Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Markets pricing in a more hawkish Fed

- Consumers & businesses splurging for the big game

- Retailers may boost 4Q21 earnings growth

Are you ready for the football finale? A potentially record setting 117 million fans are expected to tune in to see which city—Cincinnati or Los Angeles—has the will to win the big game. Even before kickoff, Sunday’s match-up is one for the record books. First, a Los Angeles victory would make for back-to-back years that a team wins the championship at its home stadium. Second, Joe Burrow could become the first #1 draft pick to lead his team to a title win in just two years. No matter the outcome, you can count on elite perseverance, discipline, and team work being on display—the same qualities needed for a successful investment strategy! Ahead of the showdown on Sunday, we draw a few additional parallels between the game’s terminology and the state of the economy and financial markets.

- Monetary Policy Under Further Review | The annual pace of headline inflation rose to 7.5% in January—the fastest pace since February 1982. As a result, the markets are now expecting a more hawkish Fed ahead of the March Federal Open Market Committee (FOMC) Meeting on March 16. In fact, more than six interest rate hikes are priced in for the year (four by June!) compared to just one anticipated hike six months ago, and the probability of a 50 basis point hike has increased to 83%, up from 33% just one week ago. While we continue to scramble to avoid getting sacked on our expectation for a 25 basis point March increase, there are reasons the Fed may not tackle a 50 basis point hike on its first down in this tightening cycle drive. First, the last four tightening cycles have all began with a 25 basis point rate hike, and the last time the Fed raised interest rates by 50 basis points was in 2000 at the end of a cycle. Second, there are other economic data points that indicate supply chains and pricing pressures are starting to ease finally. Ultimately, the Fed still has time on the clock before it makes its final call—25 or 50 basis points—and it will receive additional important insights that include the Producer Price Index (2/15), the minutes from the January FOMC meeting (2/16), personal consumption expenditure (2/25), the February Jobs Report (3/4), and the Consumer Price Index (3/10). Admittedly, given the strength in recent data, it is a close call.

- Consumers The Most Valuable Players | The willingness of fans to participate and bring back game day traditions suggests that 1) consumer spending is still resilient, and 2) society is learning to live with COVID as we return to ‘normal’ activities. In fact, the National Retail Federation survey found that 90 million people are planning to throw or attend a party (up from 62.8 million last year) and another 13.7 million plan to watch the game at a bar or restaurant—boosting the projected Game Day spending to $14.6 billion! While this is still below the pre-pandemic record of $17.2 billion, the trend is moving in the right direction. It is also worth noting that last year’s stadium attendance was limited to 30% capacity, but this year all ~70,000+ seats are up for grabs with tickets currently the most expensive in history! But the fans aren’t the only ones willing to spend big bucks, as businesses are spending a record $7 million per 30 second television commercial. Many of us can admit that the ads are just as entertaining as the game itself, so it’s a positive for fans and the US economy that business sentiment is so strong.

- Big Stars Showed Up To Play This Earnings Season | The 4Q21 earnings season is well past halftime, with more than 80% of the S&P 500 market capitalization having reported. Some of the big time players on the S&P 500’s roster (e.g., Alphabet, Apple, Amazon, Microsoft) made some big time plays to move the earnings growth chains. If other players are able to shine in the final minutes, earnings growth may rise even higher (31% versus 24% prior to the start of the season) and put some points on the board ahead of the 2022 season. S&P 500 earnings for 2022 have risen slightly since the start of earnings season, so any additional yardage may bring estimates closer to our goal line of ~15% earnings growth ($235).

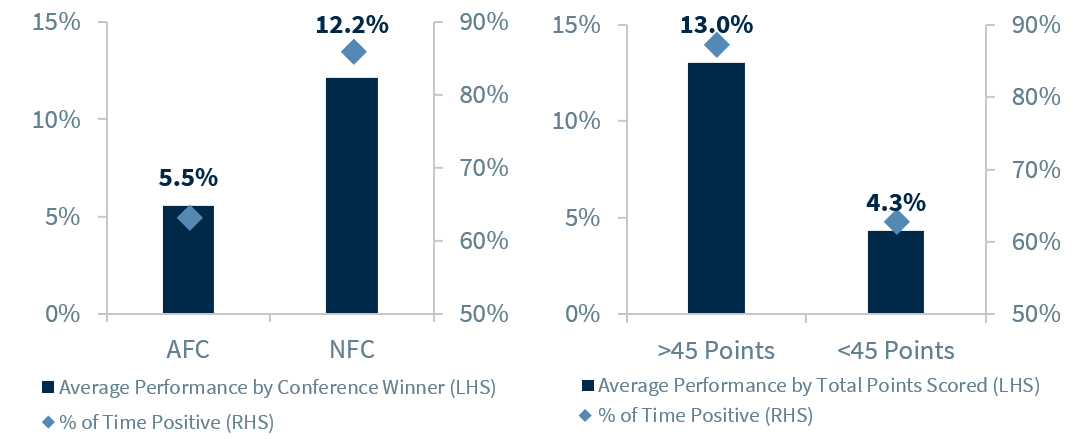

- Fantasy Football Perspective | Unquestionably, our positive outlook for the US equity market is based on resilient economic fundamentals, a healthy consumer, continued strong earnings growth, and attractive valuations. While not statistically significant, sometimes investors want to ride the wave of interesting historical trends. So if you have not decided which team to root for, history suggests that the best equity market performance has occurred when Los Angeles’ conference (NFC) defeats Cincinnati’s (AFC). But for our friends and followers in Cincinnati who are rooting for their program to achieve its championship dream for the first time, you can at least hope for either a high scoring game or a complete blow out, as both of these outcomes have coincided with strong equity market returns in the 12 months following the game.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.