What Did We Learn This Week?

Chief Economist Scott Brown discusses current economic conditions.

As expected, Fed Chair Powell’s Jackson Hole speech pointed toward tapering, but fell short of signaling precisely when. Powell includes himself in the camp expecting to start by the end of the year, provided that “the economy evolves broadly as expected.” To taper, the Federal Open Market Committee had set an objective of “substantial further progress” on its inflation and employment goals. Powell indicated that this test had been met on the inflation front, but we’re not quite there on employment. Powell and other Fed officials have emphasized that tapering the monthly pace of asset purchases is distinct from raising rates. Meanwhile, the economic data present a mixed picture in 3Q21.

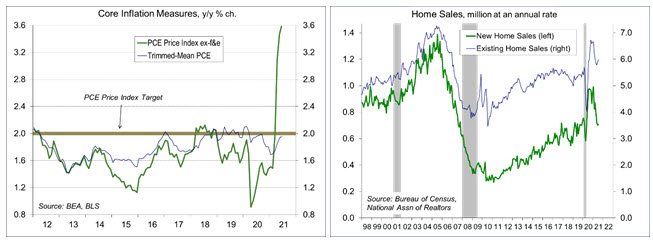

In his speech, Powell listed five reasons that the Fed expects higher inflation to be transitory. First, inflation pressures have not been broad-based. The recent spike is due to increases in a narrow group of goods and services. The Dallas Fed’s Trimmed-Mean PCE Price Index, which excludes the largest price movements, is up just 2.0% year-over-year. Second, we’re now seeing a moderation in prices that had risen more rapidly. Third, there is limited evidence that wages are putting much upward pressure on consumer price inflation. Fourth, long-term inflation expectations remain well-anchored. Fifth, global disinflationary pressures are expected to continue. Of course, things may change. The Fed will continue to closely monitor inflation indicators.

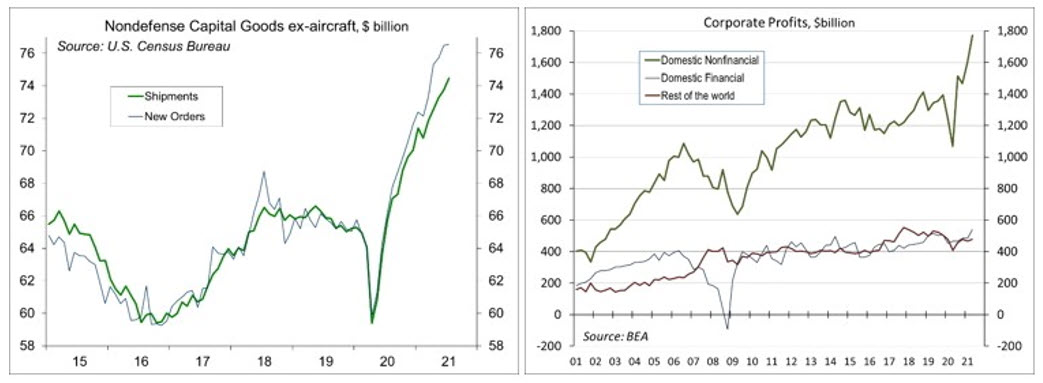

Orders for nondefense capital goods ex-aircraft, a rough proxy for business fixed investment, were flat in July, but had risen 6.8% over the six previous months. Much of the increase likely reflects that shift from services to goods during the pandemic, and the expectation that much of that shift will be long lasting. However, there’s also the question of whether it may be over-exuberance. Indeed, there’s a reason the call it the “business cycle.” In the past, over-investment, or mal-investment, has often led to corrections. However, investment has been supported by a strengthening in corporate profits. So this may not be much to worry about.

