Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Costs are rising faster than wages

- Elevated cash balances have softened the impact

- Job growth is critical to improving collective spending

Resilient consumer spending led the economy’s recovery, but will it now be the cause of a downfall? With record cash balances thanks to stimulus checks, pent-up demand drove the economy as it gradually reopened. As a result, the economy posted its best year of growth (2021 GDP: 5.7%) since 1984 last year. Now, with gasoline prices over $4 per gallon, the dream of home ownership getting tougher, and restaurants adding inflation to the menu, it begs the question: how much more can the consumer spend and for how much longer? Since consumer spending accounts for ~70% of GDP, it is the backbone of our economic outlook. With day-to-day costs soaring and outpacing compensation increases, we outline why the economy can continue to grow above-trend and avoid a recession.

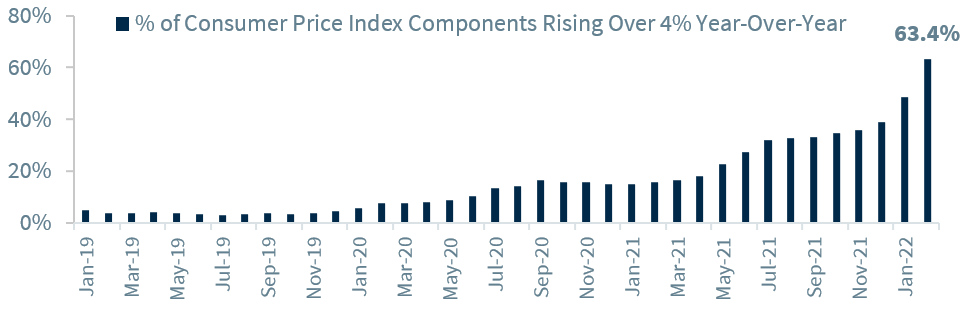

- The Cost Conundrum | While inflation has surged, what is equally as worrisome is that it has broadened out and impacted more and more goods and services. In fact, nearly two-thirds of the components of the Consumer Price Index are rising at a year-over-year pace in excess of 4%. With consumers facing higher prices on a daily basis, economists have started to question if inflation could force spending habits to shift and force the economy into a recession. The good news is that the median monthly income of a worker has increased ~$200/month (from $3,690 to $3,890/month)—an increase of more than ~5% year-over-year. However, the bad news is that costs are going up faster than wages. Consider the following:

- Gasoline Prices | With the price per gallon of regular gasoline increasing from $2.87 to $4.24 over the last 12 months, the average driver has seen driving fuel costs increase by an average of $67/month. By the way, this does not include utility bills, which have also seen increases due to higher energy costs.

- Grocery Costs | With everything from bread to meat to vegetables moving higher, the average grocery bill has increased. The cost to feed a family of two has increased by $92/month. And for a family of four? $213/month.

- Rent | There are ~45 million households renting across the US. While there are clearly differences across the various regions in the US (e.g., rents in New York City and Miami have surged over 30%), the average rent has increased by $232/month. Similarly, for first-time homeowners seeking to buy a home, the average mortgage has increased by ~$300/month as the 30-year fixed mortgage rate has increased to 4.53% (from 3.23%) over the last 12 months.

- Student Loans | Reinstating student loan payments will impact ~15% of the population (~45 million borrowers). With the average payment of ~$390 per month, it is substantial and potentially painful for borrowers at the lower end of the income scale. But given that the suspension of student debt was an integral part of President Biden’s campaign, his closest advisors are encouraging him to continue the suspension ahead of the midterm elections.

- Negative Real Earnings | Even excluding student payments, the increase in gas, groceries and rent alone costs the average consumer ~$390/month, far outpacing the $200/month of additional earnings. With such an unflattering dynamic, how can the US economy avoid a recession? Simply put, the answer is savings and jobs.

- Solid Consumer Finances | Fortunately, the health of the consumer prior to this inflationary environment has and should continue to provide support to offset these higher costs. Specifically, cash balances remain near record highs and household debt service remains near record lows. In fact, aggregate cash balances are $2 trillion higher than the 15-year trend line, which means many consumers have the necessary cash on hand or the ability to finance purchases in order to fulfill still elevated spending plans. The emergence of the Omicron variant stalled the reopening, but as cases subside, many consumers are anxious to partake in the pent-up demand for pre-COVID activities (e.g., movies, restaurants, vacations). With real-time activity metrics still advancing, we expect the shift from goods to services spending to be more pronounced in the months ahead.

- Jobs, Jobs, Jobs | If there’s one way to improve the collective spending power of consumers, it’s the creation of more jobs! More people having the ability to spend will lift the economy. This continues to be a favorable job market with job openings (11+ million) near record highs and evidence that companies are competing for available labor—many still offering substantial incentives (e.g., doubling shift pay). With job creation such an important driver of growth that is why next Friday’s March jobs report will be so important to the market. If the current consensus expectation of 450k jobs is added, that is well above the 300k figure we believe is needed to maintain robust growth. That type of job growth will also keep the Fed on its steady pace of interest rate hikes for the remainder of this year. However, any disappointments to job growth (numbers below the 100k level) will bring into question the strength of the economy and complicate the Fed’s path to tightening monetary policy.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.