Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Soft landing expected for the U.S. economy

- The health of the consumer remains key

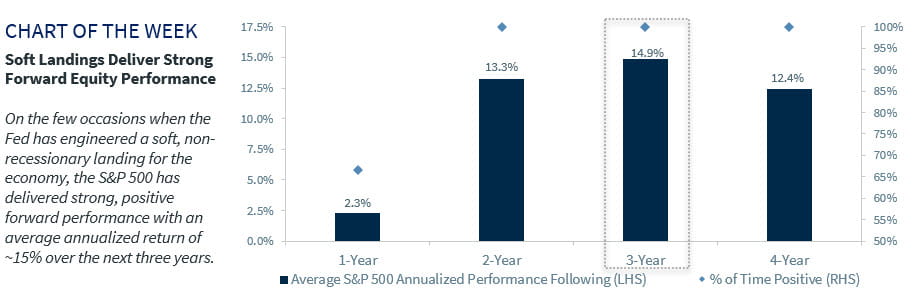

- Equity markets perform well after soft landings

As we approach the official start to summer, one of the defining characteristics of this time of year is the gratifying tradition of ‘graduation.’ As college and high school graduates throw their caps in the air in celebration, there is both excitement and anxiety for what lies ahead. While some may be going to college as others start their careers, there are many that are still unsure about their next step. Regardless, the bottom line is that all graduates hold some level of uncertainty for what the future holds. The economy is going through its own ‘graduation’ after registering its strongest economic growth since 1984 last year. The transition to tighter monetary policy (e.g., higher interest rates, balance sheet reduction) has created nervousness about the future direction of the economy. Despite the uncertainty, we believe the Federal Reserve (Fed) can engineer a soft landing, and the health of the consumer is key.

Is A Soft Landing The Next Step? | Swift monetary tightening is likely to continue over the summer months as the Fed prepares to rein in inflation that is running near a 40-year high. Rate expectations have rapidly adjusted, with the market now pricing in a 2.7% fed funds rate at year end, up from an expected 0.75% rate at the end of last year. While the Fed just started quantitative tightening on June 1 and has only delivered 0.75% worth of rate hikes to date, it is clear that expectations of aggressive Fed tightening are taking some wind out of the sails of the economy.* Some of the most interest rate sensitive areas of the economy, such as housing, are slowing as evidenced by mortgage purchase applications falling to a four-year low. Sentiment has also fallen sharply, with consumer, business, and investor sentiment now sitting at multi-year lows. Although the Fed has a delicate balancing act to cool demand without tipping the economy into a recession, we think they can successfully navigate the challenging environment and deliver a soft, non-recessionary landing if it doesn’t overreact and tighten as aggressively as the market is expecting. Critical to our outlook is the resiliency of the consumer, particularly as consumer spending makes up ~70% of the economy. Thus far, consumer spending has held up well in the face of rising prices and increased asset volatility, but how much more can the consumer absorb? The consumer is well positioned to power the economy going forward for a few reasons.

-

- Fundamentals Support Positive Future | Despite current inflationary headwinds and depressed sentiment, the consumer has not stopped spending. This is because consumer balance sheets have rarely been in better shape. Robust job gains, strong wage growth and a significant amount of accumulated savings since the pandemic began continue to provide plenty of firepower to support consumption.* Consumers also used the pandemic to pay down debt. Household debt servicing ratios are now running at a 40-year low, significantly below the levels seen during the three prior recessions. This suggests that consumers have the ability to increase their debt-financing options (i.e., credit cards), if needed, to maintain their spending.

- Consumers Taking the Road Less Travelled | Goods-producing companies were big beneficiaries during the pandemic as people spent money on things they could enjoy at home, such as furniture, electronics and other at-home gadgets. However, as the economy has reopened, people have shifted their spending to more services-related items, such as airline travel and restaurant spending. While this shift was predictable, some ‘big box’ retailers have reported elevated inventory levels and slowing sales that have raised concerns about the health of the consumer. But our real-time activity metrics confirm consumers are spending on services as restaurant bookings, hotel occupancy and TSA screenings are all at or near post-pandemic highs.* In fact, with over 80% of consumers planning to take a summer vacation this year, many airlines/cruise lines have raised their forward sales guidance due to the increased demand. This shift will be supportive of economic growth as services spending makes up ~60% of total consumer spending and remains below its pre-pandemic trend.

Why A Soft Landing is So Important | Healthy consumer spending, combined with a potential Fed pivot to be less aggressive over the summer, lays the foundation of our outlook for a soft landing with no recession over the next 12 months. This is critically important. Why? Because following the three other time periods that the Fed has engineered a soft landing (1965, 1984, and 1994), the S&P 500 was up ~15% on an annualized basis over the next three years and was positive each time.* This is in stark contrast to when the economy enters a mild/moderate recession, when the S&P 500 experiences a ~24% decline, on average.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.