Has the Fed’s tightening cycle reached the finish line?

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Economic growth will slow in the coming quarters

- Labor market strength is easing

- Disinflationary trend remains intact

Happy National Cliché Day! Who knew there was a day dedicated to celebrate the often vague (although sometimes useful) and frequently annoying catchphrases and buzzwords that have become part of everyday life? There are literally thousands of clichés that have infiltrated our media, popular culture and exist across all industries. And there is no shortage of these well-known expressions in the investing world. Our long-time readers know that we pride ourselves on going beyond these buzzwords when explaining our directional views on the financial markets and the economy. But one well-known financial market cliché that is apropos right now is “Don’t fight the Fed” – suggesting it is unwise to position against the direction of monetary policy. While Chairman Powell wants to keep open the possibility of another rate hike, below are three reasons we think the Fed is done with its tightening cycle:

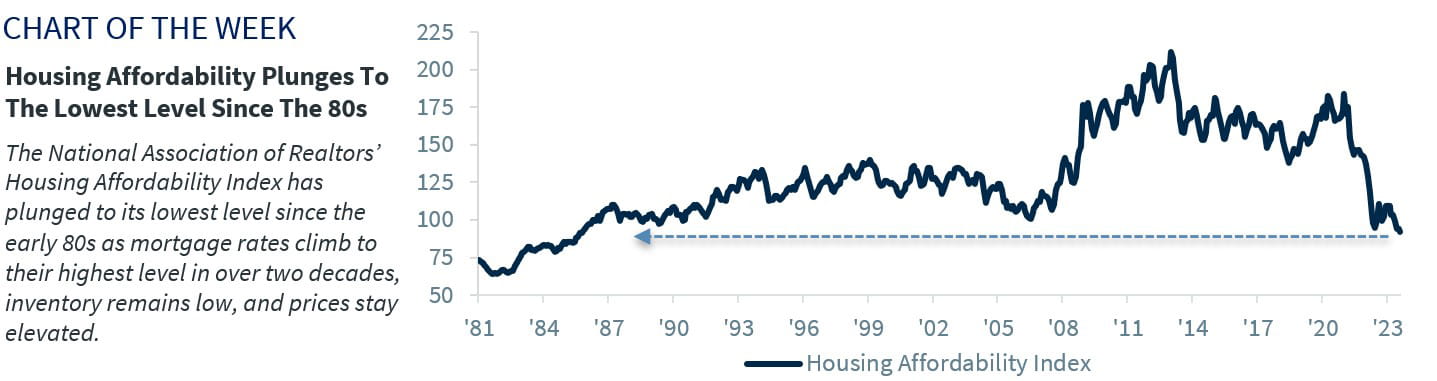

- Economic growth will slow in the coming quarters | While 3Q23 growth showed the economy expanded at a 4.9% annualized rate, it is important to remember that the GDP report is backward looking. From our vantage point, many real-time indicators we follow suggest that economic growth is decelerating, and tighter financial conditions will only exacerbate this trend. Why? First, manufacturing activity remains sluggish. This week’s ISM Manufacturing Survey reported that activity remained in contractionary territory for the 12th straight month, falling to its fourth lowest level (ex-COVID) since 2009. Second, consumer confidence fell for the third straight month to its lowest level since April. This downbeat sentiment is likely to spill over into consumer spending, with the National Retail Federation expecting holiday spending to rise 3-4% – its slowest pace in five years. Third, elevated interest rates are hampering the interest rate sensitive sectors of the economy. Housing affordability is at the lowest level since the early 1980s, existing home sales have slowed to the weakest level since 2010 and loan demand is likely to fall for the fifth consecutive quarter in next week’s Senior Loan Officer Survey. As a result, we expect the economy to enter a mild recession in 1Q24.

- Labor market strength is easing | The labor market has remained resilient in the wake of the Fed’s aggressive rate hikes. In fact, while job growth slowed in October (+150k), the U.S. economy had added an average ~200k jobs/per month over the last three months and job openings remained elevated. However, there are cracks forming that signal weakness ahead. First, the employment subsector within ISM Manufacturing report declined into contraction territory for the third time in four months as commentary within the report suggested that businesses are having an easier time finding prospective employees. Second, while initial jobless claims hovered near cyclical lows, continuing claims have risen to a six-month high, and the duration of those unemployed is climbing, suggesting that it is taking longer to find jobs. Third, the percentage of consumers that viewed jobs as “plentiful” declined to the lowest level since March 2021. The slowdown in hiring should continue, with job growth turning negative in 1Q24. The cooling labor market should keep the Fed from tightening further.

- Disinflationary trend remains intact | Inflation has eased considerably from its peak last year. While it’s trending in the right direction, Fed policymakers are not ready to claim victory given ‘core’ inflation remains above their 2.0% target. The recent uptick in energy prices may slow the trend, but the disinflationary trend is likely to continue. Why? For starters, shelter inflation should ease considerably in the coming months as the lagged impact of falling rental prices starts to feed into the official statistics. In fact, core inflation less shelter was up 1.9% YoY in September, down from a peak of 10.6% in June 2022. Second, wage growth (+4.1%YoY) has eased. In fact, during this week’s Fed press conference, Powell remarked that wage growth is nearing a level that is consistent with the Fed’s inflation objective. The jump in productivity (+4.7% QoQ) should also keep inflation contained. Finally, the sharp rise in car prices, which drove inflation higher during the pandemic, is declining. Specifically, the Manheim Used Vehicle Index is down over 18% from its peak, the worst drawdown in the history of the Index. And the mid-month report suggests further declines are likely when the monthly data is reported next week. These dynamics suggest the Fed’s work on inflation is largely done.

Bottom line | While rising interest rates and aggressive monetary policy have been a headwind for the equity and bond market over recent months, the end of a Fed tightening cycle has historically been a positive catalyst for both asset classes. In fact, in the 12 months following the final Fed rate hike, the equity market is up ~14%, on average, and is positive ~75% of the time. From a fixed income perspective, 10-year Treasury yields typically decline ~100 bps in the 12 months following the final Fed rate hike. These historical relationships are embedded within our forecasts and are one reason why we see upside for equities and downside for interest rates (a positive for bond prices) into year end and over the next 12 months.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.