Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The shift from goods to service spending continues

- Tech capital expenditures remain healthy

- Energy capital expenditures will gain momentum

While the broad economy may be expanding, not all areas of the economy move at the same pace. This was true in the previous expansion from 2009-2020. Although it was the longest economic expansion on record, the economy experienced several ‘mini-cycles’ during its duration. Similarly, while we remain confident the US economy is not in recession, its growth is unbalanced. For example, weak inventories and net exports have muddied the economic landscape the last two quarters, but the consumer remains in good shape. With today being International Traffic Light Day, we found it fitting to highlight the areas in the current cycle that have ground to a halt ‘red light,’ exhibit caution ‘yellow light’ and remain robust ‘green light.’ While this is our current assessment, we continually monitor the different aspects of the economy because, like a traffic light, they can change very quickly.

Red Light | These are areas of the economy that have slowed over recent quarters.

- Housing | With mortgage rates rising to their highest level since 2008 and home prices appreciating 20% over the last year, housing affordability has plummeted. In fact, the average payment on a 30-year fixed mortgage is now $700 higher than it was a year ago. This has ground the housing market to a halt. The NAHB Housing Market Index, a survey that measures home builder and prospective buyer sentiment, has fallen to its lowest level (ex-COVID lockdowns) since 2015. Mortgage purchase applications have also declined to their lowest level (ex-COVID lockdowns) in over five years.

- Goods Spending | Inventories are one of the most volatile components of GDP and therefore can produce big swings in the quarterly stats. While inventory restocking was a huge tailwind for growth in 2021, it has been a big drag in the last two quarters. Consumers are still spending, but they have shifted their spending away from goods toward more service-oriented sectors, such as travel and entertainment. This has forced major retailers, such as Walmart and Target, to slash prices to reduce their bloated inventories. Finding the optimal level of inventory remains challenging in the post-pandemic era.

Yellow Light | These areas are still expanding, but caution is warranted.

- Tech Spending | When looking at tech investment in aggregate, it’s clear that it remains healthy as fixed investment in tech-related products rose at an annualized rate of 9.2% in 2Q, outpacing the broader fixed investment decline of 0.1%. This marks 16 out of the last 18 quarters that tech investment outperformed. Microsoft’s CEO made the point on their 2Q earnings call that “IT spending is going to increase because every business is fortifying itself with digital tech.” However, not all companies are faring as well. Some one-time pandemic beneficiaries (i.e., streaming, at-home services, etc.) have struggled to maintain visibility in their sales after bringing forward much of their sales. As a result, many have had to announce layoffs recently.

- Manufacturing | The shift from goods to services, weakness in the global economy and strength in the dollar (which makes our exports less attractive to overseas buyers) have all been significant headwinds for the manufacturing sector. This has led ISM Manufacturing to decline from 63.7 in March 2021 (the highest level since 1983) to just 52.8 this week. While the composite index remains in expansionary territory (a level above 50), further declines in the new orders and production sub-indices have us raising a yellow caution sign about the current state of domestic manufacturing demand.

Green Light | All systems are a go for these areas of the economy!

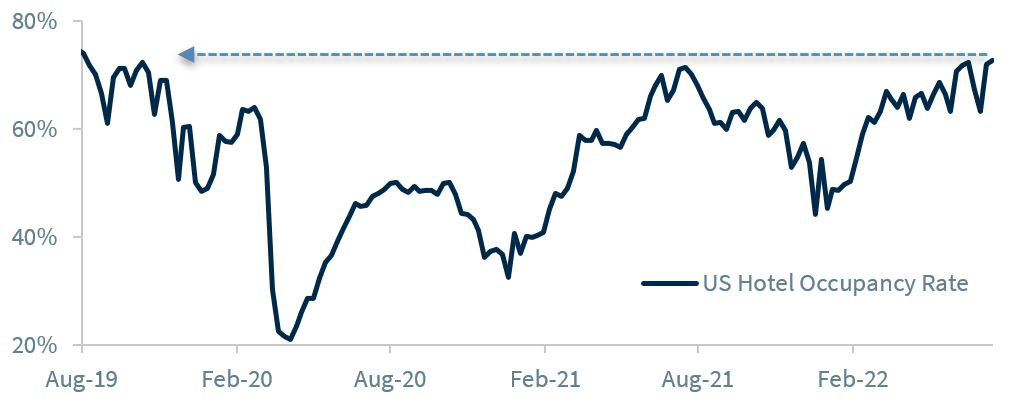

- Services Spending | After two years of social distancing measures, consumers are all in for the ‘the summer of revenge travel.’ While overall spending has slowed, consumers have shifted their spending to different things. Case in point, our real-time metrics show that airports are packed (TSA screenings are at a three-year high), hotels are fully booked (hotel occupancy at the highest level since August 2019) and restaurants (bookings are 2% above pre-COVID levels) are booming. In fact, Marriott’s CEO expects travel to remain strong throughout 3Q and Visa sees cross-border travel volumes back above 2019 levels.

- Energy Capex | The ongoing energy crisis and coincident sharp rise in crude oil prices (up ~30% YoY) has been a significant tailwind for the Energy sector. In fact, the Energy sector has seen its earnings increase 298% year-over-year, with some of the largest oil producers beating estimates by 10% (the most of any S&P 500 sector). We expect energy companies to expand their production further which should be supportive for capex going forward.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.