Investment-grade municipal income in intermediate to long maturities

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

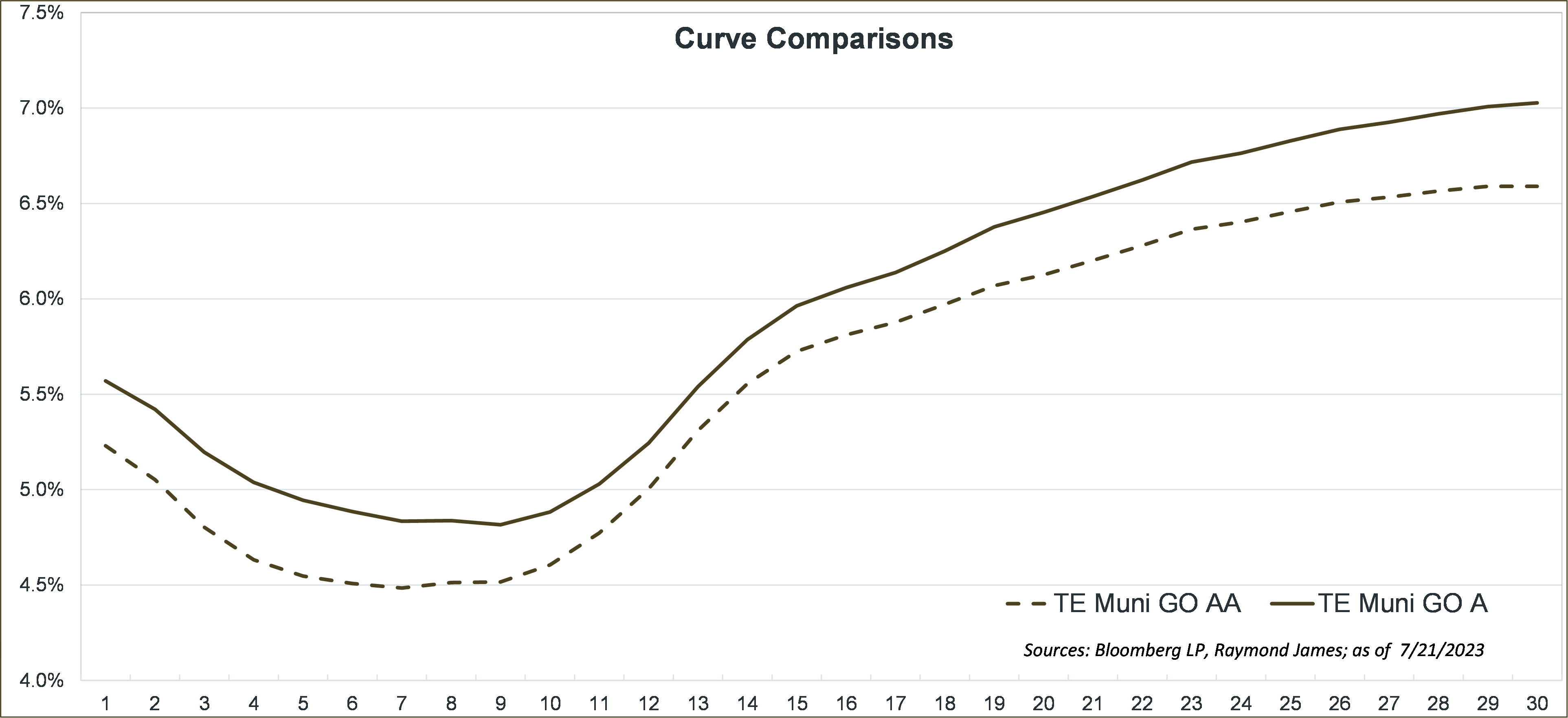

Last week I talked about the income opportunity in short to intermediate investment-grade corporate bonds. This Monday, I want to talk about the income opportunity obtainable in the intermediate to long end of the curve. Although the Treasury yield curve remains inverted (short term Treasuries have higher yields than long term Treasuries), and the corporate curve, albeit elevated, is very flat, the municipal curve, from about 9-years and out is upward sloping.

This means that municipal bond investors are rewarded with more income as they take more interest rate risk by extending out on the curve. This may be appealing while rates reach levels not seen in nearly fifteen years. Although the primary purpose of municipal bonds is often to protect a portfolio’s principal, the market now allows investors to add attractive income and for an extended period. Put this in perspective. The average annual total return of the S&P 500 index since the turn of the century (23+ years) is 6.91%. Compare that for a municipal investor reaping tax-equivalent yields from 5% to more than 7% depending on the tax bracket, maturity and municipal bond structure.

High quality investment grade municipal bonds provide growth-like returns for investors in a relatively more conservative investment vehicle than equities. Have your financial advisor assess the opportunity as it pertains to your specific goals.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.