High Coupon Bonds in a Rising Rate Environment

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Over the next few years, are interest rates going to head higher, move lower, or stay about where they are? That is the million dollar question that everyone wishes they knew the answer to. Depending on which camp you are in, you can make a very strong argument supporting your stance and a quick search on the internet will probably find many other supporting opinions across the investment landscape who agree with you. The fact of the matter is that nobody knows. Everyone has their forecast and assumptions, but when it comes down to it, everyone is just taking an educated guess.

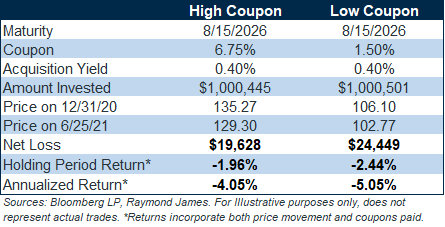

For those in the “rates are heading higher” camp (which based on many of the articles I read, interviews I listen to, and conversations I have on a daily basis, is a large percentage of people) I wanted to highlight the benefits that purchasing high-coupon, high-premium bonds can have for a portfolio. All else being equal, a high-coupon bond is going to perform better than a low-coupon bond in a rising rate environment. An example of this is shown in the chart below, which depicts the differing performance of two Treasuries since the beginning of the year, a timeframe in which the 5-year Treasury rose from 0.36% to 0.90%. Both bonds mature on the same date in 2026 and have the same amount of credit risk in that they are both Treasuries. The difference between them is the coupon, 6.75% versus 1.50%, and the corresponding price of each bond. The chart assumes that they were both purchased on 12/31/2020 at the same yield (0.402%), which translates to a price of 135.37 for the high-coupon bond and 106.10 for the low-coupon bond.

Both bonds have had negative total returns year-to-date, as would be expected given the move higher in yields. What should jump out at you is the difference in the returns. The low-coupon bond lost 2.44% while the high-coupon bond lost only 1.96%. If those numbers are annualized, those returns translate to a full 1% difference in total return performance. Remember, the only difference between these two bonds is the coupon. When rates rise, low-coupon bonds are going to perform worse than similar high-coupon bonds. In a perfect world, no one would ever see negative returns anywhere in their portfolio, but we don’t live in a perfect world. Purchasing higher coupon bonds allows investors to position their portfolio to potentially perform better in a rising rate environment, while still maintaining an appropriate allocation to fixed income.

Understanding the benefits of high-coupon bonds is important for many reasons, but to highlight a few:

- If it is your prediction that rates are going to rise, then (all else being equal) you will want to own the highest coupon bonds you can find, as they should perform the best under this scenario. They will be much more defensive.

- The higher the coupon, the higher the price of a bond. A large percentage of bonds that are currently outstanding are priced at relatively high dollar prices. If an investor is averse to purchasing high-premium/high-coupon bonds, they are limiting themselves to a very small corner of the market when searching for investment ideas and building a portfolio. No matter what you are purchasing, from a car to a house to a pair of shoes to a bond, giving yourself the most options is going to put you in the best position to find an ideal product. Being open to high-coupon/high-premium bonds gives you a much larger menu to choose from.

- Many investors are averse to purchasing bonds over an arbitrary dollar price, as noted above. This means that in general, there is less demand for high-dollar priced bonds, which means that oftentimes they are priced more attractively (higher yields) than similar bonds with lower coupons. An investor that is open to purchasing high-coupon bonds can sometimes earn additional yield simply by buying a higher coupon bond.

- Cash flow, cash flow, cash flow. A high-coupon means more cash flow. Creating cash flow is a high priority for many fixed income investors. Purchasing high-coupon bonds is an easy way to increase the cash flow and current yield in a portfolio. In the Treasury example above, the high-coupon bond is going to produce nearly 3 ½ times the cash flow of the low-coupon bond.

- A higher coupon bond will have a lower duration than a similar low-coupon bond. This is tied to the better price performance noted above, but it also means that if your portfolio has a duration target, you are able to purchase longer maturity bonds (which typically will offer higher yields), while keeping the duration shorter because of the higher coupon. For example, the high-coupon Treasury shown above has a duration of 4.42, while the low-coupon Treasury’s duration is 4.91. That is a fairly significant difference for two bonds with an identical maturity date. For investors with a duration target or range for their portfolio, high-coupon bonds can assist in controlling the duration while maximizing yield.

Hesitancy by some investors to purchase a bond at a premium can put them at a disadvantage while benefitting those investors who understand the math and positive attributes that a higher coupon bond can provide.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.