Calm the considerable uncertainty

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Wishful thinking, political gain, hidden agenda, strategic endorsements – there many reasons why stories are written and data is interpreted the way it is, sometimes intentionally and other times unwittingly by seeing what we want or wish to see. There are also sensible, logical and valid interpretations of data that lead to very different deductions and therefore genuinely dissimilar approaches to investing money. These differences explain why when there is a seller of one idea, there is a buyer of that same idea. The more plausible either of the sides of any disagreement, the potentially more volatile the markets may become.

With all the market data and information released in the past couple of weeks, one key takeaway is, that from experts to individuals, there continues to be uncertainty about the future. We can observe some of these varying opinions from very credible and highly regarded experts in the financial world. Inflation will dissipate… inflation is sticky and will linger. We are in a recession… there are too many signs of production in the economy. Supply chain issues are fading… we are far from solving supply issues. Money supply must shrink… modern monetary theory is viable. You get the idea. At the end of the day, there is one (almost) certainty in this mayhem? Volatility is highly likely to persist but it doesn’t mean decision-making needs to be complex. Fixed income is often about principal preservation, income and cash flow – it’s long term in nature. Focus remains firmly on long term fixed income strategies and current conditions are providing some of the best opportunities we’ve seen in decades.

The Job Market

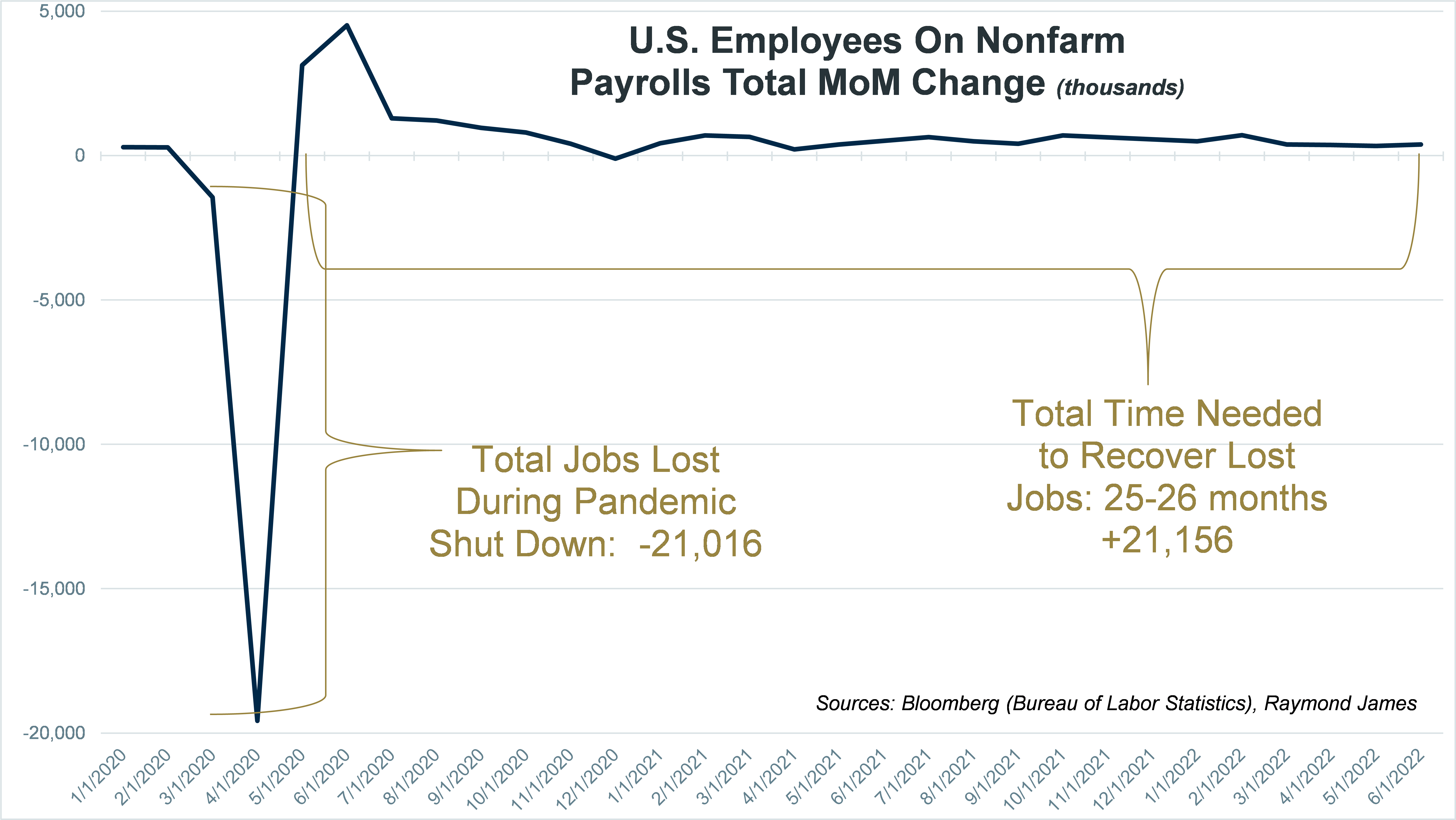

The job market is headline data and is being used as a basis for many arguments. We need to recognize that one event that put us in unchartered waters was the substantial business shutdown initiated by an unforeseen pandemic in 2020. In March through April 2020, 21 million jobs were lost. It took 25+ months to recoup (not create) these jobs.

