March employment report / yield curve

Chief Economist Scott Brown discusses current economic conditions.

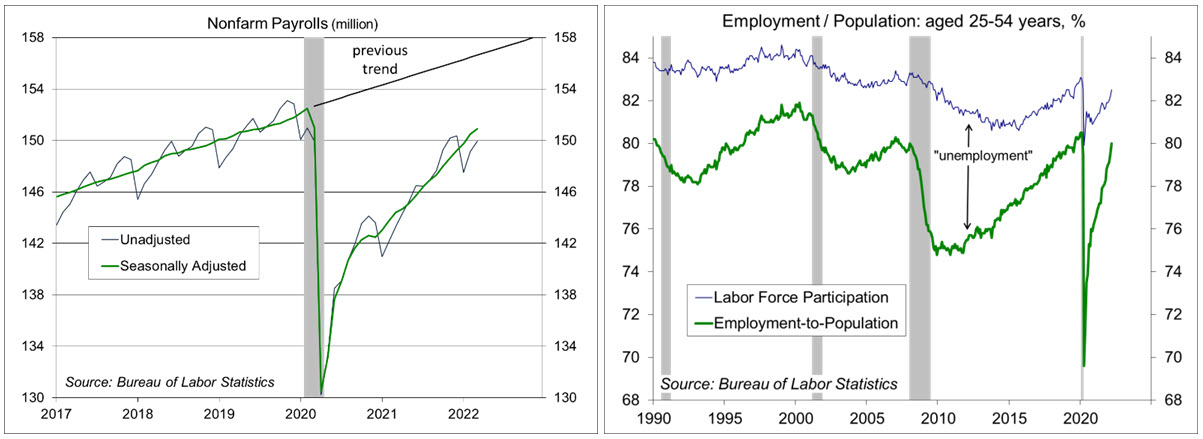

The job market remained strong in March. The unemployment rate fell to 3.6%, which is where it was before the pandemic (3.0% for the prime aged cohort, those 25-54 years). With the exception of older workers (those 55 and over, who are generally more concerned about the pandemic), labor force participation rates are at or near pre-recession levels. Good news can be bad news for the markets sometimes, as a strong economy will lead the Fed to raise short-term interest rates, potentially causing a recession. The slope of the yield curve is the best single indicator of recessions. However, it is the difference between long and short rates that matters, not the 10yr-2yr spread.

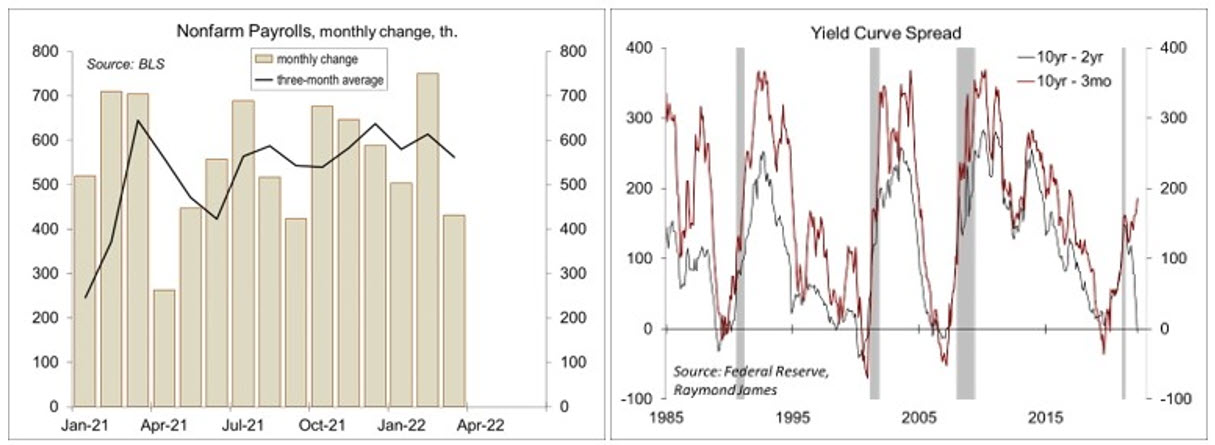

Nonfarm payrolls rose by 431,000. Weather wasn’t much of a factor. The household survey showed that 89,000 could not work during the survey period due to adverse weather, lower than a typical March (a 145,400 average over the last ten years). The weather was mild in February too, so some seasonal job gains may have been pulled forward. Whatever the case, job growth has remained well above a long-term sustainable pace. The unemployment rate fell further. At the March 15-16 FOMC meeting, the median forecast of Fed officials was that the rate would hit 3.5% by 4Q22 and stay there through the end of 2023.

