What If Rates Don’t Move Higher?

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

If you could see into the future, there would be no need to diversify your investments. You would simply invest 100% of your assets into the single investment that was going to perform the best. Unfortunately, the future is unknown and therefore diversification should likely have a part in your portfolio construction, both among different asset classes and within them. Frequently, I hear from investors who are positioning their portfolio in the way that they are because “rates are going to move higher”. The timing and magnitude of the prophesies for the move higher varies from person to person, but the general certainty that most people have about the future direction of interest rates raises alarm bells, especially considering many investors are letting that “certainty” guide their fixed income allocation (or lack thereof).

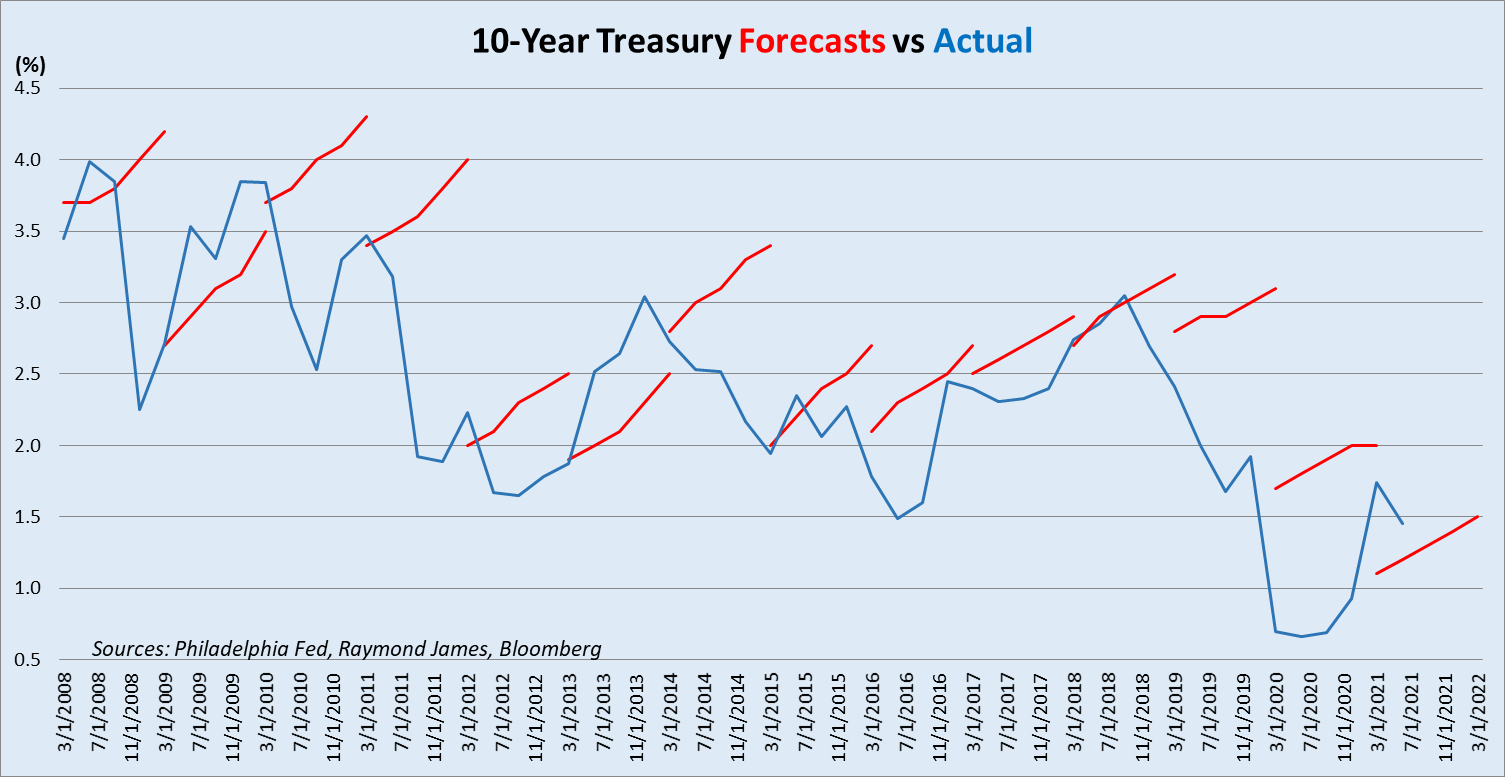

Now is a good time to remind ourselves that the reason for diversification is to position ourselves for the wide range of potential scenarios that could play out in the future. So consider the scenario that rates don’t move significantly higher in the near or intermediate future. I know, I know… everyone is certain rates are moving higher, so why invest as if it’s not a certainty? The chart below illustrates why. The red lines show the consensus expert forecast for the direction of rates at the start of each year going back to 2008; the blue line is what interest rates actually did. The picture speaks for itself: year after year after year after year, professional forecasters have been calling for higher rates, yet the overall trend has been lower and lower rates, year after year.

So, what if rates don’t rise? What if we’re in a “lower for longer” environment for the foreseeable future? Would that change how or if you allocate assets to fixed income? Would you get off the sidelines and put some money to work? If rates stay low for the next three years, would you rather earn near zero percent by remaining in cash or would you rather earn 5, 10, or 20 times money market rates in 3, 4, or 5 year bonds? Would you go ahead and implement your long term strategy so that it starts earning money today rather than wait for the move higher that might never come?

Position your portfolio as if you don’t know what the future holds, because you don’t. The combined economic knowledge and forecasting abilities of the professional forecasters that make up the graph above have had an interest rate prediction that was too high nearly 85% of the time. Consider the importance of time in the market versus trying to time the market. Could this be the start of a long-term move higher in yields? Yes, it could. Could yields remain about where they are or move lower from here and stay there for several years? Yes, that is also a possibility. Position yourself for success no matter what rates do in the future. Remember, if you buy a bond and hold it until maturity, a rising rate environment has zero effect on your cash flow and principal return. The primary reasons that you own bonds (known cash flow and a known return of principal) are locked in the day you purchase a bond, regardless of what interest rates do in the future (barring a default, of course). Instead of isolating yourself to the idea that interest rates will be significantly higher in the not too distant future and positioning your portfolio accordingly, ask yourself: what if rates don’t move higher?

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.