Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Explaining a technical versus an actual recession

- The Fed has an 8-week hiatus after next week’s decision

- Pessimistic earnings narrative has not materialized so far

Monday is National Thread the Needle Day, a holiday that acknowledges all of the interpretations of the phrase. It can relate to precision in sports, striking harmony or balance between opposing views, and the actual act of sewing. But for investors, it’s a phrase they have heard countless times over the past few months as we’ve expressed the need for the Federal Reserve (Fed) to ‘thread the needle’ with monetary policy to avoid a recession and the need for companies to ‘thread the needle’ when it comes to earnings results and forward guidance. The timing of the holiday is ironic, as next week will bring a plethora of economic data points, the July Federal Open Market Committee Meeting, and the biggest week of the 2Q22 earnings season. In anticipation of these releases and events, we’re analyzing how the results and decisions will craft the fabric of the market moving forward.

- Economy May Stitch Together Two Negative Quarters Of Growth | When it comes to a ‘technical’ recession as defined as two consecutive quarters of negative GDP growth, the Atlanta Fed GDPNow indicator projects that the 2Q GDP report (released next Thursday) will be -1.6%—the second quarter in a row of negative growth.*While our economist believes the 2Q GDP will be positive (RJ Est: +0.7%), a potential second quarter of negative ‘headline’ GDP will sound the recessionary alarm bells.But even if this occurs, we do not believe we are in an ‘actual’ recession and do not believe that the official arbiter of recessions, the National Bureau of Economic Research (NBER), will declare the economy is in recession. Why? The main reason is that the two biggest contributors to economic growth—consumers and businesses—continue to spend and are additive to GDP. In addition to packed vacation venues this summer, just look at Amazon’s record Prime Day sales last week to see that consumers are still spending. Then what is detracting from growth? Well in 1Q, it was that our imports were far greater than our exports and that detracts from growth. But the reality is that if we are demanding overseas goods, that means that our demand is strong. If anything, it is an indication that other economies around the world are not doing as well as ours. For 2Q, the big drag on growth is expected to be a reduction in inventories. But how is that bad given that inventories are falling because we are buying those goods. It is also a payback from the significant build-up in inventories during last year that helped ‘super-size’ GDP results back then. The bottom line: even if the 2Q GDP is negative, it is premature to say the US economy is in a recession. Solid job growth, excess savings, and signs of still healthy consumer spending suggest the that the economy, while slowing, is not in a recession.

- Equity Market May Be On Pins & Needles Ahead Of The Fed Decision | After the worse than expected June inflation report (CPI: +9.1% YoY), all eyes will be on the Fed next week as it announces its next interest rate move. While the highest read on headline inflation in over 40 years initially caused the market to expect a full 1% increase, that has since simmered down over recent days. We’re in the camp that the Fed will raise interest rates 0.75% (from 1.75% to 2.50%), and that the market’s reaction will be dictated by the accompanying statement and Chairman Powell’s press conference as there are no updated economic projections or dot plot released at this meeting. After this July FOMC Meeting, the Fed will then have eight weeks before its next ‘official’ meeting (there is the Jackson Hole Symposium in August) on September 21 to digest the impact of its moves on the economy. It is in these weeks that we anticipate commodity prices and other inflationary indicators (e.g., transportation costs, discounting, wage pressures, chip lead times, etc.) to continue to rollover, and with inflation expectations already falling to the lowest level since July 2021, this hiatus could set the stage for a more patient Fed in the final months of the year.

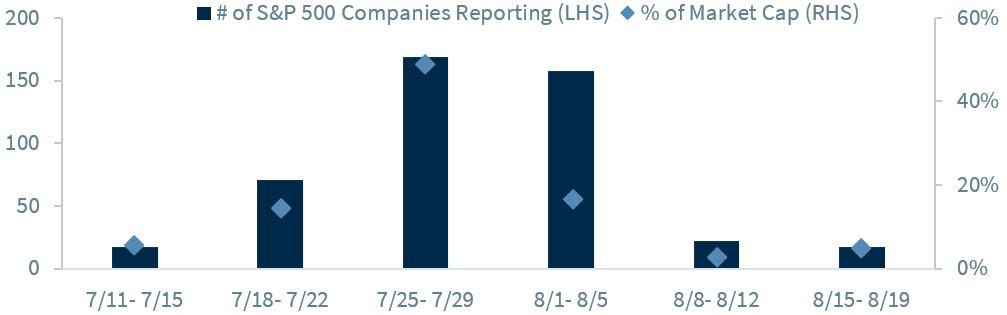

- Companies Are Not Hanging On By A Thread | Nearly 90 S&P 500 companies representing ~20% of the index’s market capitalization have already reported earnings, and it has admittedly been a lackluster start to the 2Q22 earnings season. Only 68% of companies have beaten their earnings estimates, well below the historical average of 77%, and the average magnitude of beats (+3.3%) is the lowest since 1Q20. However, the results have been better than feared, dampening the concerns that this quarter’s earnings and guidance would lead to significant downward revisions to earnings estimates. 2Q earnings and revenue growth have remained resilient at 6% and 11% respectively. Thus far, major banks have suggested consumer spending and borrowing remain healthy, transportation and delivery companies suggest healthy volumes, and healthcare providers continue to see robust activity—all signs reinforcing a better-than-feared earnings backdrop. Next week will be the biggest test yet for the markets as it will be the busiest week of the 2Q22 earnings season. Nearly 170 S&P 500 companies representing almost half of the index’s market capitalization are set to report. Our focus will be on the key sector constituents, such as Apple and Microsoft, which account for ~40% of the Tech sector’s earnings, and Alphabet, which accounts for ~37% of Communication Services earnings.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.