Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Pullbacks Are Part Of The Fabric Of The Market

- Timing The Market Is A Difficult If Not Impossible Feat

- Rebalancing Is Critical In Maintaining Risk Profile

From school bells to the bells of New York Stock Exchange—the ringing of bells often signifies the beginning and/or conclusion of an event. Unfortunately, there is no distinctive bell to signify the beginning of a meaningful equity market rally or pullback. Keep in mind that few foresaw the swift COVID-induced 34% decline last year and even fewer saw the unprecedented ~100% rally since last March. In fact, this S&P 500 bull market is the best on record at this juncture, outperforming all previous bull market runs by at least ~40%. While timing the stock market precisely is a challenging, if not impossible feat, there are techniques investors can employ to maximize their long-term performance, which are discussed below. As calls for a potential pullback ring louder from many pundits, it is essential to put volatility into perspective and address what steps you should or should not take when one occurs.

-

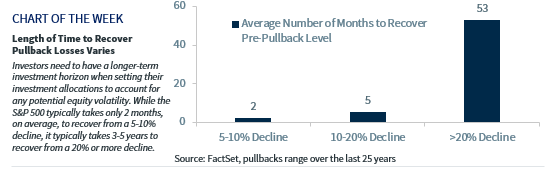

- Time Does Not Toll The Bell | Pullbacks, like rallies, are part of the fabric of the market, the pattern of which is not always predictable. As a result, getting a pullback is normal and may very well be ‘overdue’— we have not had a 5% or more retreat in the S&P 500 in ten months—the third longest streak over the last 25 years and nearly four times the previous historical average. Additionally, from an historical basis, the S&P 500 typically experiences ~three to four 5%+ pullbacks per year and we have not had one year-to-date! So, using history as a guide, it should be no surprise if we get a modest pullback of that magnitude in the equity market over the next few months or so—in fact, history says we should expect it. Larger pullbacks in the 10-20% range are less likely, but do occur—usually less than one per year (19 instances over the last 25 years). However, pullbacks of more than 20% are even less likely unless we have a major disruption in our optimistic economic outlook. Specifically, the five 20%+ pullbacks experienced over the last 25 years have all coincided with a recession—which is not our base case.

- The Investment Strategies That Ring True | In the near term, another factor that makes us cautious is investor complacency and there are some signs brewing: the percentage of portfolio stock allocations is at a three-year high, the percentage of portfolio cash allocations is at the third lowest level in 20 years, and the percentage of analyst ‘Buy’ ratings on individual stocks has reached an 18-year high. While the equity market often likes to humble investors who get overly confident with contrarian moves to the downside in the short term, it is important to maintain a long-term view of the equity market. We continue to view pullbacks as a buying opportunity because of strong fundamentals: continued above-trend economic growth into 2022, upside risk to consensus earnings estimates for 2022, increasing dividends and buybacks, and attractive valuations relative to bonds. If we do experience a pullback, we do not expect it to be substantial from a duration or magnitude perspective. Our advice is to focus on the factors you can control: creating a financial plan that provides proactive guidance as to how to adjust positioning in light of pullbacks and diversifying. Patience, discipline, and rebalancing are three key words to consider in volatile times.

- No Cause For Alarm With A Plan In Place | As much as we advise against attempting to time the market, we also discourage investors from allowing emotions to dictate portfolio decisions. Often times, the two go hand-in-hand, and historical returns reveal just how detrimental emotionally-driven, panicked selling can be. In fact, an investor who missed the 20 best trading days (of the total 5,030 trading days) over the past 20 years would have posted an annualized price return of -0.1%. In comparison, an investor who remained invested and participated in all the trading days would have had an annualized price return of 6.6%. Even more insightful, these ‘20 best trading days’ occurred within two weeks of a 5%+ pullback 90% of the time, reflecting that ‘panic selling’ in the midst of bouts of volatility is likely to underperform the broader market over time.

- Saved By The Diversification Bell | While pullbacks are a natural, healthy occurrence in the equity market, they can be uncomfortable, especially if you do not have a well thought out financial strategy. But once the appropriate asset allocation parameters are established, rebalancing is a fundamental dynamic needed to help achieve investment goals consistent with a predetermined level of risk. Our proprietary study shows rebalancing (either monthly, quarterly or annually) is vital.** For example, since 1980, a ‘rebalanced’ 60% equity/40% bond portfolio earns relatively the same amount of return as the S&P 500 while experiencing much less risk. Why? In times of crisis (e.g., the tech bubble, Great Financial Crisis, COVID) the stability of bonds provided a ballast and the ability to rebalance opportunistically into depressed equity markets.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.