Should You Wait?

Markets are expecting the FOMC to raise the Fed Funds rate one or two more times (25 basis points each) in this cycle. While this is a market estimate and in no way guaranteed, let’s just pretend for a minute that there is a 100% chance of this coming true and the FOMC is going to raise the Fed Funds rate by an additional 50 basis points. If you have money to invest in fixed income, should you hold off on investing until the FOMC acts so that you can purchase bonds at higher yields?

There are a few things to consider when answering this question. First, when the FOMC raises “rates,” they are raising the Fed Funds rate. The Fed Funds rate is an overnight lending rate. This means that the effects of an FOMC move influence the short end of the curve; however, effects may be and often are diminished the farther you extend out on the curve. Many buy-and-hold fixed income investors purchase intermediate and long-maturity bonds to align with their long-term strategy. This part of the curve and corresponding rates are not necessarily impacted in parallel fashion by Fed hikes. While market volatility can track Fed policy, a rate hike will not always result in intermediate and long-term rate increases.

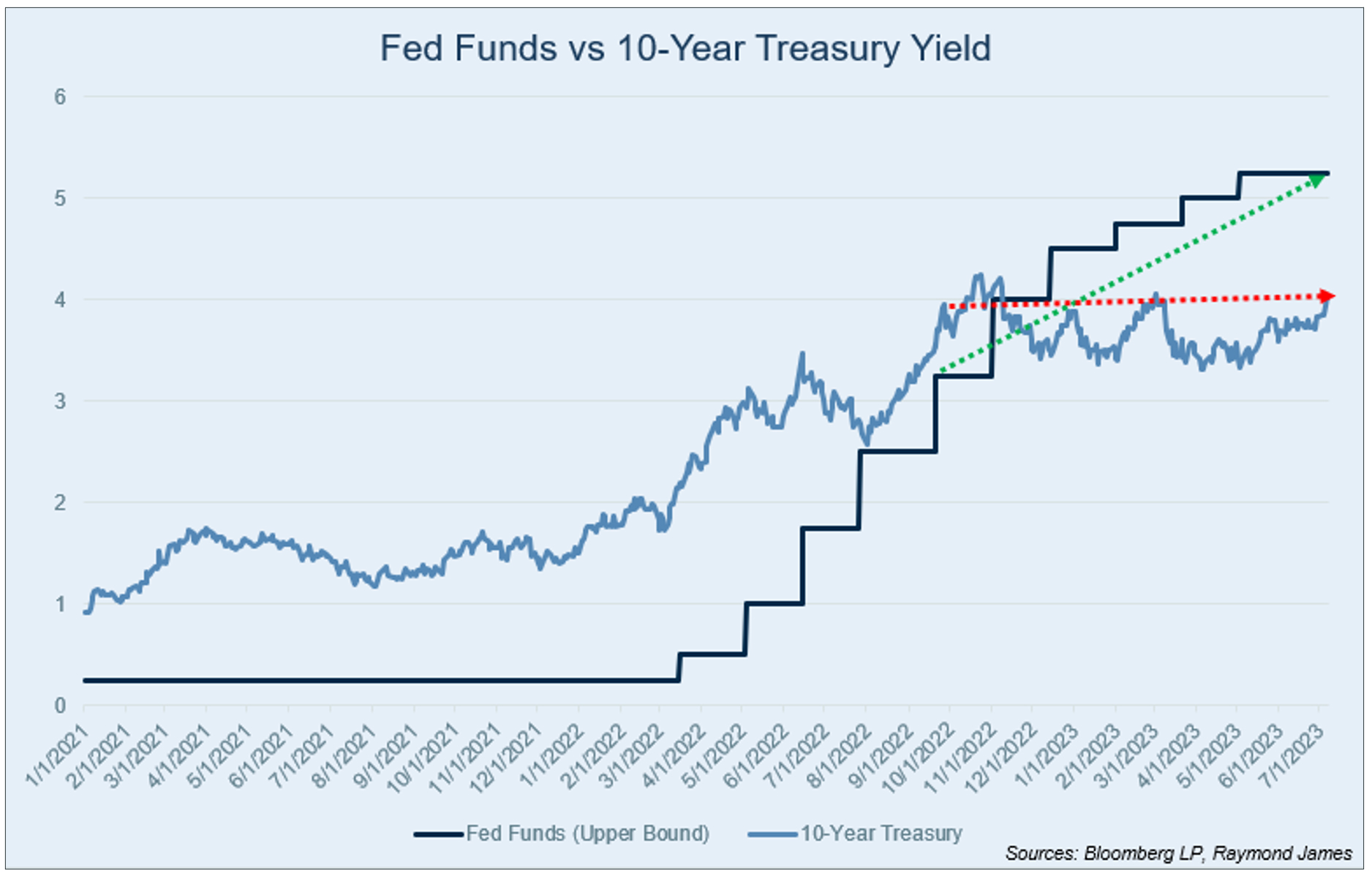

The chart below highlights previous FOMC rate hikes and compares the movement of Fed Funds versus the 10-year Treasury. Since last September, the Fed Funds rate has been raised 200 basis points. Over that same timeframe, the 10-year Treasury has essentially gone unchanged. Investors considering waiting to invest in fixed income until the FOMC acts one to two more times should consider the recent trend. Longer term rates tend to take their direction from longer term macroeconomic outlooks and trends. So while they can sometimes move in the same direction as short-term yields, they often don’t.

Yields across most sectors of the fixed income landscape are near their highest levels over the past 10-15 years. Locking in the attractive yields that are currently offered and locking in for longer can benefit investors. Waiting or hoping for yields to inch just a bit higher before investing could backfire should market sentiment, trends or economic data push rates lower. Take advantage now of the market opportunity to lock in income for longer.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.