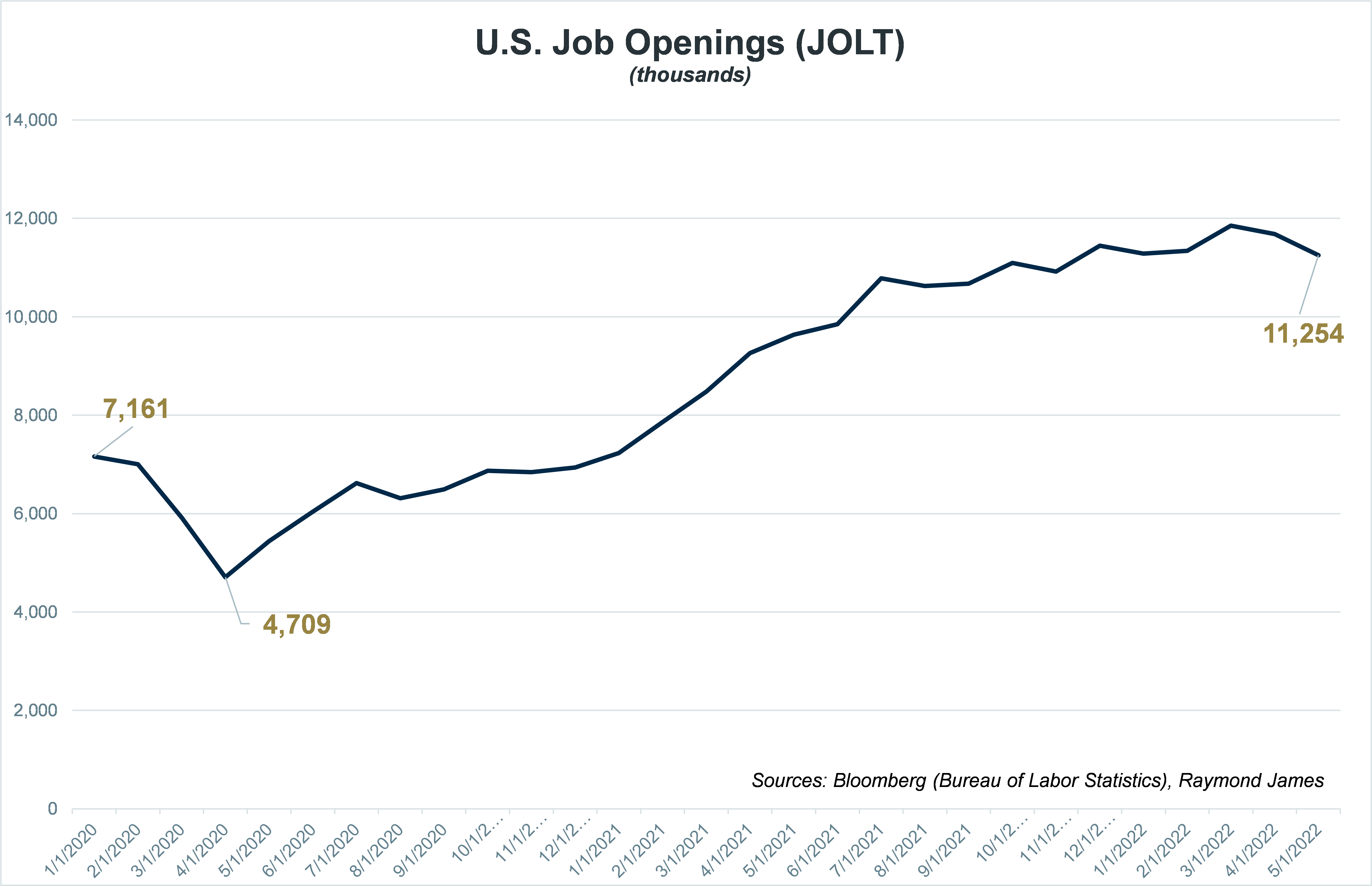

The JOLT index tracks the number of job openings in the economy, created or unoccupied positions where an employer is taking specific actions to fill these positions. In January 2020, there were 7.1 million such positions. The May 2022 release reflects 11.2 million or an increase of 4.1 million available jobs. This economic strength gives pause or outright rejection to the idea that we are in a recession for some pundits.