Labor force constraints ought to limit the pace of job growth in the months ahead, but labor force participation may increase further. There are 99 million people of working age without jobs. Presumably higher wages should encourage some of these people to work, and higher inflation could necessitate a return to work for many stay-at-home spouses (to help make ends meet).

The 10yr-2yr spread inverted after the employment report was released, raising investor concerns that we may be heading toward a recession. However, the 10yr-3mo is the preferred recession gauge. Simply put, an inversion at the short end of the yield curve reflects a market expectation that short-term interest rates will fall, which they do in a recession (as the Fed lowers short-term interest rates). There is no similar logic for the 10yr-2yr spread. Also note that two-year inflation expectations are much higher than ten-year inflation expectations, which explains much of the 10yr-2yr inversion. The 10yr-3mo spread is still wide, signaling that a recession is unlikely anytime soon.

Of course, the Fed may end up raising short-term interest rates a lot more in order to contain inflation and could raise them enough to cause a recession if inflation fails to fall. The odds of a recession in 2023 have been creeping up. Demand does need to slow, which along with balance sheet reduction, could be a difficult transition for the stock market.

While wage growth has picked up, we don’t appear to be in a wage-price spiral, but that is a danger. Inflation has continued to broaden out. Long- term inflation expectations remain well-anchored, but an inflationary mindset is becoming more rooted. This is turning out to be an ever more challenging environment for Federal Reserve policymakers and for investors.

Recent Economic Data

The March Employment Report was strong. Nonfarm payrolls rose by 431,000, less than expected but with upward revisions to January and February (a 562,000 monthly average in 1Q22).

The unemployment rate fell to 3.6% (from 3.8%), which is where it was in 4Q19. Labor force participation increased to 62.4% (vs. 63.3% in 4Q19) and was at or near pre-pandemic levels for all categories except for those 55 years and older (who are generally more concerned about the virus).

Job openings were little changed at 11.3 million in February, far above pre-pandemic levels, while another

4.35 million people quit their jobs (consistent with a tight job market)

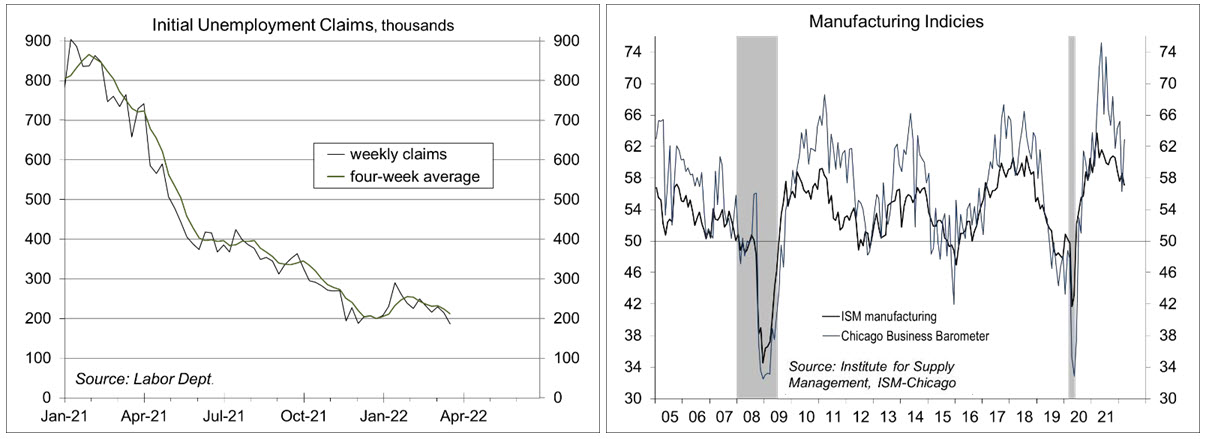

Initial claims for unemployment benefits rose to 202,000 in the week ending March 26. The four-week average was 208,500, consistent with extremely tight labor conditions.

The ISM Manufacturing edged down to 57.1 in March, from 58.6 in February – details indicated strong demand and a general worsening of supply chain issues (due partly to Omicron abroad).

The Conference Board’s Consumer Confidence Index rose to 107.2 in the initial estimate for March, following 105.7 in February (revised from 110.5). Evaluations of current conditions improved, but expectations weakened. Consumers are pessimistic about inflation, but job market perceptions have never been higher.

