Individual Bonds in a Rising Interest Rate Environment

Drew O’Neil and Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

There are pros and cons (benefits and risks) associated with every investment product. Investors must find the balance most suitable to our own personal risk profile. All investors have one thing in common: we want to maximize our returns. The differences occur in our tolerance level for risk. Typically, the higher the risk, the greater the potential return and conversely, the lower the risk, the lower the expected return.

The bond markets have been in a general interest rate decline for over forty years, thus bond investment selections have had one commonality: in general, they have appreciated in price as rates have fallen. Therefore, throughout most of our investment years, there has been negligible to no negative price consequences of our bond product selections. Our current investment environment has many investors considering a rise in interest rates. Should the trend of rising rates commence, we as investors will find ourselves evaluating a market factor that hasn’t been in play very often for over forty years: rising interest rates and thus falling bond prices.

While no one knows when interest rates may rise and by how much, a welcome benefit to rising interest rates is that it will provide investment opportunity for higher yielding bonds. Bond investors’ common appeal for higher returns will be pleased; however, product selection might comprise very different risks. If interest rates rise, bond prices will fall. For buy-and-hold investors of individual bonds, this phenomena has no impact on the cash flow, income or the date when a bond’s face value will be returned to the investor (barring an outright default or an investor’s choice to sell before maturity). Holding high credit quality bonds mitigates default risk and a choice to hold or sell is an absolute controlled event for investors in bonds. Investors of packaged products do not control choice of which bonds are held, choice of when holdings are bought or sold, or the changing balance of bond holdings adjusted when fund balance changes. Certain packaged investment products do not provide investors with an option to hold to maturity and therefore cannot provide a known exit price at a known time.

Many investors buy bonds to protect the wealth in their portfolios. Individual bonds can provide that benefit in a manner unlike and arguably with more certainty than with many other product choices. Individual bonds look forward and independent of interest rate moves, allow investors to “see” future cash flows, maturity dates and redemption prices. Most packaged products have no stated maturity. Should interest rates rise, the price of the bonds held will fall. Managers of many funds must buy and sell based on the inflow or outflow of money invested, not necessarily matching ideal timing and always changing the overall portfolio composition. Uncontrolled market risk exists in a much different way for packaged product investors versus individual bond investors.

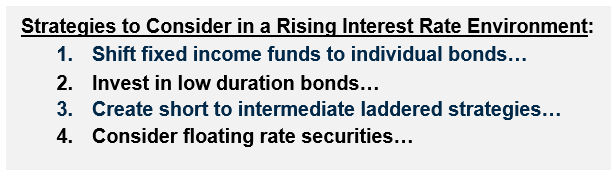

Fixed Income Strategy Considerations in a Rising Interest Rate Environment:

- Shift fixed income funds into individual bonds. This, barring a default, allows you to lock into a known cash flow, a known yield (return) and a known date when each bond’s face value is returned. Principal protection is achieved in a way not provided by most other options.

- Before interest rates begin to rise with any tempo, avoid overweighting in high duration bonds and look to purchase low to intermediate duration bonds. Duration has been an investor’s best friend during falling interest rates as rising prices insulated bond values. If you believe rates will begin to rise, low duration bonds will moderate principal decline. The shorter maturities also position investors to take advantage of increasing rates as bonds mature and dollars are reinvested.

- Create short to intermediate individual bond ladders. A laddered strategy will mitigate interest rate risk associated with reinvestment by providing stepped cash flows and principal reinvestment over various markets rather than isolated to one specific future date. A laddered strategy can mimic many of the benefits of floating rate securities as continual reinvestment into a rising interest rate environment can gradually increase the average yield of the portfolio.

- Consider floating rate securities which allow coupons to adjust to changing interest rates. Selection depends on market availability and advantageous pricing.

Discuss these options with your financial advisor. We can assist your advisor with sample proposals to support various strategic options. Begin or revisit the long term planning process now as we move into the new year. After all, positioning is an integral part of long term plan.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.