Following up on our 10 Themes for 2023

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Three consecutive years of P/E contraction is unusual

- The multiple & earnings don’t bottom in tandem

- Final Fed rate hike supportive of multiple expansion

Last week, we released the rationale behind our Ten Themes for 2023 via webinar. While there were a few themes related to the equity market (e.g., reduced volatility, select sector and industry biases), our overarching theme was that corporate fundamentals would be more resilient than the consensus expects, resulting in upside from current levels. However, we have repetitively received two questions: How can you expect equity market upside (S&P 500 year-end target: 4,400) if earnings are set to decline this year? And, how can the current P/E (price to earnings) multiple expand? To address these thoughtful questions, we detail below five reasons why we believe the S&P 500 P/E multiple is likely to expand from current levels in the year ahead.

- Three Consecutive Years Of Contraction Unusual | Last year’s equity market decline marked the second consecutive year of P/E contraction. In fact, on an annual basis, the P/E has fallen 42% over that time span, marking the largest two-year contraction in nearly 50 years (far greater than even severe recessionary environments like 2007/2008). The good news is that three consecutive years of P/E contraction is atypical for the S&P 500, as it has occurred only one time over the last 30 years (1992-1994).

- The Multiple And Earnings Don’t Bottom In Tandem | Since a mild recession beginning in 2Q23 is our base case, it is important to understand the timing of when both earnings and the P/E multiple traditionally bottom. Earnings typically rise into the start of a recession, but then steadily decline in the one-year following, on average, as weakening economic activity hits corporate fundamentals. The P/E multiple does not mirror this path. Instead, the P/E multiple typically contracts into the start of a recession, bottoms shortly thereafter, and then rapidly expands despite earnings growth struggling. Why? The market is a forward-looking mechanism, so the P/E multiple starts to anticipate the downturn coming to an end and the eventual healthy rebound in earnings. If that holds, by around mid-year, the multiple could begin to expand and support an equity market rally.

- Lower Interest Rates Support Higher Multiples | As economic activity cools and inflation moderates, we anticipate the 10-year Treasury yield falling to 3% by year-end 2023. Historically, lower interest rates have led to higher P/E multiples, as lower rates push investors up the risk spectrum in search of greater returns. This inverse relationship between interest rates and P/E multiples is illustrated in the regression analysis in figure 5 on page 3. As the 10-year Treasury yield falls to ~3%, a multiple in the range of 20-21x is not only quite doable but happens to fall on the trend line (otherwise known as the line of ‘best fit’).

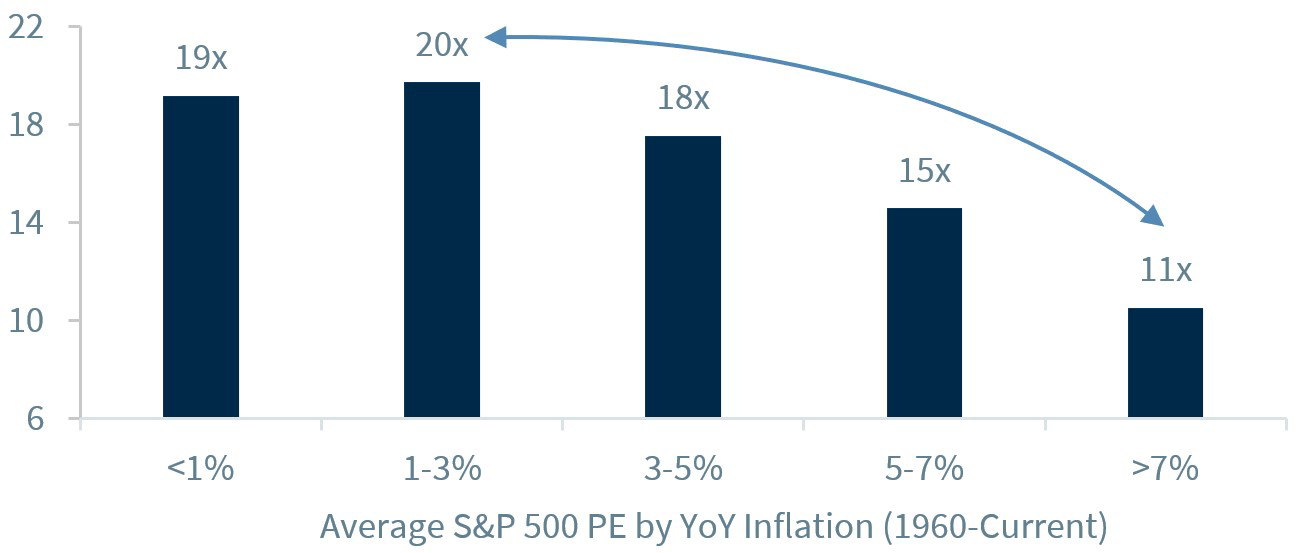

- Moderating Inflation Conducive To Multiple Expansion | Last week’s Weekly Headings publication took a deep dive into our expectation for the path of future inflation, and the breadth of evidence supporting easing pricing pressures in even some of the ‘stickier’ areas such as food and shelter by year end. As such, our forecast is that headline inflation will moderate to sub-3% on a year-over-year basis by year end. Now where does the P/E multiple historically stand with this level of inflation? Dating back to 1960, when year-over-year inflation has ranged between 1-3%, it has coincided with an average P/E of 20x. This is vastly different from the peak in inflation seen last year (+9.1%), as greater than 7% inflation has historically led to an average multiple of 11x.

- P/E Multiple Bottoms Near The Final Fed Rate Hike | Among the economy, interest rates, inflation, and sentiment, monetary policy is also one of the determining factors for the direction of equities. As the Federal Reserve (Fed) has embarked on its most aggressive tightening cycle since the 1980s, the equity market has become even more sensitive. But with inflation easing, the end of this tightening cycle is within sight. In fact, we forecast the Fed will only implement two additional interest rate hikes—with the last coming at the March FOMC Meeting. This timing of the final hike is important from a multiple perspective, as the multiple has historically bottomed coincident with the final Fed hike and then expanded 7-8% in the 12 months following, on average.

Bottom Line | 2022 was a challenging year for the equity market as a result of the second consecutive year of multiple compression. However, as we articulate above, history suggests that our view of mild recession ending by year end, moderating inflationary pressures, falling interest rates and a less aggressive Fed all suggest that the ‘bad news’ has been priced into the multiple and sets up the prospects for multiple expansion in 2023. While we do expect a modest decline in earnings in 2023 (from $220 to $215), our view that the multiple will expand from the current level of 17.5x to 20.5x supports our year-end S&P 500 target of 4,400.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.