Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Child tax credit A new source of fiscal stimulus

- June inflation data may be the peak

- Tight credit spreads may limit capital appreciation

Investing is not a game. In reality, it encompasses some of your most important decisions as it can have long lasting repercussions on the ability to accomplish your financial goals and objectives. However, surprisingly, classic board games, such as Monopoly® and Operation®, can be helpful in articulating our economic and financial market views for the second half of 2021 and as we peek into 2022. To us, they provide nostalgic visuals that help explain and clarify our views on topics that are often times very complex. Below is a prelude of the most critical components of our outlook with some of the references to board games. For a more detailed analysis of our views and the creative connections to board games, please join us for our upcoming Quarterly Coordinates webinar this Monday, July 12 at 4:15 EDT titled ‘Investing Is Not A Trivial Pursuit®.’

- US Consumers Simultaneously Passing ‘Go’ | The US economy is playing its own version of Monopoly® thanks to consumers getting a ‘Get Out Of The House For Free Vaccine’ card and Congress’ stimulus-driven community chest. By the way, the community chest is likely to grow with the Child Tax Credit beginning this month. With consumption accounting for ~70% of GDP, the health and wealth of the US consumer is of the upmost importance. The combination of $2 trillion in excess disposable income, net worth at record highs, confidence at post-COVID highs, improving labor market conditions, and pent-up demand supports our view that robust consumer spending will lead to 2021 GDP growth of ~6.2%—the best year since 1984. With the June retail sales data released next Friday, keep an eye on consumer spending patterns, as we expect a shift from goods-based consumption to services as consumers gradually return to all their favorite pre-COVID activities.

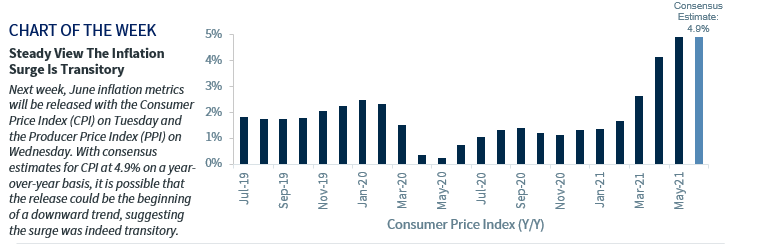

- The Fed Needs A Steady Hand To Avoid An Inflation Zap | Perhaps the largest risk to our economic outlook is the Fed’s game of Operation®, in which Chairman Powell will need a steady hand in tapering asset purchases and normalizing interest rates. With conflicting views amongst Federal Open Market Committee members, the real trick will be doing so while avoiding a zap from inflation or being shocked by unexpected economic weakness. Next week, June inflation metrics will be released with CPI (Tuesday) and PPI (Wednesday). Hopefully, the data will begin to confirm the Fed’s (and our) view that inflation is transitory and in the process of peaking before subsiding by year end. In addition, Chairman Powell could give us some further insights into the Fed’s current thinking when he gives his Semi-Annual Monetary Report to Congress next Thursday (July 15).

- Twisting, Reaching, & Stretching For Yield | With interest rates lower for longer, fixed income investors need to stay flexible like the players in Twister®. While the strong US economic growth environment will push yields higher, global investors stretching for yield will keep rates low. These counterbalancing forces will keep yields knotted in a tight range, with the 10-year Treasury yield moving modestly higher to the 2% level by year end. With much of the economic improvement already reflected in historically tight corporate credit spreads, there is limited room for capital appreciation through further spread narrowing, and coupon income should remain the main driver of returns through year end.

- Connect 4 Reasons The Bull Market Will Continue | For equities, it’s easy to Connect 4®reasons why this current bull market will continue: 1) a healthy macroeconomic backdrop, 2) attractive valuations, 3) increasing dividends and buybacks, and 4) rising earnings growth expectations. With the unofficial start to earnings season beginning with the Big Banks next Tuesday, we await the results from what is expected to be the best quarter of earnings growth on a year-over-year basis since at least 2002—up ~63%. And, if the trend of above-average estimate beats continues, there may be even more upside potential to our revised year-end S&P 500 price target of 4,400. While the lagging reopenings abroad may lead to short-term trading opportunities, overall stronger economic growth and earnings revisions should favor domestic equities over the long term.

- Bottom Line | In the aggregate, we remain optimistic on the economy and financial markets for the second half of this year. However, given the robustness of returns during the first half of the year, investors should not become complacent. There is no lack of potential Risk®: COVID-19 variants, geopolitical tensions, and politics. Remember that successful investing can enhance the real Game of Life® and is not a Trivial Pursuit®.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.