Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Market still anticipating a faster Fed tightening cycle

- Political leaders will amplify pressures on OPEC+

- Election results may encourage congressional compromise

This month marks 30 years since the release of the Disney Classic, Beauty and the Beast! Those fondly recalling the film probably remember the iconic songs and cast of household objects that came to life; but the moral of the story is to not be deceived by appearances. Ironically, this same message is quite applicable for investors. Those tuning into the nightly news are likely anxious as the photos of bare shelves, docked ships, and high gas prices continue to circulate, but it is important for investors to take a step back and look beyond the headlines. Between the Fed’s decision, OPEC+ meeting, election outcomes, and a few economic data releases, there was a lot of information for investors to evaluate this week. We invite you to be our guest as we share our thoughts on these newsworthy developments, and what the implications of each may be moving forward.

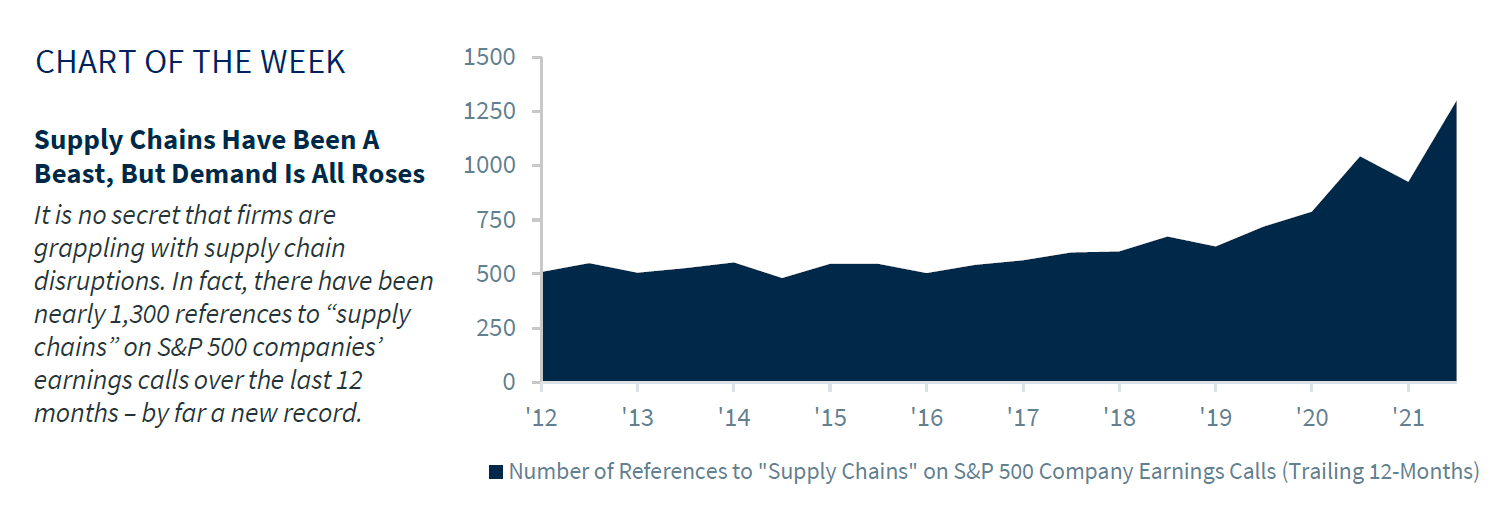

- Supply Chains Have Been A Beast, But Demand Is All Roses | It is no secret that firms are grappling with supply chain disruptions. In fact, there have been nearly 1,300 references to “supply chains” on S&P 500 companies’ earnings calls over the last 12 months – by far a new record. However, instead of focusing on the transitory issues (e.g., surging input prices, staffing shortages, delays to unload containers at the ports), we’re focused on the creative solutions corporations are implementing to maintain operations as close to normal as possible. As companies shift suppliers, rely on air freight, offer new employment incentives, and invest in automation, we’ve become increasingly confident that these disruptions and the inflationary surge will peak this quarter and begin to improve as we move into 2022. Once these supply constraints ease, the economy should regain its lost momentum as demand and the health of the US consumer remain strong. As cases of the Delta variant decline, real-time activity metrics have rebounded as consumers feel confident and safe to spend in restaurants, hotels, and airports. As a result, the ISM Services Index rose to a record high in October. While headlines predominantly highlight the areas of weakness within the economy, our expectation for robust demand and strong consumer spending should lead to above-trend growth in 2022.

- Controlling Tempers Amid The Fed’s Taper | Chair Powell announced that the Fed would begin tapering bond purchases by $15 billion per month at the Federal Open Market Committee meeting this week, and due to the telegraphed nature of the decision, the dreaded repeat of the 2013 taper tantrum was avoided. And despite his repeated commentary that tapering would precede any interest rate hike, the financial markets are still pricing in a Fed tightening cycle beginning by July with a 25 basis point interest rate hike. With the unwinding of asset purchases lasting until June at the current pace, and a degree of uncertainty still prevalent as supply chains and labor market conditions normalize, we anticipate that the Fed will maintain its patient approach and that interest rate hikes will become a late 2022/early 2023 story (at the earliest).

- Pressure On OPEC+ Is A Tale As Old As Time | In just over a year’s time, the world has transitioned from overflowing oil storage to pleading with OPEC+ to expedite their path to increasing oil production. As countries across the globe achieved a sustainable reopening, demand within the Energy sector sharply rebounded, leading oil prices to rally over 70% year-to-date alone. As it pertains to the US, President Biden has voiced concern about fuel prices heading into the colder months, and how the spike in the national average gasoline price from $2.12 to $3.40 in just 12 months may negatively impact the consumer. While OPEC+ did not waiver in its stance at yesterday’s meeting, we expect the pressure from political leaders across the globe to amplify, just as it did last year amid the Saudi Arabia-Russia price war. If history proves prescient, adjustments (both in the US and abroad) will be made to better align supply with current demand, and there will be downside risk to oil prices in the months ahead.

- Election Outcomes May Enchant Congress To Make A Deal | The Republican Party is hoping that their victory in Virginia’s election for governor is a precursor for the mid-term elections, but we’re focused on the near-term impact to President Biden’s social spending and infrastructure bills. It is possible that the election results could respark debates within the Democratic Party—progressives arguing for more aggressive legislation as they maintain congressional control while moderates focus more on aligning policy with the priorities of middle-ground voters. Ultimately, our base case is that the packages will proceed as is, pending the support from Senator Manchin, and that the less than previously anticipated tax provisions (on corporate, individual, capital gains, dividends, and estate taxes) will be a positive for the equity market.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.