chicago Fed Advance Retail Trade Summary (CARTS). The index is based on several indicators and tracks the Bureau of Census retail sales data (ex-autos) well. The CARTS data is tracking at a June increase of 0.1%, not exactly rolling over, but consistent with a slowing in the pace of growth in consumer spending on goods.

As more people go out to restaurants, sporting events, and other things they couldn’t do during the pandemic, spending on goods should moderate. We may have seen a little of this in May, when motor vehicle sales declined (although a large part of that likely reflects production issues). Keep an eye on vehicle sales over the summer months.

The University of Michigan’s consumer sentiment survey had some interesting points in the latest narrative. Consumer expectations of inflation are declining and most see the recent increase in inflation as transitory. Consumers are concerned about COVID variants. That would imply that a full recovery in consumer services will be delayed (services will continue to rebound as the economy reopens, but not as quickly as was hoped for earlier). Additionally, the report noted that consumers may maintain increased household savings as “precautionary funds,” rather than spend. Now there is a wide range of behavior across households. Some spent their direct payments right away. Some banked them. Most of the increased savings is concentrated among upper income households. However, bankers note that savings and checking accounts for low- and middle-income accounts have remained flush. While this could provide fuel for consumer spending strength in the months ahead, we may not see the first half surge in spending carry through at a similar pace in the second half of the year.

Consumer spending will be supported by continued growth in jobs, but labor market frictions could limit the pace of improvement in the second half of the year. However, we are merely talking about the difference between very strong growth and extremely strong growth.

Recent Economic Data

Real GDP rose at a 6.4% annual rate in the 3rd estimate for 1Q21 (same as in the advance and 2nd estimates). Private Domestic Final Purchases (consumer spending, business fixed investment, residential fixed investment) rose at an 11.5% pace (vs. 10.6% in the advance estimate and 11.3% in the 2nd estimate).

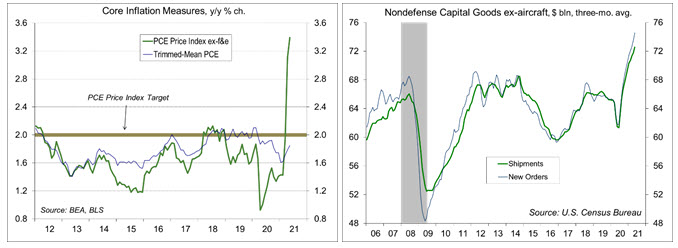

Personal income fell 2.0% in May (+2.8% y/y), reflecting an 11.7% decline in transfer payments. Private-sector wages and salaries rose 0.8% (+15.7% y/y). Personal spending was flat (+18.9%), down 0.4% adjusting for inflation, but that followed strong gains in March (+5.0%) and April (+0.9%). The PCE Price Index rose 0.4% (+3.9% y/y, vs. +0.5% y/y a year ago), up 0.5% ex-food & energy (+3.4% y/y). The Dallas Fed’s Trimmed-Mean PCE Price Index rose 1.8% y/y in May.

Durable goods orders rose 2.3% in May, reflecting a 27.4% jump in civilian aircraft orders. Ex-transportation, orders rose 0.3% (following +3.3% in March and +1.7% in April). Orders for nondefense capital goods ex- aircraft edged down 0.1% (following 1.6% in March and 2.7% in April).

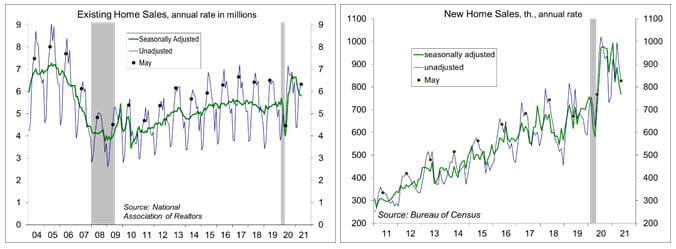

Existing home sales fell 0.9% in May, to a 5.80 million seasonally adjusted annual rate (+44.6% y/y).

New homes sales fell 5.9%, to a 769,000 seasonally adjusted annual rate in May (+9.2% y/y).

The Advance Economic Indicators report showed a wide merchandise trade deficit in May ($88.1 billion, vs.

$85.7 billion April). Inventories were mixed (wholesale up 1.1%, retail down 0.8%), but retail auto inventories continued to fall sharply (-5.3% m/m, -18.9% y/y).

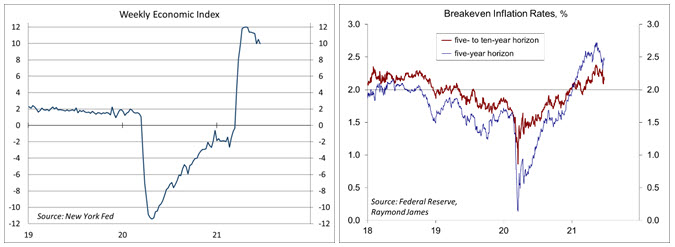

Gauging the Recovery

The New York Fed’s Weekly Economic Index edged down to +9.96% for the week ending June 19, vs. +10.50% a week earlier (revised from +10.35%), signifying strength relative to the depressed level of a year ago. The WEI is scaled to year-over-year GDP growth (GDP was down 9.0% y/y in 2Q20).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations, but close enough) continue to suggest a moderately higher near-term inflation outlook. The 5-10-year outlook had crept above the Fed’s long-term goal of 2%, but has since moderated.

are projected to rise 0.1% from May.

Jobless claims fell by 7,000, to 411,000 in the week ending June 19. Claims figures are often subject to distortions at the end of the school year, but the trend is lower.

The University of Michigan’s Consumer Sentiment Index was 85.5 in the full-month assessment for June (the survey covered May 26 to June 21), vs. 86.4 at mid-month and 82.9 in May. The June increase was concentrated among households with incomes above $100,000. The report noted a decrease in inflation expectations, while consumers generally believe higher inflation will be transitory. Consumers also expressed concerns about COVID variants and will likely maintain precautionary funds rather than spend down household savings.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.