Sitting on the Sidelines IS Making a Decision… To Do Nothing!

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

In this economic environment of uncertainty, undeniable certainties still exist. $0 x 8.00% or $0 x 2.00% both equal 0.00%. The hockey great Wayne Gretzky once said, “you miss 100% of the shots you don’t take.” In our investment world, regardless of interest rate or inflation levels, investment money sitting on the sideline misses 100% of its earning potential and yields 0.00%.

Say a five year investment can yield 2.00%. If you sit on the sideline for one year, that investment would need a 25% increase or a yield of 2.50% in order to yield the same return over the same period of time. Waiting two years would require a 68% increase or a yield of 3.35%.

The two most recurrent questions we are receiving now concern inflation and interest rates. Everyone has an opinion on where they are headed and sometimes that opinion gets in the way of prudent investment decisions. It is human nature to get caught up in the present day drama but it is imperative to remain disciplined in investment choice and allocation. Chances are high that our future prognostications may not be 100% accurate. Fortunately we do not need to be precise, we just need to stay invested in order to get ahead. Recall the wise quote, “it’s about time in the market, not timing the market.”

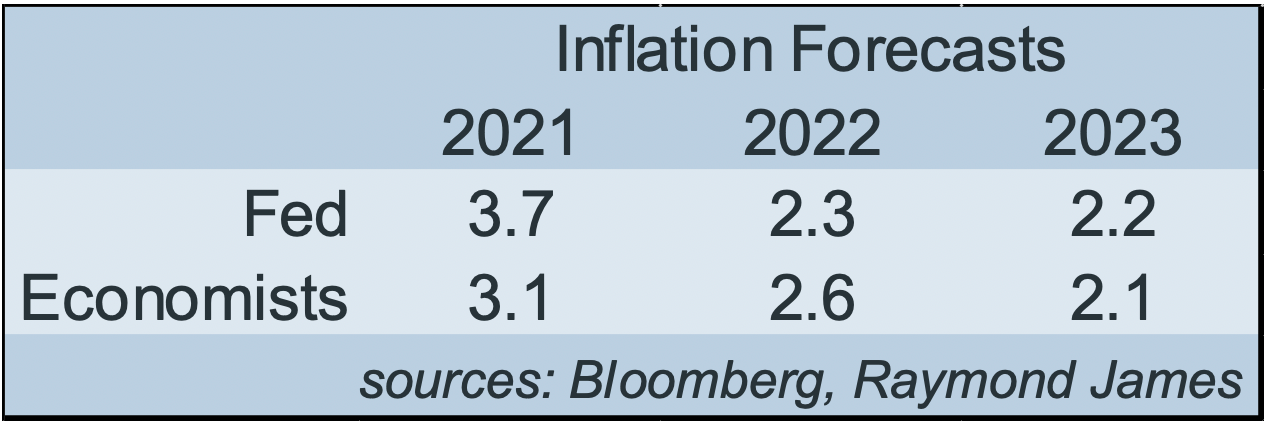

Many economists would agree that inflation running somewhere between 2% and 3% is a sign of a healthy economy. It is a good sign that the economy is growing. As I pointed out last week, the Fed and pool of economists are predicting inflation at this healthy level. No one is suggesting runaway inflation. Let me also confront the idea that inflation somehow is like a leaky faucet that is draining your fixed income principal. This is nonsense. Individual bonds hold their value regardless of interest rate changes or inflation moves. When held to maturity, a bond’s cash flow, income and time when face value is returned are not altered by either inflation or interest rates. Inflation dictates spending power, not principal amount. Unlike the value of your house, business or stock portfolio, we know the future value of a bond portfolio when held to maturity. The only two events that can change that are a default (which may be mitigated by purchasing high quality investment grade securities) or selling a bond prior to its maturity.

When inflation rises, typically interest rates also rise. There is opportunity risk in trying to time these events, yet an active short duration ladder allows the events to approach it. A fixed income allocation with recurring cash flows is continuously positioned to take advantage of an interest rate bump without sacrificing current income. Keep the inflation and interest rate hype within realistic, educated and informed boundaries so that long term fixed income strategy keeps working to protect your principal and is positioned for future changes. Don’t miss what the market is giving today because of some guess on where the market might be going. Timing the market is impossible while time in the market is your ally.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.