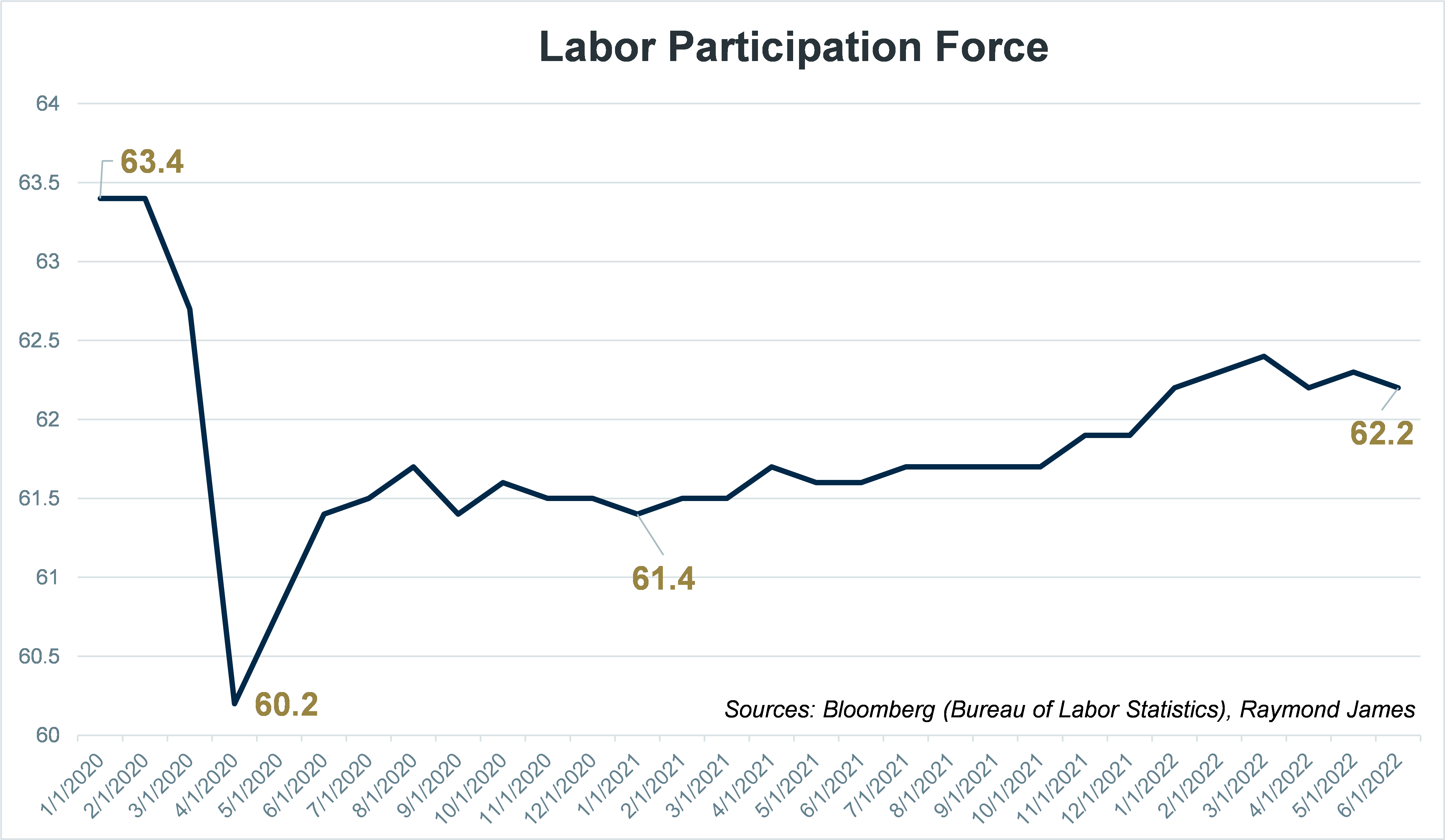

One last employment statistic looks at the 16+ year old civilian labor force in relation to the current population. Pre-pandemic, the labor participation force ratio was 63.4% and has dropped to June 2022’s 62.2%. In other words, the pool of available workers as a percent of the population to fill these open jobs has shrunk. Without getting too deep into the weeds, the participation rate relative to the changed population divulges that we have about the same number of people working today that we did in January 2020. Ideally, the workforce grows with job openings/creations, but this did not happen. The unemployment rate in January 2020 was 3.5%, very similar to today’s 3.6%. It has been suggested that the pandemic enticed many into working for themselves (sole proprietors do not show up in employment data) and still others into an earlier than anticipated retirement (removing them altogether as a labor participant). At the end of the day, some employers are struggling to fill open positions. This can contribute to inflation as employers up the ante to attract needed workers in what has developed as a limited employment pool.

It is appealing to think that raising the labor participation rate may provide the needed pool of workers employers are seeking. In addition, although it may or may not raise the unemployment rate (depending on if those seeking work actually fill some of the job openings), it may lessen inflationary pressure as jobs are filled and employer’s incentives are relaxed. The problem is that the Fed cannot control individuals in the labor force by either making them willing participants or dictating they fill open jobs.

