Remember these investing concepts when planning your future

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Start saving for your retirement early

- Staying the course will lead to better outcomes

- Be mindful of age-appropriate asset allocations

Happy National 401(k) Day! Did you even know there was a day dedicated to celebrating saving for retirement? Well now you do! And that’s a good thing because it is a very important topic – one that needs to stay top of mind for everyone. When you step back and think about it, it is hard to believe that this hugely important retirement benefit has only been around for just over 40 years. More important, the legislation that created tax-deferred retirement plans (and some stellar market returns) has allowed U.S. households to accumulate significant retirement nest eggs. In fact, at the end of 2022, employer-sponsored retirement plans had amassed nearly $9 trillion in assets according to the Investment Company Institute’s Fact Book. That surely is something worth celebrating! And while market volatility over the last few years may have shaken some participants’ confidence, there are four important investing concepts to remember when it comes to planning for your future.

-

-

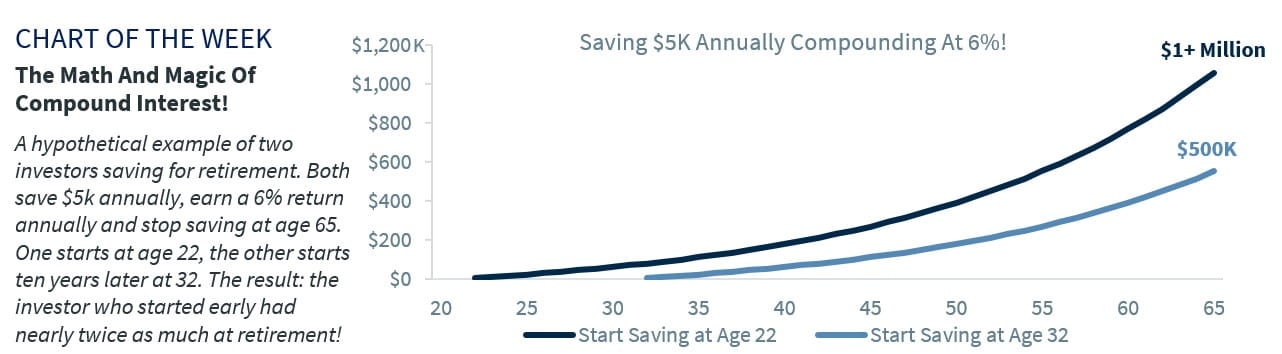

- Start building your nest egg early | I can’t emphasize this enough, the sooner you start saving for retirement, the more time you have to accumulate wealth. Sure, it’s easy in this inflationary environment to worry that you may not have enough funds to make ends meet. But, even if you start small and then gradually increase your contributions over time, your nest egg in the future will likely be greater. Why? Well, for all my fellow math geeks – it’s the power of compounding! The more time your money has to grow, the higher the potential it will be bigger in the future. For example: A 22-year old who starts saving $5,000 a year and earns 6% annually on his/her investments would have accumulated over $1 million by the time he/she is 65. That’s nearly double what one would earn if they started saving at age 32. It’s math, not magic! And trust me, you will start to feel better about the prospects of your retirement lifestyle when you implement this practice.

- Stay invested | During periods of extreme volatility, it’s natural to want to pull out of the market and seek shelter in the safety of cash. And let’s face it, the market has endured two significant bear markets over the last fifteen years that surely tested the most stalwart investors. But having an emotional reaction during these heightened periods of stress often does more harm than good. Timing the market is notoriously difficult. For example, over the last twenty years, the average price return of the S&P 500 is 7.6%. But, if you tried to time the market and missed just the ten best performance days (which are usually clustered around the worst performance days), your return drops to 3.5%. And, if you missed the twenty best days in the market, your return would have been a paltry 0.9%! As you can see, staying the course is a much better strategy that tends to lead to a better retirement outcome. At a minimum, assuming you are buying systematically throughout the year, when the market is down, you are opportunistically buying your additional investments at a better price!

- Follow age-appropriate allocations | Having the proper asset allocation that matches your risk tolerance and time horizon is essential. While the financial media often discusses asset allocation in terms of the traditional 60% stocks/40% bonds portfolio mix, investors should always take their age into consideration (among other things) when deciding the appropriate asset allocation mix. Those who are starting out early and have multiple decades to retirement generally have more tolerance for risk and therefore should be more heavily weighted to growth assets, such as equities, as they typically provide larger returns for investors over long-term periods. But, as investors get closer to retirement, it is generally prudent to dial back portfolio risk and have a greater allocation to conservative investments, like bonds. To be sure, last year’s market rout was painful for investors – regardless of their age or asset allocation mix. However, for investors who stayed the course with their strategy, the silver lining is that equities have rebounded strongly this year out of bear market territory, and despite the historic drawdown in bonds last year, they are now providing a healthy income stream again for the first time in over a decade.

- Take advantage of the tax-deferred benefit | Tax deferral is a powerful financial tool that can help investors compound their wealth overtime. Setting aside part of your income in a retirement plan will not only lower your current tax obligation, it will also help save on taxes over the long run. Why? Because 401(k) investments are able to grow tax-free! First, because you don’t pay taxes on your initial contributions, you get the full benefit of your contribution from the start. Second, you do not pay taxes on interest or dividends received or capital gains incurred as long as your investments remain in your retirement plan. The reduced tax burden enhances compounding! And when you withdraw funds at retirement, you will pay taxes – hopefully at a lower rate!

-

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.