How Russia’s war has shifted the geopolitical landscape

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

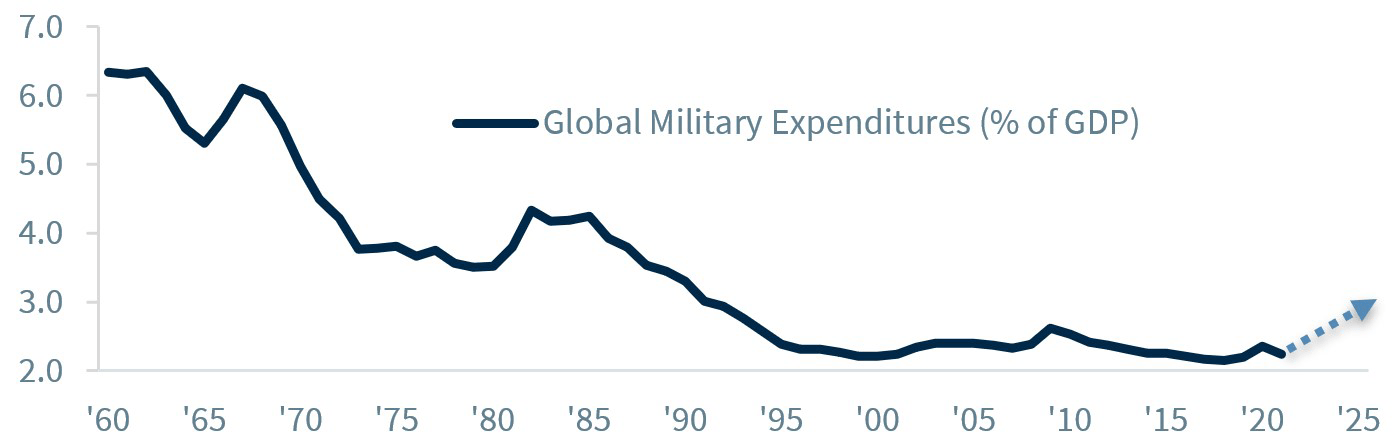

- National security concerns will drive defense budgets higher

- Shifting alliances pose a growing risk

- Food and energy security remain a top concern

Today marks the one-year anniversary of Russia’s war with Ukraine. Sadly, there is no end in sight to the conflict. Neither side has been willing to negotiate or make concessions. While Vladimir Putin hoped to secure a quick victory, Ukraine, with the help of its Western allies, has mounted a formidable defense. No one knows exactly what 2023 has in store. But what we do know is that Putin, despite Russia’s economy being crippled by an unprecedented number of sanctions, is adamant about winning the war he started. And Ukraine’s ability to defend itself remains dependent on its allies’ continued military and financial support. As we enter the next phase of the war, whether it ends in months or lingers for years, the geopolitical landscape has shifted. Here are five ways that Russia’s war has changed the world:

- The peace dividend is over | The collapse of the Soviet Union in the early 1990s ushered in a period of economic prosperity across the world. With the world no longer worried about Russia’s menacing, governments reduced their military budgets and diverted spending toward domestic priorities, such as health care, education or lowering taxes. Russia’s invasion of Ukraine is upending this ‘peace dividend.’ For the first time in decades, defense budgets, which had been cut to the bare minimum, are on the rise. The U.S. is leading the way with Congress authorizing $860 billion for national defense in fiscal year 2023. European governments have similarly ramped up their defense spending. The desire of nations to enhance their military preparedness and replenish the military equipment and artillery sent to Ukraine should continue to support the aerospace and defense industries.

- Shifting alliances | Putin underestimated the Western world’s reaction to the war he started against Ukraine. NATO countries have rallied behind Ukraine, providing the war-torn country with the financial and military aid it needs to defend itself. Even countries with a history of neutrality (i.e., Finland, Sweden and Switzerland) have pledged their support. More concerning, however, has been China’s deepening political, economic and military ties to Russia. With China becoming an increasingly important trade partner for Russia, the U.S. administration is rightfully concerned that China is providing assistance to Russia with its war efforts. If this persists, there is a risk it could elicit new China-focused rounds of sanctions. China must tread carefully as its still fragile economic recovery could falter if President Xi alienates its two biggest trading partners (e.g., U.S. and Europe). China is attempting to mend fences with the West by taking a more active role in negotiating an end to the war. With President Xi’s motives in question, this remains a critical risk to our emerging market equity preference that needs to be monitored.

- Food security remains a key concern | Russia and Ukraine are key agricultural players. Combined, they account for 30% of the world’s wheat production and are major producers of corn, sunflower oil and barley. Russia, and China, are also top exporters of fertilizer. Russia’s war with Ukraine led to food shortages and sky-rocketing prices around the world last year. While food commodity prices have retreated from their highs, multiple risks remain. For example, wheat prices are rising again as concerns about the upcoming spring planting season resurface and the renewal of the Black Sea Grain Deal (a deal Russia signed off on to allow agricultural exports) remains uncertain. Fertilizer shortages are also expected to continue in 2023. With food inflation a critical driver behind the aggressive monetary tightening last year, a resurgence in food prices could prolong what we believe is the final innings of the global tightening cycle.

- Energy security in a state of flux | Europe’s rapid shift away from its dependence on Russia for its energy needs has been a game changer. While Putin attempted to weaponize energy prices to his advantage, his miscalculation has been a major failure. Russia’s gas deliveries to Europe have plummeted to their lowest levels in years as European leaders adeptly replaced much of Russia’s lost supply through alternative sources. The mild winter and reduced energy consumption, which has fallen by almost 20% in the last six months, have also helped. The price of oil and natural gas in the U.S. are now below where they were at the start of the war, with oil down 20% and natural gas falling over 50% to a multi-year low. Even in Europe, natural gas prices are down over 60% since the war began and fortunately, 85% below their recent peak. The only thing helping Russia is selling oil at a significant discount to China and India, with Urals trading nearly $30 below crude oil prices. With global oil supply remaining steady and Russia selling oil below market prices, we reiterate that oil prices above $100/barrel remains unlikely.

- Russia is no longer investable | Putin’s unprovoked war has isolated Russia on the global stage. Over the last year, much of the Western world, and a growing list of companies, have either imposed sanctions, ceased operations or cut ties with Russia. While this has not deterred Putin’s aggressions against Ukraine as Russia’s economy has proven more resilient than expected, its economy will continue to struggle. Meanwhile, with Russia cut off from the world and the markets it is no longer investable.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.