Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Core inflation may have reached its peak

- Job & wage gains may counteract pricing pressures

- Earnings environment will normalize this year

Play ball! Opening Day is a day of optimism for baseball fans across the country. The crowds return to the stadiums to enjoy America’s pastime knowing every team is starting with a fresh record and renewed hopes of contending for a championship. With the excitement of what’s ahead, the losses from the prior season become a distant memory. Contrary to this mindset, many investors entered this year with the expectation that the successes of last year would carry into 2022. Instead, geopolitical hotspots came out of ‘left field’ and the start of Fed tightening to combat soaring inflation rattled the financial markets. With next week the ‘big leagues’ in terms of potential market moving events, we are ‘covering all of the bases’ of what will be released and our expectations moving forward.

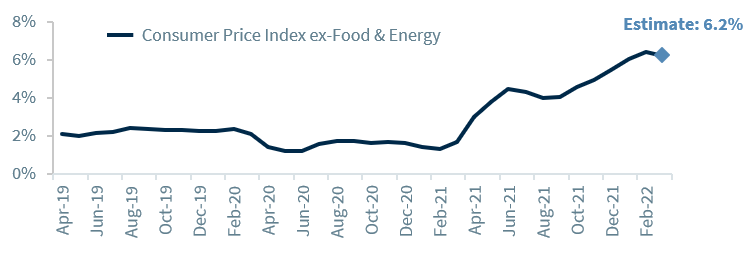

- Will Inflation Still Swing For The Fences? | Economists are fearful that next week’s Consumer Price Index readings will continue to soar, especially as more Fed members voice that they are ready to play ‘hardball’ when it comes to taming inflation —whether it be through a faster, earlier than expected tapering of the $9 trillion balance sheet or a 50 basis point rate hike at the May meeting. While consensus estimates indicate that the headline inflation reading may move higher (from 7.9% to 8.2%), there is the expectation that core inflation—which excludes energy prices that have soared due to the Russia-Ukraine crisis—could moderate (from 6.4% to 6.2%) on a year-over-year basis for the first time in seven months. And there are early signs that some inflation due to supply chain bottlenecks is easing—declining backlogs, lower delivery times, and inventory levels that are now higher than pre-COVID levels. Additionally, international freight costs are easing from their recent peak and truck rate forecasts anticipate a deceleration that is expected to continue through year end. Also of importance, used vehicle prices—which have significantly contributed to the run up in inflation—eased in March. In fact, the Manheim Used Vehicles Index declined for the second consecutive month and posted the largest monthly decline (exclusive of COVID) since 2008. This is likely a harbinger of the easing of the ‘goods’ component (which had been the primary driver of the recent acceleration) in inflation moving forward. ‘Service’ related inflation is likely to remain in an uptrend as the economy reopens.

- Will Retail Sales Strike Out? | Retail sales for March are up at bat next Thursday. And with 32% of the respondents in our Quarterly Investment Strategy Survey (1Q22) stating that they are cutting back on overall spending due to inflation, we will be able to gauge how much inflation is truly impacting discretionary consumer spending. As much as headlines tout the fears of higher expense costs resulting in a recession, we believe savings, wage growth, and job creation could be the antidote. Consumers still have ~$2.5 trillion in excess savings, and the labor market continues to show signs of strength.* If the economy can continue to add jobs in the ballpark of ~300k per month (jobless claims reaching the second lowest level on record is a good sign), the economy should be able to weather higher prices as overall spending capacity increases. President Biden extending the freeze on student loan payments reduces a near-term burden that could have hampered some discretionary spending going forward.

- Another Heavy Hitting Earnings Season? | Corporate earnings hit for the ‘triple crown’ in 2021, as the S&P 500 achieved 30% earnings growth in four consecutive quarters for the first time since 3Q10 (post Great Financial Crisis), companies beat earnings per share estimates by 10% for six quarters (the longest streak on record) and margins rose to a record high.* These factors powered the S&P 500 to all-time highs and helped compress elevated valuations. With the Big Banks set to kick off the unofficial start of the 1Q22 earnings season next week, investors are questioning whetherthe S&P 500 can continue its streak. As we distance ourselves from the pandemic, the time of easy comparisons is over as the earnings environment is transitioning to a more normal environment this year. But even as metrics moderate, even a beat rate of ~5%, which would be in line with the historical average, could help the earnings growth forecast of 5.2% stretch into double digits.* A better-than-expected earnings season could allow corporate fundamentals to overshadow the macro headlines (e.g., inflation, Fed tightening) and help the equity market regain its positive momentum. Forward guidance will be critical. Given that the worst of the Omicron surge and Russia’s invasion of Ukraine (and the related commodity prices surges) happened in the first quarter, companies may blame disappointing results on these ‘curveballs.’ But longer term, insights into expected sales growth, margins, supply chains, capital expenditures, hiring, and more could confirm that our expectation of robust corporate earnings growth will ‘step up to the plate’ and help lift the S&P 500 to our target of 4,725 by year end.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.