A More Aggressive and More Uncertain Fed Policy Outlook

Chief Economist Scott Brown discusses current economic conditions.

As was widely anticipated, the Federal Open Market Committee raised the target range for the federal funds rate by 25 basis points (to 0.25-0.50%) and signaled more to come. However, the rate outlook was more aggressive than the markets had expected. The time has come to jettison the obsession about the number of Fed rate hikes and focus more on the expected level of short-term interest rates.

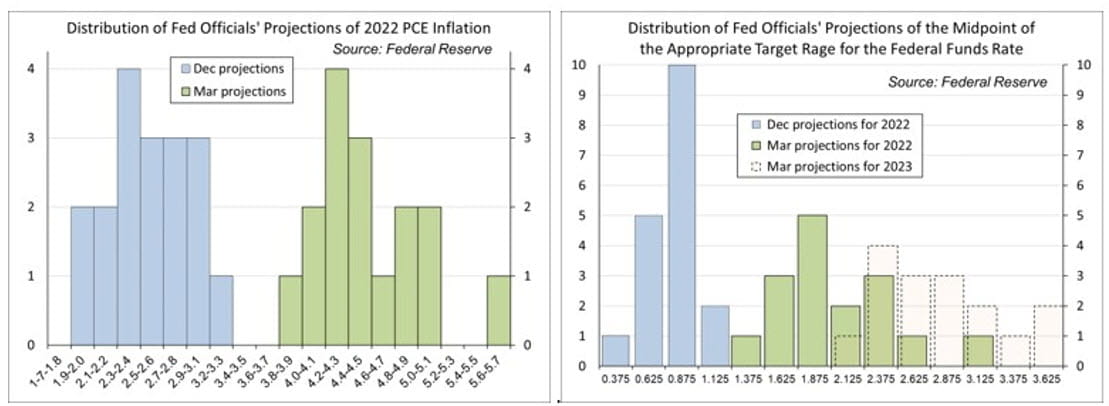

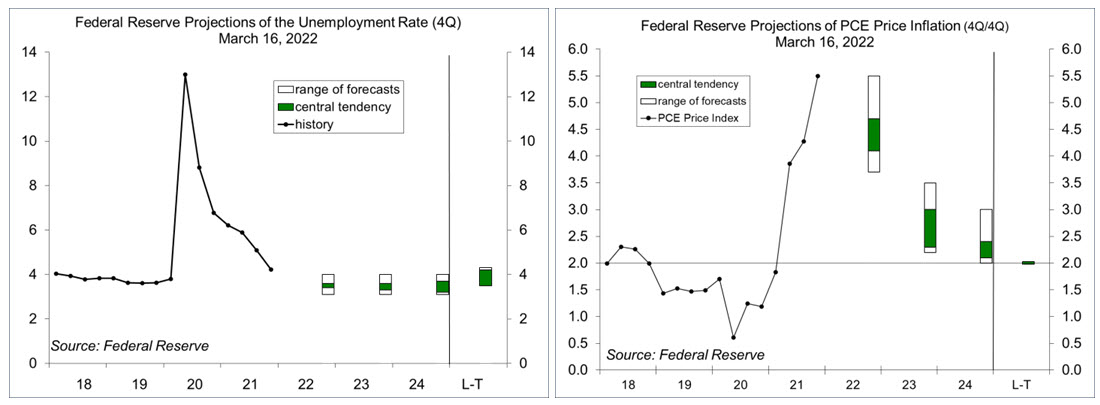

No surprise, Fed officials lowered their expectations for 2022 GDP growth (a median forecast of 2.8%, vs. 4.0% in December). Officials also raised their forecasts of inflation dramatically. The range among individual forecasts was wide. Supply chain disruptions have been larger and longer lasting than anticipated and price pressures have spread to a broader range of goods and services. In the policy statement, the FOMC noted that Russia’s invasion of Ukraine would have “highly uncertain” implications for the U.S. economy, but would likely add to inflation pressure and weigh on economic activity. In his press conference, Chair Powell said that a firming in the stance of monetary policy should lead back to the 2% inflation goal. However, he admitted that “inflation is likely to take longer to return to our price stability goal than previously expected,” and added that Fed officials “continue to see risks as weighted to the upside.”

