Inflation decelerating as pricing pressures continue to cool

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Energy prices a critical component of CPI

- Higher prices may hamper the consumer’s ability to travel

- Mismatch between rental price beliefs and reality

In totality, the December CPI inflation report was another print supporting the global disinflation trend afoot. At the headline level, CPI decelerated on a month-over-month basis for the first time since May 2020 and the year-over-year pace (+6.5%) is now the slowest since October 2021. At the core level, while the still sticky shelter costs had the Index rise 0.3% month-over-month, the year-over-year pace (+5.7%) is now the slowest since December 2021. As for the market’s reaction? It was welcome news that inflation is trending in the right direction, but the results were relatively in line with expectations. Since the Fed’s future actions hinge on how quickly inflation eases, we’re revisiting our five-step timeline – insights we shared during the summer – to update how pricing pressures should continue to cool.

- Commodities | How many investors would have believed that oil prices would turn negative on a year-over-year basis? My guess – very few, especially if told this past summer when filling up at the pump was a rather painful experience. Either way, the decline in oil (37%) and gasoline (35%) prices from their peaks provided consumers with some much-needed relief and were significant catalysts for inflation easing from its June peak. Recently, natural gas prices, which declined nearly 50% in December due to warmer than expected temperatures, have helped headline inflation ease even more. Given that oil, gasoline, and natural gas combine for a 7% weighting in the CPI Index, declines in these prices are necessary for a sustained easing of inflation.

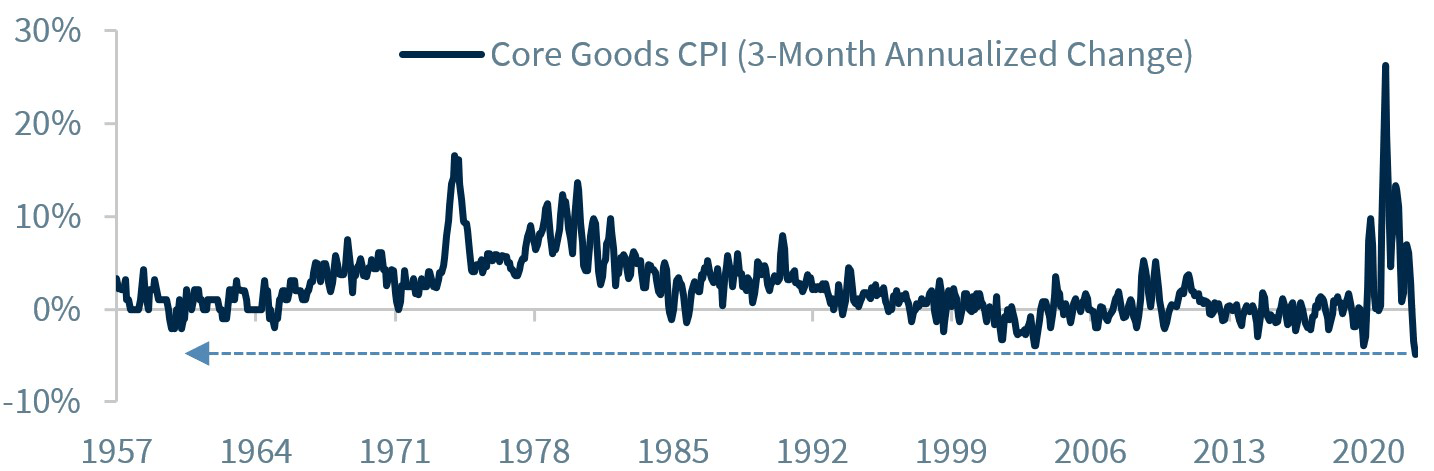

- Goods | Goods prices declined for the third consecutive month and are rising only 2.1% on a year-over-year basis – the slowest pace since March 2021. Even better, on a three-month annualized basis, prices are declining 4.8% – the sharpest decline on record. Throughout the pandemic and the early days of the reopening, retailers had pricing power and stimulus helped pull demand forward, especially for items related to the home (e.g., appliances). But as supply chains normalized, this power shifted, and consumers are eyeing the best discounts as retailers attempt to offload excess inventories as quickly as possible. Take durable goods for example. Inventories increased 18% over the last nine months, while sales were essentially flat. And it’s not just appliances, as easing prices for apparel, used and new vehicles, and computers are helping this subsectordecelerate.

- Services | Airlines are a critical services industry to monitor, as there is so much spending related to travel (e.g., hotels, restaurants). While airfares are still up over 28% on a year-over-year basis, they have declined for six of the last seven months and there is reason to believe they will ease in the near future. From a demand perspective, the days of ‘Revenge Travel’ are behind us – partly because some passengers are being priced out and partly because many of us have already checked the dream vacation off our bucket list. From a supply perspective, FAPA (Future and Active Pilot Advisors) has estimated that ~13,500 pilots were hired by the 12 major airlines in 2022 – more than double the record set in 2021. Ultimately, a diminishing desire or ability to travel combined with more flight availability should lead to an easing of prices in this critical services industry.

- Food | Despite CPI’s food inflation resisting a sharp move lower, the good news is that the UN Food Price Index has declined for nine consecutive months. In fact, the Index ended 2022 roughly where it started – hard to believe given the fallout from the Russia-Ukraine war and the severe weather conditions across key agricultural regions. From a ‘food at home’ perspective, there have been price improvements for select protein sources (e.g., pork and poultry prices have decelerated for three consecutive months). From a ‘food away from home’ perspective, many fast-food chains hosted their own deal days for the holidays—offering a cheeseburger for as low as $0.50! As supply and demand normalize, the pace of food price increases should slow and favorably impact grocery bills and restaurants receipts throughout the first half of this year.

- Rents | Shelter costs rose 0.8% in December—the steepest monthly increase since May 1985. However, given that rent prices typically lag the move in housing prices by approximately one year, the recent housing market weakness should be reflected in rents in the upcoming months. And there’s already evidence! First, 3Q and 4Q 2022 saw the weakest rental demand since 2013, with December posting the weakest leasing traffic in over a decade. Second, Zillow estimates that rents are rising at the slowest pace since June 2021, and Redfin forecasts that the YoY growth rate in rents is a third of what it was in December 2021.

Bottom Line – Easing Of Pricing Pressures | Inflation will continue to decelerate, and by our metrics, we are seeing a broad-based decline among most of its components. It appears that the downside momentum will continue as we progress throughout 2023. In fact, our economics team believes that headline CPI inflation, which peaked at 9.1% last June, will fall to ~2.2% by the end of the year. If that occurs, it will reduce the pressure on the Fed and allow it to conclude its tightening cycle by the end of the first quarter (with the Fed funds rate at ~5%) and remain on hold for the rest of the year.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.