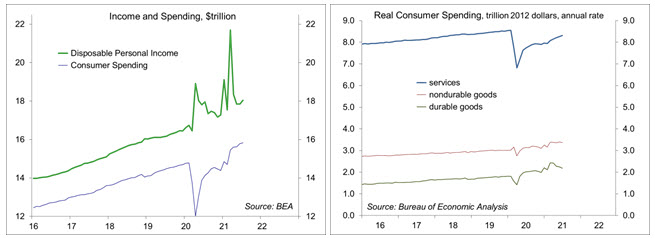

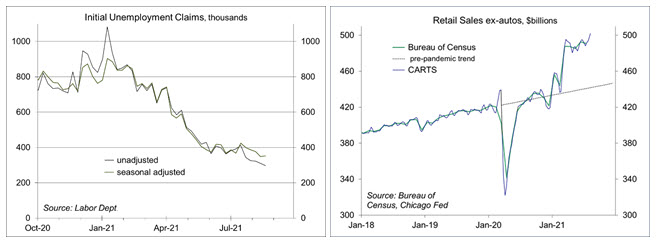

The impact of the Delta variant on consumer spending has been mixed. According to the University of Michigan’s Consumer Sentiment Survey, expectations fell sharply in August, reflecting “the least favorable economic prospects in more than a decade.” The report noted that “the extraordinary falloff in sentiment also reflects an emotional response, from dashed hopes that the pandemic would soon end and lives could return to normal.” Importantly, what people say and what they do are two separate things. The Chicago Fed Advance Retail Trade Survey (CARTS) suggested strength in retail sales in the first half of the month. Other indicators point to a Delta impact on services, such as air travel. A prolonged pandemic is consistent with a more protracted shift from services to goods – and strong demand for goods implies that production bottlenecks and supply issues will last a while longer.

Tapering is coming, and we can expect to hear more details following the September 21-22 FOMC meeting. However, tapering is not tightening. The Fed will still be adding liquidity as it reduces asset purchases. It’s more akin to gradually taking the foot off of the gas pedal – not hitting the brakes. Will financial market participants recognize the distinction?

Recent Economic Data

Durable goods orders edged down 0.1% in July, held back by a 48.9% drop in civilian aircraft orders. Ex- transportation, orders rose 0.7%. Orders for nondefense capital goods ex-aircraft, a rough proxy for business fixed investment, were flat, but that followed exceptionally strong gains in recent months.

Real GDP rose at a 6.6% annual rate in the 2nd estimate for 2Q21 (vs. +6.5% in the advance estimate) – and that still understates the economy’s strength. GDP growth was held down by a further drop in inventories and a wider trade deficit, both of which are likely to add to GDP growth in the second half (offsetting a moderation in growth of consumer spending and business fixed investment).

Personal income rose 1.1% in July (+2.7% y/y), led by a 1.0% rise in private-sector wage and salary income (11.2% y/y). Child tax credit payments more than offset declines in unemployment benefits.

Personal spending rose 0.3% (12.1% y/y), as a 1.0% increase in services (+11.4% y/y) more than offset a 2.3% drop in consumer durables (+16.1% y/y). Adjusted for inflation, consumer spending slipped 0.1% (+7.6% y/y),

The PCE Price Index rose 0.4% (+4.2% y/y), up 0.3% (+3.6% y/y) ex-food & energy. The Dallas Fed Trimmed Mean PCE Price Index, an alternative measure of core inflation, rose 0.3% (+2.0% y/y).

New home sales rose 1.0% in July, to a 708,000 seasonally adjusted annual rate (-27.2% y/y). Existing home sales rose 2.0%, to a 5.99 million seasonally adjusted annual rate (+1.5% y/y).

Gauging the Recovery

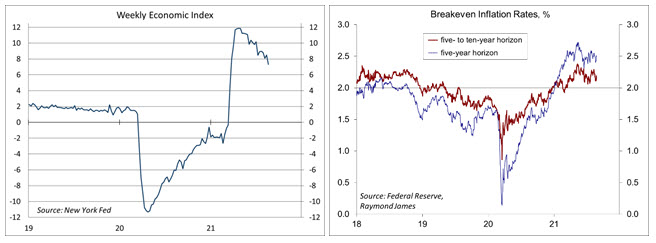

The New York Fed’s Weekly Economic Index fell to +7.32% for the week ending August 21, vs. +8.49% a week earlier (revised from +7.96%), as a decreases in rail traffic, tax withholding, and fuel sales, and an increase in initial unemployment insurance claims (relative to the same time last year), which more than offset an increase in electricity output. The WEI is scaled to y/y GDP growth (- 9.1% y/y in 2Q20 and +12.2% y/y in 2Q21).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations, but close enough) continue to suggest a moderately higher near-term inflation outlook. The 5- to 10-year outlook remains consistent with the Fed’s long-term goal of 2%.

Jobless claims fell by 29,000, to 348,000 (a new pandemic low, but still high by historical standards) in the week ending July 31. Seasonally adjusted figures have been trending about flat in the last several weeks. Unadjusted claims are normally low in August and September.

In the second week in August, the Chicago Fed Advance Retail Trade Summary (CARTS) index (a composite of multiple retail gauges) showed a 1.0% increase in retail sales (ex-autos), following a 0.7% rise in the previous week. August retail sales (ex-autos) were projected to be up 2.4% from July.

The University of Michigan’s Consumer Sentiment Index fell to 74.1 in the full-month assessment for August (the survey covered July 28 to August 23), vs. 70.2 at mid-month and 81.2 in July. Expectations sank to 65.1, from 79.0, reflecting concerns about the Delta surge.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.