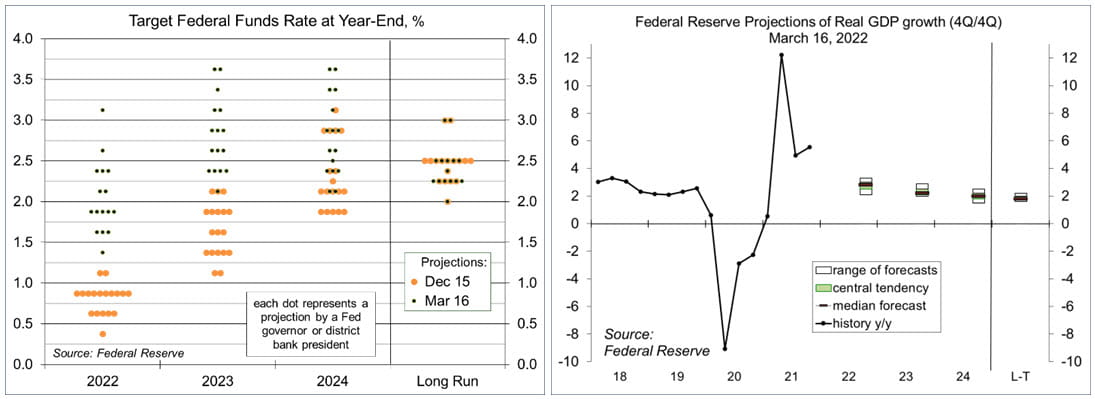

If the outlook for inflation is higher, with risks to the upside, shouldn’t the Fed be more aggressive in raising rates? It is. According to the revised dot plot (Fed officials’ individual projections of the appropriate year-end federal funds target rate), 12 of 16 officials anticipate an increase of at least another 150 basis points by the end of this year, with another 75 or so by the end of 2024 – taking the federal funds target rate above estimates of its long-run equilibrium. There is a wide dispersion in the interest rate outlook.

Powell said that if the Fed knew then what it knows now, “it would have been appropriate to move earlier.” While there was only one formal dissent in the Fed’s March 16 decision to raise rates (St. Louis Fed President Bullard preferred a 50-bp move), officials are divided on the need to catch up. Powell note that every FOMC meeting is a live meeting “and if we conclude that it would be appropriate to raise interest rates more quickly, then we’ll do so.”

The Fed’s laying out of a higher outlook for short-term rates should cause credit conditions to tighten (or become less easy). That appeared to be the case even before the policy announcement. Higher oil prices have raised fears of recession in some quarters. Higher oil prices tend to have an outsized impact on the U.S. economy, meaning that they dampen growth more than one would expect based on the calculation of the direct impact on consumer spending and business costs. That is largely because the Fed’s response to higher oil prices has historically had a bigger impact. The Fed ought not to make that mistake this time.

Fears that Powell will go “full Volcker” – steering into a recession to get inflation down – are overdone. It might come to that, but the current situation is far from where we were in the early 1980s.

The FOMC Decision and Summary of Economic Projections

The Federal Open Market Committee raised the target range for the federal funds rate by 25 basis points (to 0.25-0.50%) and said that it “anticipates that ongoing increases in the target range will be appropriate.” In its policy statement, the FOMC cited elevated inflation and strengthening employment. The implications of the Ukraine conflict to the U.S. economy are “highly uncertain,” according to the FOMC, but “are likely to create additional upward pressure on inflation and weigh on economic activity” in the near term.

Of the 16 senior Fed officials, 12 anticipate raising rates another 150 bps or more this year.

The median projection of real GDP growth for this year fell to 2.8% (4Q22/4Q21), down from 4.0% in December. That works out to a 5.4% annual rate in the second half of this year (vs. +6.4% in the first half of the year). The median forecast of 2023 GDP growth remained at 2.2%).

Fed officials generally expect the unemployment rate to fall to 3.5% by the end of this year.

The median forecast of 2022 inflation rose to 4.3% (vs. 2.6% in December). There was a wide range among individual forecasts. Officials generally expect inflation to fall back more significantly next year (a median forecast of 2.7% for 2023 and 2.3% for 2024) – still above the long-term goal of 2%.