Inflation

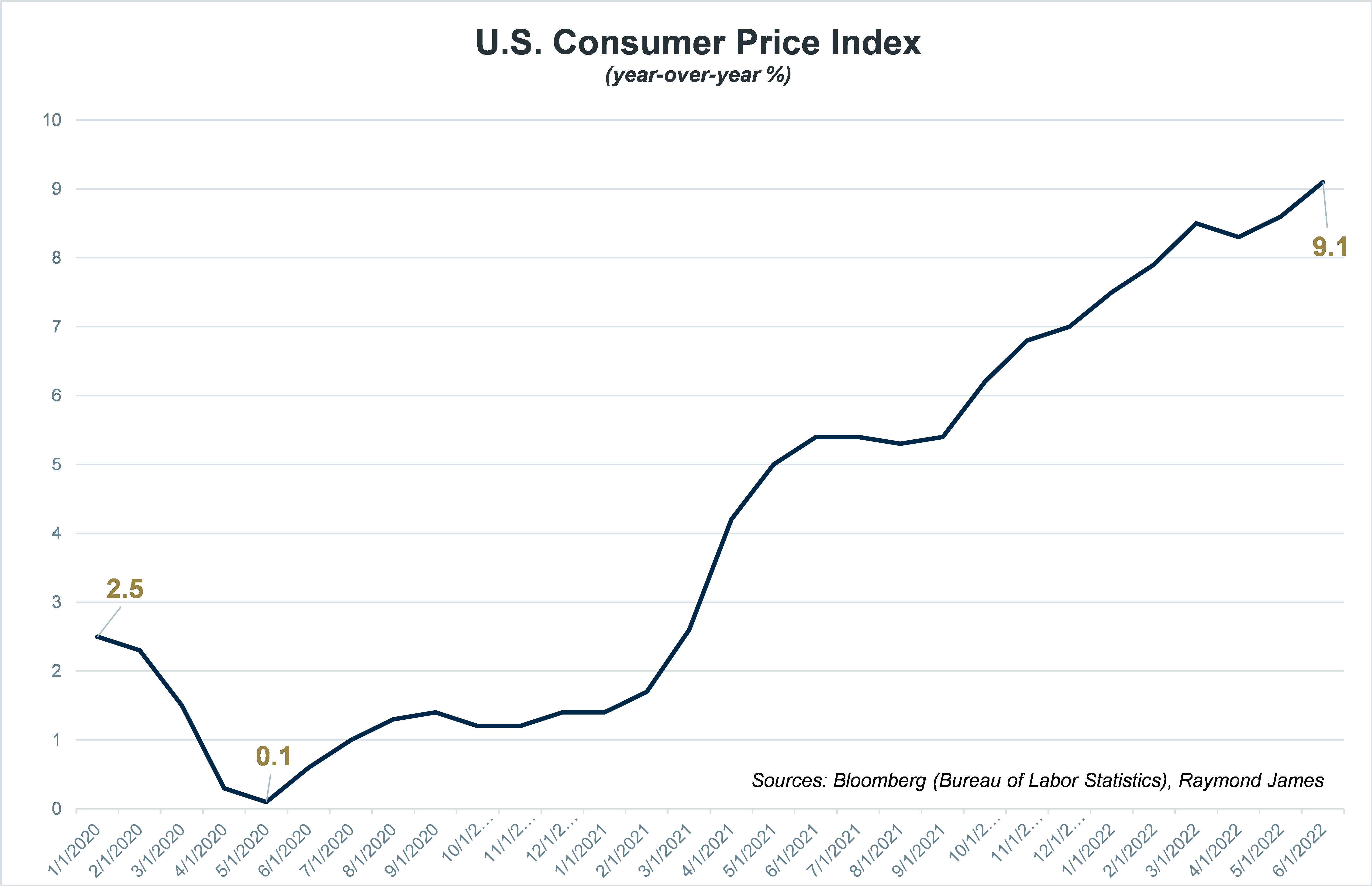

Let’s be clear that inflation affects all persons and all assets. It is easy to pinpoint the negative effects inflation has on fixed assets because we can see the math; however, inflation impacts every dollar spent on stocks, every dollar spent on a house, every dollar spent on food, etc. There is no place to hide from inflation so don’t be misled by catchphrases or slanted biases. Inflation, as it often is implied, does not take your wealth. It is a reduction of purchasing power that may slow/reduce certain purchases or the impact of your spending power. Eventually it can reduce your standard of living by preventing you from buying all desired/essential goods or services.

If the Fed continues to raise interest rates to combat inflation, the higher rates go, and the more unlikely consumers can continue to spend at a healthy pace. As goods and services get more expensive, purchasing power decreases and consumers must decide where they spend.

The Fed is in a dreadful position. Chairman Powell stated that the focus will be on getting inflation down. What if they can’t do this so easily? Will they continue to raise Fed Funds attempting to break inflation? Some of the market components contributing to high inflation are outside of the Fed’s control. For instance, wage labor costs are elevated to better compensate low wage earners. Now employers are raising wages to attract needed employees. The Fed has no control here. Higher wages eventually translates to higher prices on corresponding goods or services.

In addition, the Fed cannot hasten the reinstatement of the supply chain which collapsed due to the global pandemic shutdowns. Therefore the argument exists that the Fed is limited on how profoundly they can impact inflation. Regardless of the unemployment number, if the economy is slowing while inflation remains elevated, there exists the possibility for stagflation. Some would argue we are already there. If the Fed pushes rates high enough, they run the risk of slowing economic output and putting an end to any argument about whether the economy is in a recession.

Recession

Since the end of World War II, there has never historically been two consecutive quarters of reported negative Gross Domestic Product (GDP) where the National Bureau of Economic Research (NBER) hasn’t eventually announced a recession. Whether this occurs or not, it will not stop the argument. I implore you to not waste your energy proving or disproving a label and instead focus on a plan. Job creation is an actuality but inflation is also our current reality. It is in all our lives as we fill up our gas tanks, stock our refrigerators or book long-awaited vacations. No matter one’s level of wealth, no one wants to pay more for desired goods or services much less for necessities. Fed engagement is playing out. Economic data appears to be leaning to the negative. There is enough gray area to convince yourself into a biased confidence. The following chart highlights some the recent key economic data releases and I will leave interpretation open to the reader.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.