Surprise? Not Really…

Doug Drabikl discusses fixed income market conditions and offers insight for bond investors.

I’ve heard quite a bit of chatter about how surprising it is that interest rates have dropped while our economy and earnings are doing so well. It’s just not logical when company after company appear to have found their footing and are reporting lofty earnings. Inflation is here, yet Treasuries are rallying (yields continue to fall) in the face of all this.

Well, it really isn’t so surprising. The yield curve’s behavior is not only genuine, the readers of this commentary have known that it was all very probable and the yield curve’s behavior is as expected.

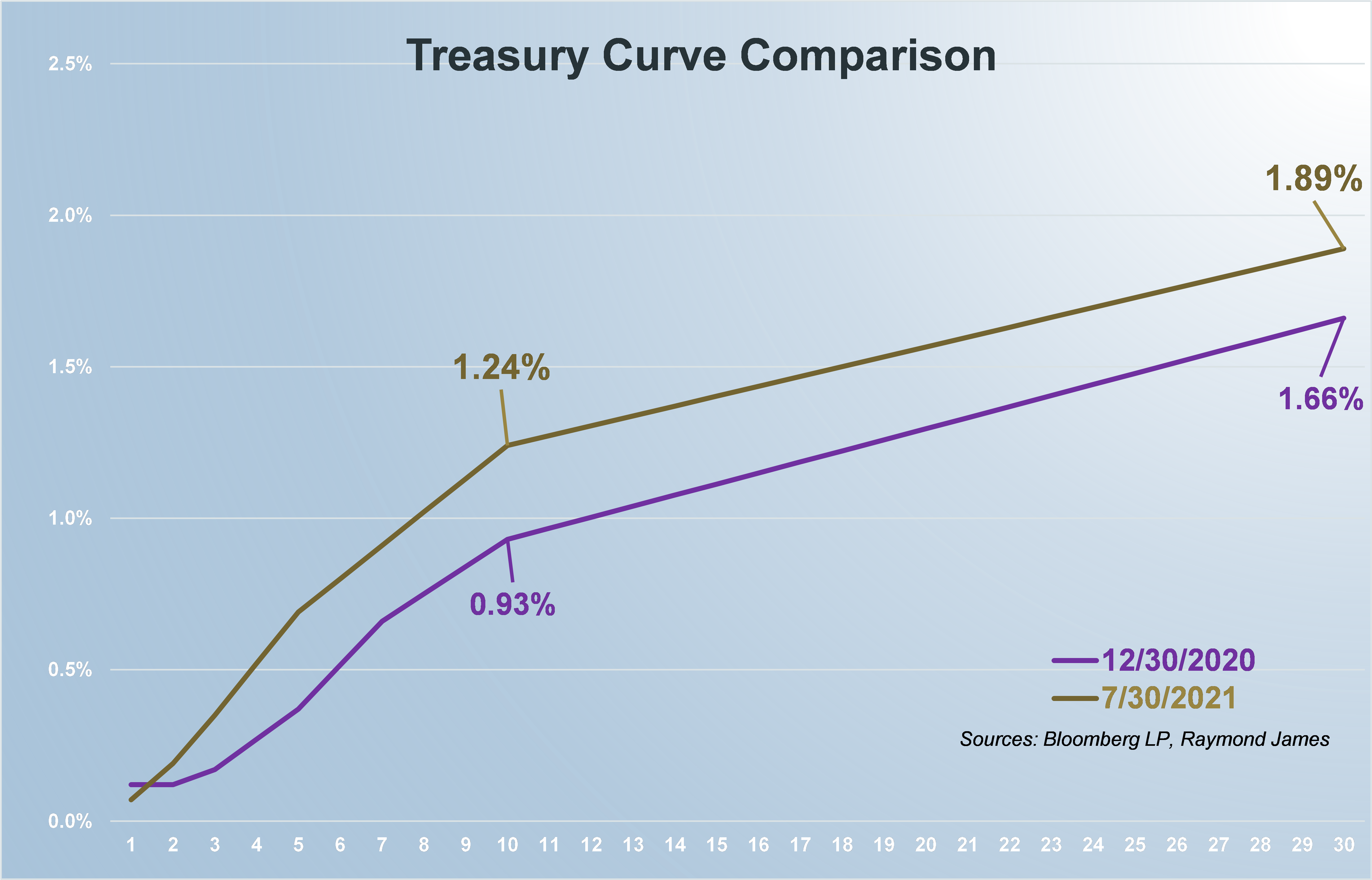

Let’s put things in perspective. The yield curve is still significantly higher than where it started 2021. The ten year Treasury is ~31bp higher and the long bond (30yr Treasury) is ~23bp higher. Interest rates, despite the continued judgments to the contrary, could stay low for longer or even move lower. We will explain why but please acknowledge the most important take-away of all: keep invested and allocated appropriately. Most fixed income investors use this allocation to protect principal and offset growth assets. Wealth preservation is continuous, regardless of interest rate levels.

As we have emphasized for years, the Fed is driving the ship. They are in control and to fight the Fed is a losing battle. There is tremendous pressure to keep interest rates low as government debt climbs. The Fed has actually been very transparent about their intentions and in the latest FOMC release, indicated that despite economic progress, they are looking for substantial progress before even beginning to talk about tapering. In other words, they will continue to be accomodating in policy until further notice. This is evidenced by their continued monthly $120bn in open market purchases. Talk “taper” all you want, but recognize that it just isn’t happening yet.

If the Fed, their power and their transparency aren’t enough to convince you of a low rate environment for longer, there are plenty of other tailwinds to Treasury prices (headwinds to higher rates).

We exist in a global interest rate environment. Domestic interest rates can drift only so far from other major economic country’s rates. The outside (foreign) demand for higher yielding US securities will persist as long as there is interest rate disparity. Foreign interest rates continue to lag and therefore impede higher domestic rates.

Demographics have absolutely nothing to do with the pandemic and seem to get little attention in the press, yet, play such an important part for a consumer-driven economy such as the US. We have an aging population that has a significant number of individuals reaching retirement age daily. The significance is twofold: 1) the US population over 60 years of age holds a majority of the nation’s net worth and 2) the buying patterns of this age group are significantly different versus 20-50 year olds. A majority of the net worth in the US has moved to the savings and investing phase of life. This matters for a consumer-driven economy and it would be occurring whether we had a pandemic or not.

There are other headwinds to higher interest rates which include uncertainty about earnings peak or overall sustainability of progress. It is important to recognize that not only is the Fed controlling the markets, there are a multitude of additional factors hindering higher interest rates. Do not forget the primary purpose to stay invested: protect your wealth and keep appropriate fixed income allocations in your portfolio!

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.