Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- GDP is ‘old news’ vs. real-time activity metrics

- Biggest week of Q3 earnings season next week

- Company commentary focus: bottlenecks, demand & visibility

Out with the old, in with the new! This is a phrase used in all walks of life, as people part ways with things/ways of the past and update to newer and better things. As US consumers spent more time at home during the pandemic, this saying could not have been more true as consumers moved to new houses, renovated their homes, and upgraded their technology—from Wi-Fi to TVs. This robust demand to enhance daily living is one reason consumer spending is at all-time highs, home prices are rising at an astonishing 20% YoY pace, ‘goods’ spending is rising at nearly the fastest pace on record and, importantly, is the main driver of the significant supply chain disruptions we are experiencing! While this saying may be true for consumers, there are important parallels that suggest that it may be equally important when assessing the importance of both economic data and earnings releases.

- GDP vs the New Kid on the Block — Real-Time Indicators | From an economic perspective, the highly anticipated Q3 GDP report will be released next Thursday. There is much debate surrounding the strength of the economy during Q3 (current consensus: 4.1%) because of the spike in COVID cases, supply constraints, weaker than expected employment figures, and the expiration of government support programs. While GDP is an important number, it is backward-looking as it covers the months of July, August, and September. Given the ever-changing dynamics of the economy, how much we spent during the Fourth of July holiday (110 days ago) does not tell us much about the economy today! To get a real-time assessment of the economy, we prefer our compendium of high-frequency data points (e.g., daily and weekly observations). Below are a few we closely monitor:

- Withholding Taxes and Jobless Claims | While record job openings drive the headlines, the labor market continues to improve. With withholding taxes (reported daily) at record highs and growing 14% year-over-year and jobless claims (reported weekly) at post COVID lows, two conclusions can be deduced—the job market is healthy and consumers, in aggregate, will have more money to spend as businesses raise wages to counteract staffing shortages. With the consumer representing ~70% of the economy, these figures suggest a robust and expanding economy.

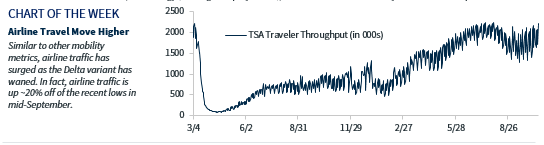

- Real-time Mobility and the Consumer | Following a Delta-induced economic soft patch throughout the third quarter, mobility metrics have dramatically improved recently as new COVID cases have eased more than 50%. Air traffic is up over 20% from the September lows and is once again approaching a post-COVID high, restaurant bookings have risen ~10% since the summer months, and gasoline demand is at two-year highs. Increased mobility is consistent with both improving consumer confidence and spending. In fact, mobility’s three-week moving average is up ~12% relative to pre-COVID levels (a new post-COVID high) and Redbook sales (an aggregate of department store spending) are up over 15% YoY.

- 3Q Earnings Results vs. Outlook Commentary | The 3Q21 earnings season is an important barometer in assessing the success of companies (actual Q3 results) and their prospects (management commentary on earnings calls). Thus far, the results have been outstanding as earnings have risen 31% YoY with 83% of companies beating estimates by an average of 13.3% (over 2x the 15-year average!). The upcoming week will be pivotal with over 165 companies representing nearly 57% of the market cap reporting. However, more important to the market is the outlook for earnings, particularly as the market turns its focus to 2022. Thus far, the key highlight from the Financials sector is that loan demand and consumer spending remain strong, supporting our belief that economic slowdown fears are overblown. Next week, we will receive reports from a broad set of companies that will provide further insights into the issues impacting the economy. Some of the dynamics to monitor include:

- Bottleneck Flexibility | Supply constraints and labor shortages continue to impair businesses. With companies proactively trying to unlock these bottlenecks, companies such as UPS, Dominion Freight, and 3M will hopefully provide optimism that improvement is on the way. How this impacts pricing power and margins (at record highs) is critical to earnings momentum.

- Consumer Spending | With consumers the main driver of economic growth, Apple, Amazon, McDonalds, and Visa will provide insights into spending patterns. In particular, Apple and Amazon’s holiday shopping outlook and their ability to meet demand given supply constraints will be of special interest. Visibility in demand is essential to power earnings growth confidence.

- 2022 Earnings Estimates | Despite a more challenging environment, 2022 earnings estimates have marched steadily higher, with earnings expected to grow ~10% next year. This growth should be driven by cyclical sectors, so the outlooks for Communication Services, Technology (the largest equity sector), and Consumer Discretionary need to remain optimistic.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.