Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Job gains & wage growth support consumer spending

- Homebuyers & renters starting to see some relief

- Guidance from retailers will indicate consumer strength

Planes, trains, and automobiles! Terminals are packed, stations are crowded, and highways are congested as travelers embark on vacations before summer comes to an end. But while vacationers travel for pleasure, the summer journeys for the Fed, CEOs, and financial market pundits have been all business. The Fed has been navigating challenging inflationary waters, company leaders have been addressing turbulence in earnings and forward guidance, and of course—many economists and investors were all aboard the recession train. While we anticipated that the economy would not travel at high speed in perpetuity, we did not have tunnel vision on a recession. Our train of thought? The consumer, who accounts for ~70% of GDP, had not run out of steam. And now, there are a number of positive developments that confirm our view that it was too soon for that recession train to leave the station.

- Wage Gains Keep Spending From Getting Derailed | Inflationary pressures have led consumers to spend down the excess savings that were built up by unprecedented levels of fiscal stimulus. While some have utilized healthy levels of financing to complete purchases, we have long said that consistent job gains and wage growth were needed to uphold the consumer in the aggregate. Fortunately, that is exactly what the economy has gotten. The July jobs report surprised to the upside, with the economy adding more than half a million jobs and revisions sending the June report higher to almost 400,000 as well. And, given the shift in spending from goods to services, it is of little surprise that over 75% of July’s job gains were within the service-providing sectors. More people employed is already a positive for the economy, but the average paycheck is rising too! Real wage growth just rose 0.5% month-over-month—the fastest pace since December 2020 and the sixth largest monthly gain over the last ten years. More jobs and more earnings should support the crux of the economy—the consumer— in the months ahead.

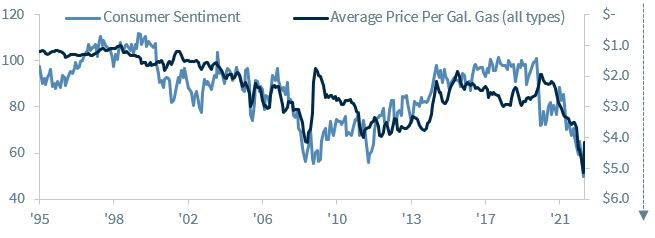

- Sentiment Getting Back On The Right Track | While a recession was not our base case earlier this summer, there were concerns about the possibility of a self-fulfilling prophecy recession as consumer, business, and investor sentiment plummeted. The preliminary July reading for Michigan Consumer Sentiment showed improvement, which we attribute to easing inflationary pressures, more specifically falling energy prices. The national average gasoline price per gallon price dropped ~15% in the month of July—the largest monthly decline since the pandemic. And the decline has continued into this month. In fact, the average price per gallon has fallen more than $1 over the last 58 consecutive days to return back below the key $4 level. Given the negative correlation between gas prices and consumer sentiment, sentiment should improve from here. While employment and wage growth make a consumer able to spend, confidence increases the consumer’s willingness to spend.

- Housing Market Brakes Were Screeching | While the impact of the Fed’s tighter policy has a lagged effect, one of the first areas of the economy to feel it was the housing market. Higher interest rates and economic concerns led to buyers having second thoughts, as nearly 60,000 home sales were cancelled in June. This equated to ~15% of transactions—the largest share of cancellations since April 2020. But now, the 30-year mortgage rate has fallen ~90 basis points from the recent peak and is back below 5% for the first time since early April. While this may not seem like a meaningful decline after years of lower interest rates, mortgage purchase applications have subsequently increased for two consecutive weeks and the principal and interest for an average 30-year fixed rate mortgage based on the median new home sales price is down ~$250 per month. But it is important to note that renters are finally seeing some relief too, as prices across the US and in popular cities (i.e., Miami, Tampa, and Phoenix) are starting to rollover. For months it seemed like the end of soaring shelter costs was nowhere in sight, but normalizing supply and demand levels in the housing market should be a positive for consumers moving forward.

- Retailers The Caboose Of Earnings Season | Next week, some of the largest retailers (e.g., Walmart, Target, Home Depot, Lowe’s) will report results as the 2Q22 earnings seasons comes to an unofficial end. Many of the big-box retailers have already pre-announced narrow profits, but we are more focused on forward guidance as these companies have had the luxury of experiencing almost half of the third quarter. Credit card data suggests that spending in the aggregate has increased due to the decline in gasoline prices, but these retailers will be able to provide specific comments on how easing pricing pressures, particularly at the pump, have impacted their customers. Many preannouncements noted an uptick in necessity spending at the detriment of discretionary items (e.g., electronics), but it is possible that the recent decline in gas prices has alleviated some of the consumer’s budget concerns.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.