Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Matter of when not if supply chain constraints resolve

- Ratio of deficit funding could be an upside catalyst

- Concerns about fuel inflation heading into coldest months

A clean slate for the start of a new month? The S&P 500 was unable to extend its 7-month streak of gains, as it fell 4.7% for the month. Markets thrive on clarity and recent headlines have temporarily clouded the clear view that we’ve been fortunate to have for most of this year. Investors have had to grapple with the four “Cs”—China (Evergrande’s potential default), Congress (brinksmanship over the debt ceiling and pending legislation), Commodities (surging energy prices) and COVID (the recent Delta surge softening economic momentum). But the good news is that COVID cases are now falling and the unofficial start to the third quarter earnings season (begins October 13) should help settle the dust. Even better news? While the financial markets have never liked uncertainty, we don’t expect these risks will take long to clean up or that they will have a meaningful impact on our forecasts.

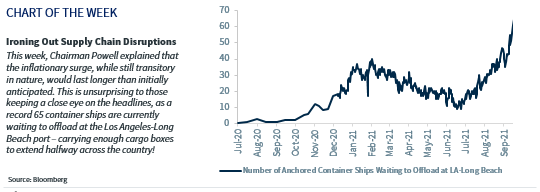

- Ironing Out Supply Chain Disruptions | Whether it has been bare shelves at the store, a prolonged wait for backordered items, or noticeably higher prices at checkout, shoppers have faced frustrations over the last several months. In fact, “frustrating” was the exact word Chairman Powell used in his Congressional testimony this week as he explained that the inflationary surge, while still transitory in nature, would last longer than initially anticipated. For those keeping an eye on the headlines, this already seemed evident given the record 65 container ships currently waiting to offload at the Los Angeles-Long Beach port—carrying enough cargo boxes to extend halfway across the country (~1,500 miles)! Concerns from companies such as Nike also made news, as COVID-related lockdowns at its Asian production facilities led to early warnings for holiday shoppers to start sooner rather than later if they expect gifts to arrive on time. While this is a headwind for economic growth, we’re still in agreement with the Fed that the resolution of the bottlenecks is a matter of ‘when’ not ‘if,’ and that the filling of open jobs, increasing wages, and boosted capital expenditures will still support the US economy in achieving above-trend growth in 2022 (RJ** forecast: ~3.3%).

- Keeping The US Debt Payment Track Record Clean | With the midterm elections nearing, neither political party wanted to be associated with a government shutdown or the first debt default in US history, which served as motivation for final hour action that funded the government until at least December 3. This provided a temporary reprieve for investors, but the more important decisions on the appropriate amount of stimulus and the debt ceiling (funds could be exhausted by October 18 at the earliest) are still to be determined. In regards to negotiating, both inter (Republican vs. Democrat) and intra-party (Progressives vs. Moderates) disagreements need to be ironed out. In particular, within the Democratic Party, Moderates (i.e., Manchin, Sinema) have taken a firmer stance in support of a lower price tag than the $3.5 trillion ‘human’ infrastructure bill while Progressives feel they have already compromised, coming down from their initial $6 trillion plan. As the market does not like uncertainty, the back and forth debate will likely lead to near-term volatility. In our opinion, the $1 trillion ‘physical’ infrastructure package will be passed, as it has bipartisan support and requires no change in tax policy. The ‘human’ infrastructure package is more complex as it involves the potential for both corporate and individual tax increases. Regardless of size (between $1.5 to $3.5 trillion), from a market perspective, the focus will be on the ratio of deficit funding to tax-increase induced funding. Currently, we expect an even split. However, if the end result leads to higher deficit funding (e.g., fewer tax increases), that would pose an upside catalyst for the equity market. If the reverse occurs (e.g., higher taxes), the market will be disappointed.

- Higher Oil Prices Will Not Be Swept Under The Rug | The Energy sector (+9.4%) was the only S&P 500 sector in positive territory in September, as crude oil and natural gas prices spiked ~10% and ~34%, respectively. Overall demand for fuel rebounded to pre-pandemic levels despite the Delta surge. In addition, natural disasters such as Hurricane Ida, which limited US production capacity for a portion of the month, exacerbated the supply crunch. Given that the health of the US consumer is critical to the economic recovery, President Biden has voiced his concerns about elevated fuel costs to OPEC+ countries, especially as our country prepares for its coldest months. Thus far, OPEC+ has expressed it will maintain its patient approach of gradually increasing production despite consumer concerns about further fuel inflation, but this sharp price rebound may shift the narrative at their next meeting, this Monday, October 4. Our belief is that oil is approaching the upper end of its range.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.