Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Politics aren’t a key driver of the markets

- Volatility from a government shutdown is often short lived

- The Fed may end its streak of 75 basis points rate hikes

As we celebrate Veterans Day, we acknowledge and express our gratitude for the service and sacrifice made by the members of the U.S. Armed Forces and their families. Thank you for being always ready, always there! While nothing will rival defending our country, there were plenty of defensive operations and tactics impacting the markets this week. First, Democrats and Republicans had to defend their views in the midterm elections. Second, the October CPI report served as the latest update in the Fed’s fight against inflation.* With Election Day (almost) behind us and with potential for a less hawkish Fed, the S&P 500 is on pace for its best week since June. But how do these two market moving events impact our outlook for the economy and markets moving forward? Here are our insights.

- This We’ll Defend: Politics Aren’t A Key Driver Of The Markets | The polarization of our political environment naturally leads to debates over which composition of government the economy and equity market favor most. Given that the midterm elections just took place, it is easy for market participants to try to extrapolate what the election results will mean to market performance. But as we detailed in last week’s Weekly Headings, there are incidents of both strongly positive and negative economic and equity market performance amongst different periods of both unified and divided government. Why? Because fundamentals drive market performance, not the power structure of Washington D.C. In our view, the macroeconomic backdrop matters most when determining the trajectory of the equity market. Now, one may be thinking, isn’t government spending a critical component of growth? The short answer is yes, but it only accounts for ~17% of GDP—a far cry from the 40% that it contributed during the mid-1950s and far less than the ~70% contribution from consumer spending. Therefore, to figure out the strength of the economy, we start with the fundamentals of the consumer, which are driven by the health of the labor market, wage growth, and sentiment rather than who controls Congress. When assessing the equity market, in addition to the economy, we look to factors such as earnings growth, Fed policy, valuations, and corporate activity as they have greater predictive power than politics.Looking Ahead | The outcome of the midterm elections will not be confirmed until the results in Arizona, Nevada, and Georgia are known, but as it stands the Republicans are projected to have a slight majority in the House and the Democrats are projected to keep control of the Senate. If this projected result proves accurate, few major legislative items are likely to be passed. Therefore, perhaps the most impactful outcome could be an elevated risk of a government shutdown. The good news is that in most cases, downward equity volatility is often short-lived, with equities quickly rebounding. In fact, history shows that since 1976 (20 shutdowns) in the one year following a shutdown, the S&P 500 has been up ~13% on average and been positive 85% of the time.

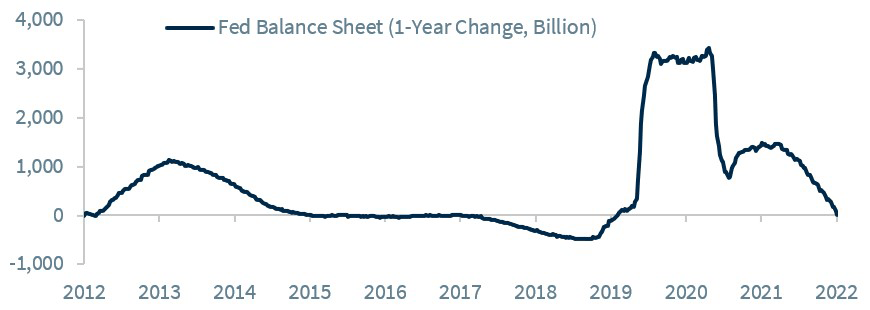

- The Fed Has Aimed High To Fight & Win Against Inflation | Outside of politics and the slow week for the 3Q22 earnings season, the key focus for investors was the release of the October Consumer Price Index report and its potential impact on the future trajectory of Fed policy. While inflation remains elevated from a historical perspective, headline CPI came in below expectations (+0.4% month-over-month versus +0.6%) and the year-over-year pace (+7.7%) decelerated to the slowest pace since January. This was encouraging not only for investors but also the Fed. As for what drove the cooler-than-expected report? We’ve highlighted in recent months that goods prices were likely to moderate due to the shift from goods to services spending and elevated inventory levels, and this came to fruition as core goods (ex-food and energy) posted their third largest monthly decline (-0.4%) in 15 years due to falling apparel and used vehicle prices. While shelter costs remain elevated, we cautioned that this component acts with a lag, and that the recent weakness in the housing market should weigh on shelter costs in 2023.Looking Ahead | This week, several regional Fed presidents made remarks that it “may soon be appropriate” to slow the pace of rate increases, and investors viewed this data release as support for the Fed easing (not reversing) the tightening cycle. While we’ve said before that one print does not make a pattern, other real-time data continuing to recede suggests that the inflation peak is behind us. Moderating inflation combined with quantitative tightening (the Fed’s balance sheet may soon turn negative on a year-over-year basis for the first time since December 2019) should allow the Fed to step down the pace of rate hikes from 75 basis points to 50 basis points at its next meeting. Even though Chairman Powell has expressed greater concern if the Fed were to do too little rather than too much, the data releases over the next 4-5 weeks (e.g., retail sales, jobs, housing data, November CPI) leading up to the December 13-14 FOMC meeting should permit the Fed to ease the pace of its tightening cycle.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.