Market and economic dynamics to keep an eye on

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The end of the Fed’s tightening cycle is near

- Tightening lending standards holds the key

- Banks Q1 earnings reports will be a key focus

It’s spring again – a season of hope and new beginnings. A season that brings more balance, sunshine and clarity into everyone’s lives. The start of a new season is also symbolic as it often marks the beginning of a new trend. And a new trend in the financial markets would be welcome after a tumultuous year that included an unprovoked war, an energy crisis, soaring inflation, the fastest global central bank tightening cycle in decades, poor market performance, and most recently, turmoil in the banking system. Uncertainty about the path forward remains elevated, but there is hope that brighter days lie ahead. While markets will remain volatile to the daily dose of news headlines, the coming weeks should provide some clarity, hopefully positive, on the economic outlook and investment landscape. Below is a summary of dynamics we’re watching:

- The Fed presses ahead with a ‘dovish’ 25 basis point hike | Fed Chair Powell attempted to carefully thread the needle during the press conference, reiterating the Fed’s commitment to restoring price stability, while reassuring the public that the banking system remains safe and sound. Although the Fed hiked rates by 25 basis points to a target range of 4.75% – 5.0%, there were hints that its tightening campaign may be coming to an end. This was evident in the forward-looking statement, which dropped the reference to “ongoing increases will be appropriate.” Faced with considerable uncertainty around the banking crisis, the Fed opted not to make meaningful adjustments to its updated set of projections. Policymakers penciled in slightly weaker growth (+0.4% in 2023 and +1.2% in 2024), modestly higher core PCE inflation (+3.3% in 2023 and +2.6% in 2024) and minimal changes to the unemployment rate (4.5% in 2023 and 4.6% in 2024). The peak fed funds rate was left unchanged at 5.1% in 2023 but moved lower to 4.3% in 2024. While Powell stated that rate cuts are unlikely in the near term, the bond market is again pricing in substantial rate cuts.

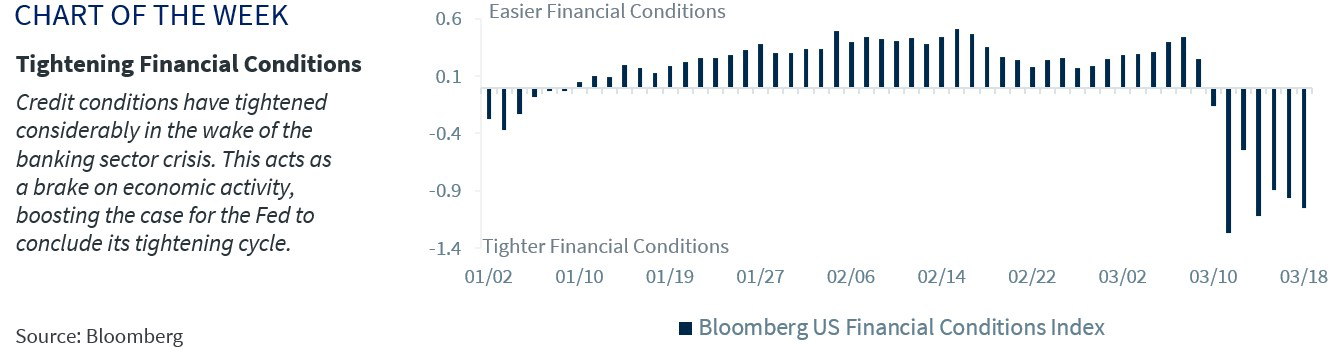

- Economic fallout from the banking turmoil | The Fed and federal regulators have taken decisive steps to shore up confidence by easing liquidity challenges at select banks and stabilizing the banking sector. Banks use of the Fed’s liquidity facilities indicated that the funding stress surpassed 2008 crisis levels. It is too early to say whether the current banking turmoil will have a lasting impact on the economy; that depends on depositor confidence (i.e., no bank runs) and the extent banks turn more cautious on lending. Tighter lending standards would mean less access to business, consumer and real estate development loans. There has already been some evidence of tightening financial conditions, which influenced the Fed’s rate decision this week. Powell acknowledged at his press conference that tighter lending conditions have acted as a rate hike, thereby offsetting the need for the Fed to push rates even higher. This reinforced the market’s view that the Fed is nearing the end of its tightening cycle, good news for risk assets provided the economic fallout is limited to the mild recession our economist expects.

- Geopolitical environment remains unsettled | While the world was focused the banking sector crisis, President Xi travelled to Moscow for a three-day trip to discuss China’s flourishing economic partnership with Russia (China’s imports from Russia have nearly tripled over the last three years) and mediate a potential end to the war in Ukraine. The meeting did not yield any concrete progress on a peace proposal, however Xi’s strengthening ties with Russia were on full display. Xi’s meeting with Putin only adds to the US administration’s growing concerns about China, particularly after the spy balloon event and the concerns about sending semiconductor supplies and possibly arm sales to Russia. We continue to monitor these geopolitical dynamics given our favorable outlook for EM Asian equities, particularly if the US administration decides to sanction China or take a harder stance on trade.

- First quarter earnings season | First quarter earnings estimates have fallen over 5% since the start of the year. This decrease is larger than the five-year average of -2.7%. Earnings declines are expected to bottom in the second quarter and rebound into year end. We’ll get our first glimpse into the challenges facing the banking system when Q1 earnings season begins in a few weeks. Banks are among the first to report, and we’ll be watching for any real time insights on deposit flows, customer deposit concentration, loan loss provisions, and unrealized losses on securities that might shed some insights on the depth and extent of the current crisis.

- Temporary extension of Black Sea grain deal secured | Russia agreed to a 60-day extension of the grain deal that was brokered by the UN and Turkey last summer. This deal allows Ukraine, one of the world’s most important suppliers of grains, to transport food through the Black Sea. Russia’s blockades of Ukraine’s ports were a key factor driving food prices higher last summer. While the deal is temporary, it should alleviate near-term concerns about global food shortages and a reacceleration in food prices.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.