Recent Economic Data

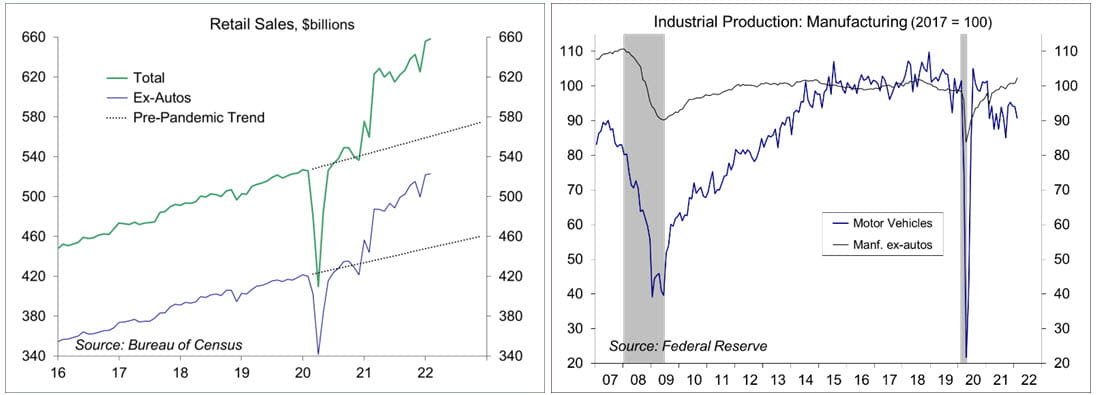

Retail sales rose 0.3% in February, up 0.2% ex-autos. Figures appear to be distorted by noise in the seasonal adjustment, but the underlying trend remains strong (driven partly by higher prices). Ex-autos, gasoline, and building materials, sales fell 0.6% (following +5.4% in January and -3.9% in December).

Industrial production rose 0.5% in February. The output of utilities fell 2.7%, following a record 10.4% rise in January. Factory output rose 1.2%, despite a 3.5% decline in motor vehicle production (supply issues).

Jobless claims fell to 214,000 in the week ending March 12. The four-week average was 223,000 – a very low trend. The insured unemployment rate fell to its lowest level since February 1970.

Import prices rose 1.4% in February (+10.9% y/y), up 0.6% (+6.5% y/y) ex-food & fuels.

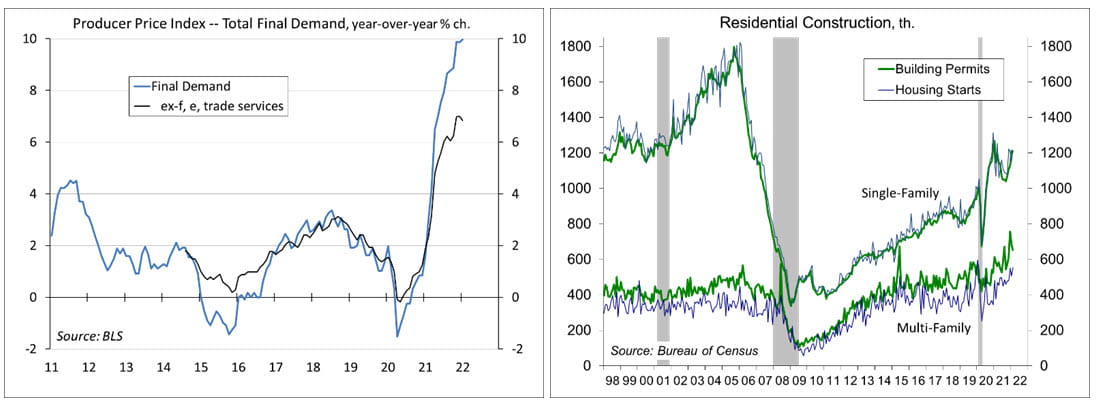

The Producer Price Index rose 0.8% in February (+10.0% y/y). Ex-food, energy, and trade services, the PPI rose 0.2% (+6.6% y/y).

Single-family building permits slipped 0.5% in February (+5.4% y/y).

Existing home sales 7.2% in February, to a 6.02 million seasonally adjusted annual rate (-2.4% y/y). The 30- year mortgage rate was 4.16% in the latest week, up from 3.22% in the first week of the year.

The Index of Leading Economic Indicators rose 0.3% in February

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.