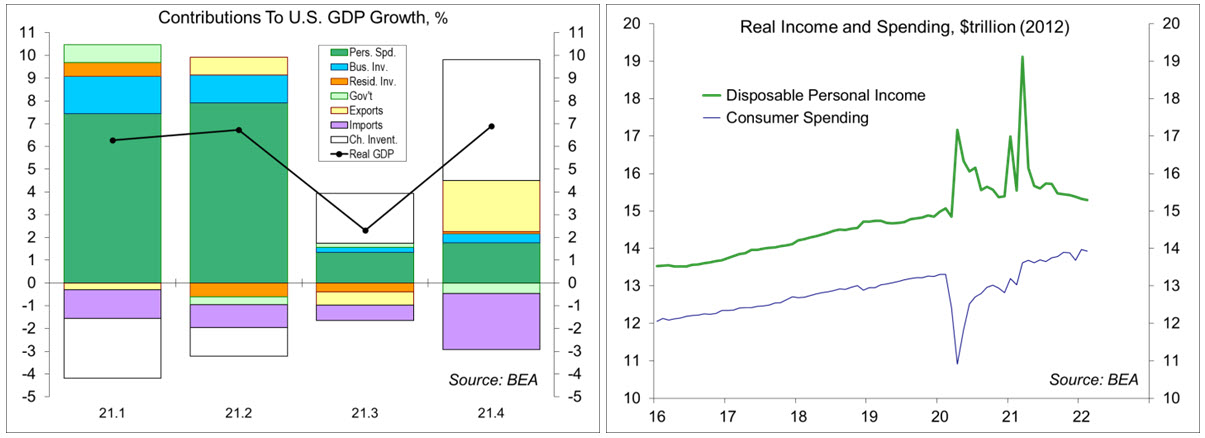

Real GDP rose at a 6.9% annual rate in the 3rd estimate for 4Q21 (vs. 7.0% in 2nd estimate). Consumer spending (+2.6%) and business fixed investment (+2.9%) were revised lower, but the change in inventories was revised higher (contributing 5.3 percentage points to headline GDP growth).

Personal income rose 0.5% in the initial estimate for February (+6.0%), led by a 0.9% gain in private-sector wages and salaries (+12.6% y/y). Inflation-adjusted disposable income fell 0.4% (-1.6%).

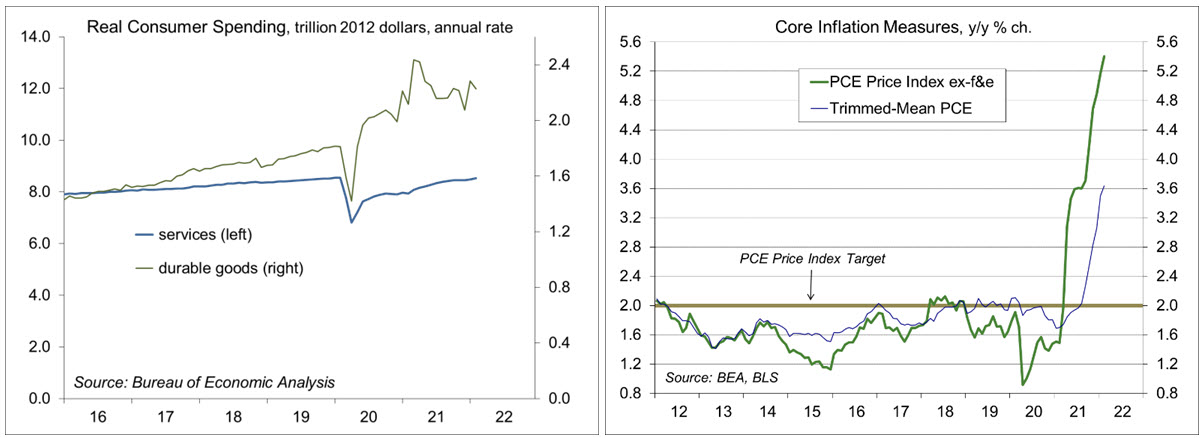

Personal spending rose 0.2% (-0.4% adjusting for inflation), down 0.4% y/y (+6.9% adjusted for inflation). Spending on durable goods slipped 0.2% (+17.2% y/y), with motor vehicle sales down 4.0% (+19.8% y/y, but down 2.8% y/y adjusting for inflation). Spending on services rose 0.9% (+12.4% y/y).

The PCE Price Index rose 0.6% (+6.4% y/y, well above the Fed’s 2% goal). The Dallas Fed’s Trimmed-Mean PCE Price Index rose 3.6% y/y in February, consistent with a broadening of price increases across categories.

The advance economic indicators for February suggested a wider trade deficit and a significantly slower rate of inventory accumulation in 1Q22 (implying a large subtraction from GDP growth).

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.