Are you protected from market mayhem?

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Much is happening with the economy, policy, media and ultimately the markets. There are multiple angles to every story creating convoluted information evaluation. As emotions intensify, the recipe is set for impulsive and/or irrational behavior – market mayhem.

The Fed is the in vogue scapegoat. If they ignore inflation and allow it to run rampant, we all suffer. Most of us have felt inflationary pain in the grocery store or while filling our gas tanks and perhaps even more distressingly through the purchase of a house. The financial drag of run-away inflation spares no one. It is a safe bet that a passive Fed on inflation would raise discontent.

The unforeseen pandemic twisted supply chains during a rising labor cost environment. Inflation has flourished in a way most investors have not experienced in their lifetime. When the Fed fights inflation, especially as aggressively as they are, there is possible fallout that can be heightened when their actions are ignored. It can be argued that the Fed has been exceedingly transparent with their intent to raise short term interest rates even at the cost of creating unemployment and/or slowing the economy. Banks succeed by mismatching their assets and liabilities. Simplified, they pay depositors interest on short term funds while using this money to invest in longer term assets, thus making money on the spread. A rising interest rate curve presents a particular problem as the cost to liabilities (paying interest to depositors) goes up while the value of held assets declines. I’m not going to get deep into the weeds as it is discernably more complex, but this explains the basic level of bank risk. Banks understand (or should understand) interest rate risk and ordinarily hedge this interest rate risk. In the case of Silicon Valley Bank, they actually unwound much of their interest rate hedge over the first two quarters of the year. Is this a Fed issue or bank management issue?

Let’s face it. Many of us fly in the face of rational behavior hidden behind self-excused actions that will net us a bigger return. When interest rates are down, it is easy to set appropriate asset allocation aside in order to reach for yield. When yields are historically elevated, we sometimes believe we can outsmart and time the entry into the market. The main difference is that our actions or non-actions only affect us. This is no consolation though because on this account, selfish thinking is okay. We need to think about ourselves when investing and tune out the herd which isn’t always heading in the right direction.

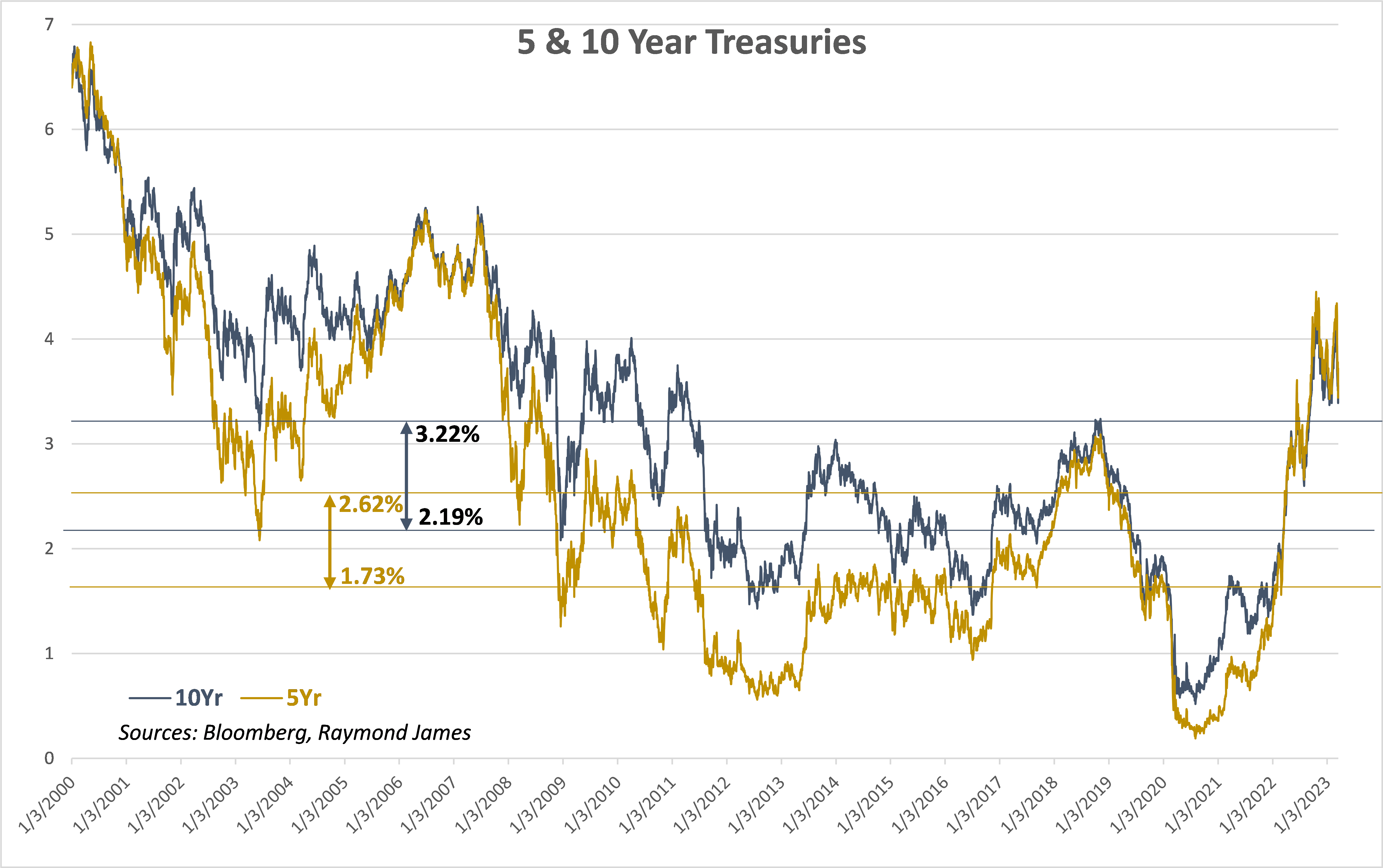

Appropriate allocation matters and I will preach this whether in a 1% or 10% interest rate environment. Growth assets such as equities, MLPs or real estate are necessary to grow wealth. Greater risks are united with potentially higher returns. On the complementary side, fixed income assets are important in protecting wealth usually accompanied with less volatility. Attractive income that supplements this purpose is a bonus. Our current rate environment has been providing attractive income. The graph below illustrates the 10-year Treasury yield (blue line) since the turn of the century. The top blue horizontal line depicts the average yield over that period (3.22%) while the bottom blue horizontal line depicts the average yield over the last 10 years (2.19%). The gold horizontal lines depict the same time line averages (2.62% and 1.73% respectively). The current yields on both the 10-year and 5-year Treasury bonds are well above these averages. Spread products like CDs, corporate and municipal bonds are spread higher to these levels, providing attractive yields to investors. Your Raymond James financial advisor can assist in demonstrating long term strategies based on your situation.

Stay rational. Maintain appropriate asset allocations with proper diversification. Diversification by maturity, sector, obligor, etc. further mitigates risk. Investing is a long term prospect. Don’t try to pick the day stocks will rally or the day when 10 year bonds might peak in interest rate. When appropriately allocated and invested for the long term, momentary volatility and market mayhem can be mitigated with strategic discipline. Recent history reflects that fixed income, despite recent mayhem, remains income friendly. Keep focused on your portfolio and your long term goals and if possible, avoid temptations arising during market mayhem.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.