Hopes bolstered for Fed’s soft landing, but watch building headwinds

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Headwinds are building for the consumer

- High borrowing rates are reaching a pain point

- Labor market strength is waning

This weekend marks the arrival of fall! The turning point in the year where the days grow shorter, nights get longer, and nature prepares for the changing season. What’s not to love about fall? A season that brings cooler temperatures, apple picking, pumpkin patches, fall festivals and football! Let’s not forget the breathtaking fall foliage—where the green leaves on the summer trees fade into brilliant shades of red, yellow and orange ahead of winter. And just as the fall season marks a turning point in nature, the economic cycle is reaching its own inflection point as we head into the final quarter of the year. While stronger than expected growth has bolstered hopes that the Federal Reserve (Fed) can achieve a soft, non-recessionary-landing, we still think a mild recession is the more likely outcome. Here are four looming threats that could tip the economy into a recession that we are keeping an eye on:

- Labor Market Strength Is Waning | The resilience of the labor market has been a key factor behind the recent strength of the U.S. economy. In fact, the economy has added four million more jobs than it lost during the pandemic. And with more people working and wages up 4.3% Y/Y, it’s not surprising that consumer spending has been so strong. However, the labor market’s strength is finally starting to wane. First, the pace of job growth has slowed considerably, with the three-month moving average falling to its lowest level since 2019. Second, job openings are starting to fade, down over three million from the recent peak. Third, consumer expectations of the labor market are moderating, with the % of consumers stating that jobs are “hard to get” climbing to its highest level since April 2021. Lastly, while Amazon announced an increase in seasonal hiring relative to 2022, a recent report from Challenger, Gray and Christmas reflected that retailers are expected to hire the lowest number of seasonal workers since 2008. As a result, our economist expects hiring to continue to slow and job growth to turn negative by January of 2024.

- Headwinds Are Building For The Consumer | Consumer spending, which makes up nearly 70% of GDP, is the single most important driver of the U.S. economy. With the strong labor market, solid wage gains and pandemic stimulus at their back, consumers have powered through the Fed’s aggressive rate hikes and higher borrowing costs. However, there are a few reasons why we expect things to change. For starters, the labor market is softening. Second, excess savings from the pandemic are fully depleted so consumers no longer have a cushion to support their spending. Third, with student loan payments set to resume on October 1 (likely to subtract 0.4% from consumer spending in ’24) and gas prices rising as oil prices move higher (from ~$68/bbl to ~$90/bbl), consumers should have less discretionary income to spend going forward. This has already started to spill over into weaker travel demand (i.e., fewer TSA screenings, subdued hotel occupancy and lower theme park/Broadway attendance). And with the headwinds building, a recent Gartner survey flagged that the upcoming holiday shopping season could be weaker than previous years, with only 9% of consumers expected to spend more this season.

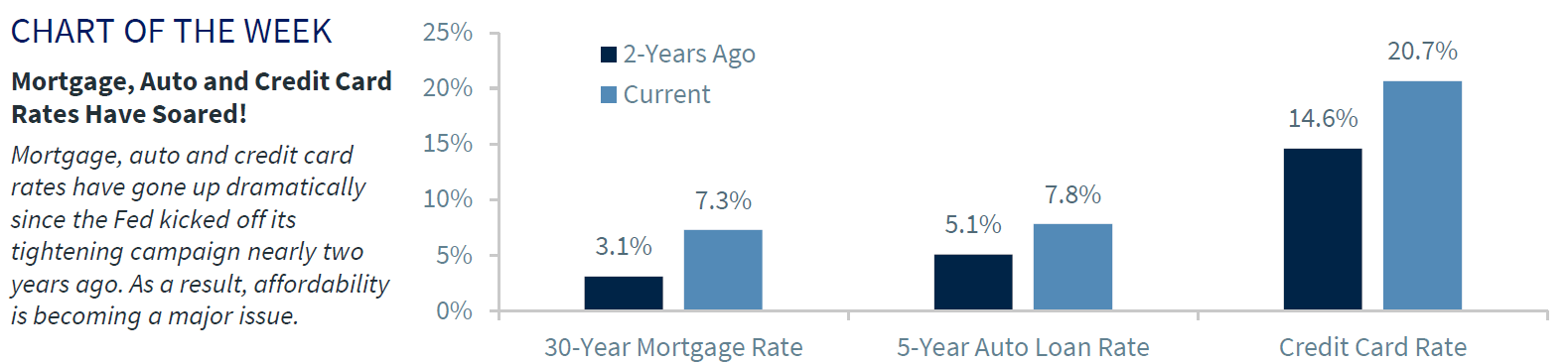

- High Borrowing Rates Are Reaching A Pain Point | While economic growth, in aggregate, has not materially slowed, the Fed’s 525 bps of rate hikes is impacting the economy. With mortgage, auto and credit card rates at multi-year highs, demand for loans from households has fallen dramatically. Banks are not only less willing to lend; the cost of borrowing has become prohibitive. For example, the average monthly payment on mortgages and auto loans is up over 70% since 2019! And with mortgage rates now well above 7.0% and house prices still elevated due to the inventory shortages, affordability is becoming a serious dilemma. While housing appeared to be stabilizing over the last few months, the recent plunge in housing starts (to a three-year low), drop in home builder sentiment (to a five-month low), and sharp decline in prospective buyer traffic (to its lowest level since February) point to further weakness ahead. And with buyers more likely to postpone their home purchases and existing homeowners frozen in their homes, the multiplier effect from housing related spending is likely to dry up.

- Rising Probability Of A Government Shutdown | While our Washington Policy analyst believes there is a path to a resolution to avoid a government shutdown ahead of the looming September 30 deadline, the rhetoric out of Washington suggests otherwise. Now of course, this could be part of the noise that naturally occurs around the process of passing government funding bills, particularly with Congress’ history of waiting until the last minute to pass legislation. And perhaps we should take comfort knowing that the market has historically looked through past government shutdowns as they are usually resolved quickly with minimal market or economic impact. But what worries us this time around is the timing. In isolation, past government shutdowns have not been a major market moving event. However, if there is a government shutdown, at a time when growth headwinds are building and strike activity (e.g., United Auto Workers) is on the rise, the collective impact of all these forces could be more potent than what is expected.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.